As the crypto space is becoming more multichained, Axelar (AXL) seems to be a foundational infrastructure layer as cross-chain communication safeguarding is enabled. As decentralized applications (dApps) grow outside the boundaries of one-chain silos, Axelar’s General Message Passing (GMP) protocol becomes crucial.

In this guide, I will focus on teaching you everything you need to understand to make price predictions for AXL Tokens until 2030, alongside predicting their price based on tokenomics, ecosystem, and market evaluation.

What is Axelar (AXL)?

Axelar powers the interchain future as a programmable blockchain interoperability layer across all of Web3. It enables users to interact with any asset or application on any chain through a single click functioning like Stripe for Web3.

Developers use a simple API built on top of a permissionless network that routes messages and secures the system through proof-of-stake consensus.

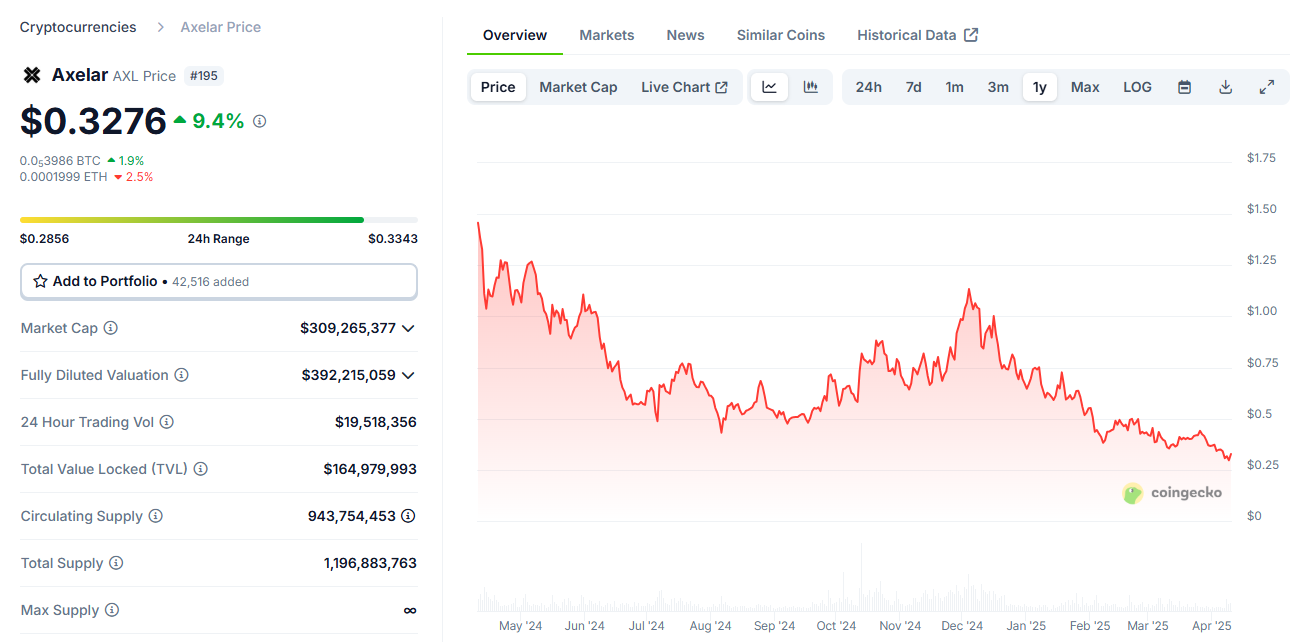

AXL Price History: From Launch to 2025

Understanding Axelar’s price history requires us to know its core functionality first. AXL tokens have had price fluctuations, with AXL tokens facing major price fluctuations with Elon Musk’s dynamics and the development of its ecosystem.

- 2022 Launch Price: Close to $0.6539

- 2023 High: $0.9989

- Bear Market Low: $0.31477

- 2024 Recovery: Ended the year at about $0.7393

- Current Price (April 2025): Fluctuates Around $0.2915

ATH (All-Time High): $2.66 (Mar 01, 2024)

ATL (All-Time Low): $0.2745 (Apr 07, 2025)

Source

AXL Tokenomics: The Core of Its Value

We can see the relations of the market cycles in Axelar’s price history, however, its long-term value is, should focus on the power of its tokenomics. The structure of allocating the tokens and the model of emissions provided ensures that AXL has no limits bound while continuing to grow.

