With staking rewards, cross-chain support, and governance features, MANTRA price prediction reveals growth potential. The article analyzes market trends, security risks, and regulatory challenges, seeking to balance opportunities and risks for investors with a precise summary.

What is MANTRA (OM)?

MANTRA is a security focused RAW Layer 1 blockchain designed to meet real world regulatory standards. It offers a permissionless blockchain for permissioned applications, tailored for institutions and developers.

Key Features:

- Built with Cosmos SDK, IBC compatible and supports CosmWasm

- Secured by a sovereign PoS validator set

- Scalable up to 10,000 TPS

- Includes modules, SDKs and APIs for compliant RAW creation, trading and management

- User friendly interface to onboard institutions and non crypto users to Web3

Past Analysis: MANTRA Price History (2023-2025)

| Year | Price Range (USD) | Note |

|---|---|---|

| 2023 | $0.02807 – $0.05848 | Start price and end price of the year. |

| 2024 | $0.05845- $3.8223 | Start price and end price of the year. |

| 2025 | $3.8233 to Continuing | The start price is $3.8233 at the start of the year. |

ATH (All-Time High): Feb 23, 2025 ($9.04)

ATL (All-Time Low): Oct 12, 2023 ($0.01728)

Source