Key Token Metrics:

- Total Supply: 1,196,883,763 AXL

- Circulating Supply: 943,754,453 AXL

- Staked Supply: ~62%

- Emission Model: Declining inflation rate

Token Distribution Breakdown:

- Ecosystem Incentives: 34%

- Core Contributors: 20%

- Early Investors: 17%

- Foundation Reserve: 10%

- Validator Rewards: 19%

Token Utility:

- Fees for transferring and sending logic across chains.

- Staking, which rewards by becoming a validator.

- Governance whereby votes can be given for main decisions on the network.

- The market where credits and even liquidity can be earned for building out the ecosystem.

The economic model of Axelar makes its system self-sufficient for development and easily scalable, which is a favorable condition for investment in the long run.

Current Market Status (April 2025)

Strategic real-world use of AXL and its advantages are synergized by the well-structured tokenomics of Axelar. The results for April 2025 show how Axelar has optimally positioned itself in the market:

- Market Cap: Around $275.08M

- 24h Trading Volume: Around $14.15M

- Rank: #195 by market cap

- TVL (Total Value Locked): $ 1.74 M+

- Staking APR: 9.4%

The demand for secure cross-chain interoperability drives AXL’s value, and its growing adoption of cross-chain solutions is expected to boost it further.

AXL Price Prediction (2025–2030)

As the use of Axelar increases, its secure cross-chain communication will be increasingly vital to the multichain economy, resulting in a direct correlation with the price of AXL. Below is a forecast table for Axelar year-wise from 2025 to 2030.

Key Factors Driving Future Prices:

- Adoption of GMP: Increased demand for AXL due to increased movement of dApps to Axelar for the execution of interchain logic.

- Partnerships: Cohesive strategic partnerships with other dApps from Cosmos, Avalanche, Polygon, and Ethereum-based protocols.

- Ecosystem Funding: Grant incentives offered for developers, which enables a shift in innovation and fosters integration.

- Tokenomics Strength: Reduced inflationary pressure on the price due to the deflationary token model.

- Market Sentiment: Reduced multichain applications increase the demand for AXL.

AXL Price Forecast Table:

| Year | Base Case Price | Bullish Case Price |

|---|---|---|

| 2025 | $1.50 | $3.50 |

| 2026 | $2.25 | $3.80 |

| 2027 | $2.75 | $4.00 |

| 2028 | $3.20 | $4.50 |

| 2029 | $3.60 | $6.00 |

| 2030 | $4.50 | $8.00+ |

If AXL becomes the TCP/IP layer for blockchains, it will result in enormous long-term value capture potential for Axelar.

Axelar Ecosystem and Strong Projects (2025 Update)

The continuous development of new tools, integrations, and projects is key to Axelar’s growing success. Many projects are cross-chain compatible, cross-integrating, enhancing the protocol, illustrating it as a major building block of Web 3.0.

Projects of Five Key Areas:

- Squid Router: Enables contract calls and cross-chain swapping (now including intent-driven routing as of 2025).

- Satellite Bridge: Token bridged directly across 30+ chains with one-click fiat onramp starting in Q1, 2025.

- Interchain Amplifier SDK: Multichain logic for dApps can be applied through less than 10 lines of code.

- Axelar Virtual Machine: Smart contracts for executing programmable interchain transactions, each equipped with its own message and token routing logic.

- Enterprise Integrations: Collaboration with some clients to defend traditional tokenized securities alongside Real-World Asset (RWA) messaging through safe, compliant channels into legacy finance.

Ecosystem Stats (April 2025):

- 170+ dApps integrated

- 60+ blockchains connected

- 200M+ cross-chain messages delivered

- $1.3B in Q1 cross-chain volume

With Axelar aiming to be the key protocol for multichain communication, its emerging ecosystem will be crucial in assuring successful sustenance.

Real-World Use Cases of Axelar in 2025

The cross-chain solution is now fully integrated into working dApps and corporate use cases. Developers and corporations have fully integrated the cross-chain solution into functional dApps and use cases. In 2025, we expect the following applications to stand out:

- Cross-Chain DeFi Aggregation: Squid and Rango Exchange are already using Axelar’s GMP for token swaps on multiple chains, further improving DeFi composability on those ecosystems.

- NFT Marketplaces with Multichain Access: NFT marketplaces are using Axelar to allow cross-chain ownership verification and bidding so users can trade assets on different markets.

- Interchain DAOs: DAOs such as the Interchain Council utilize Axelar’s GMP for the secure execution of voting across several chains.

- Tokenized Real-World Assets (RWAs): A number of FinTech players are piloting projects built on Axelar for sending compliance messages and asset issuance on regulated chains.

- Expansion of GameFi: Game developers are using Axelar to let players use in-game assets across different GameFi ecosystems.

There isn’t just one GameFi project in the market- There are many others like Solana Summer, Axie Infinity, Immutable, and more.

Security Threats: Weaknesses in Smart Contracts

Despite the great promise of this technology, the underlying security risks are the same as with most emerging technologies.

Axelar’s smart contract model is robust but still features potential failures, including:

- Replay Attacks: Improper message parsing can result in reusing the same payload.

- Permission Escalation: Untested code can allow unintended access.

- Spoofing Transactions: Malicious nodes may replace or fabricate transactions.

Internal audits, external assessments, and a community security initiative help reduce these risks. Developers should apply verified SDKs and follow defined deployment protocols.

Investing Challenges and Risks with AXL

Despite how clear Axelar’s potential may be, these are the risks investors need to think about:

- Competition: Direct competitors are LayerZero, Wormhole, and Chainlink CCIP.

- Security Risks: Any weakness in the cross-chain messaging layer can be fatal.

- Token Unlocks: Controlled token unlocks could cause issues with price stability.

- Market Cycles: Other market sentiments and conditions largely dictate the value of Axelar.

Regulatory Impact on Axelar

Due to its nature as a messaging protocol, Axelar may be able to avoid facing direct regulatory attention. However, projects utilizing Axelar to bridge tokenized securities or real-world assets could run into regulatory issues. Axelar’s distributed validator set and governance structures can offset the risks of decentralization from regulatory changes, but these changes still require careful monitoring.

Axelar (AXL) vs. Other Interoperability Tokens

Differentiating Axelar from other interoperability tokens is its developer-oriented tools and other attributes. Following is a comparison with other leading interoperability solutions.

| Feature | Axelar (AXL) | LayerZero (ZRO) | Chainlink (LINK) | Wormhole (W) |

|---|---|---|---|---|

| Messaging Type | General + Executable | Lightweight | Oracle-Based | Token Bridges + Messaging |

| Token Utility | Gas, staking, governance | Yet to be launched | Oracle payments | Not live yet |

| Chains Supported | 60+ | 30+ | 20+ | 30+ |

| Developer Tooling | Advanced SDK, AxelarJS | Moderate | Basic APIs | SDK + CLI |

Is AXL a Good Investment?

Investing at this point is favorable as Axelar supports multichain systems, accelerates adoption, and continuously adds new features, suggesting strong long-term value. Increasing requirements for communication between chains alongside limited offerings in the market give the token competitive strength.

How to Buy

You can trade AXL tokens on centralized crypto exchanges. The most popular platform to buy and trade Axelar is Binance, where the AXL/USDT pair recorded a 24-hour trading volume of $3,285,215. Other popular options include Upbit and Bybit.

Conclusion

Axelar is constructing the backbone of Web3’s multichain future. With a powerful structure of tokenomics, a growing ecosystem, and anchored real-world use cases, AXL shows strong long-term prospects. Some risk is always there, but the unique positioning of Axelar as a leader in cross-chain communication shows that it is crucial for the development of the decentralized web. Axelar is positioning itself for strong, sustained growth by actively expanding its network and adoption in preparation for 2030.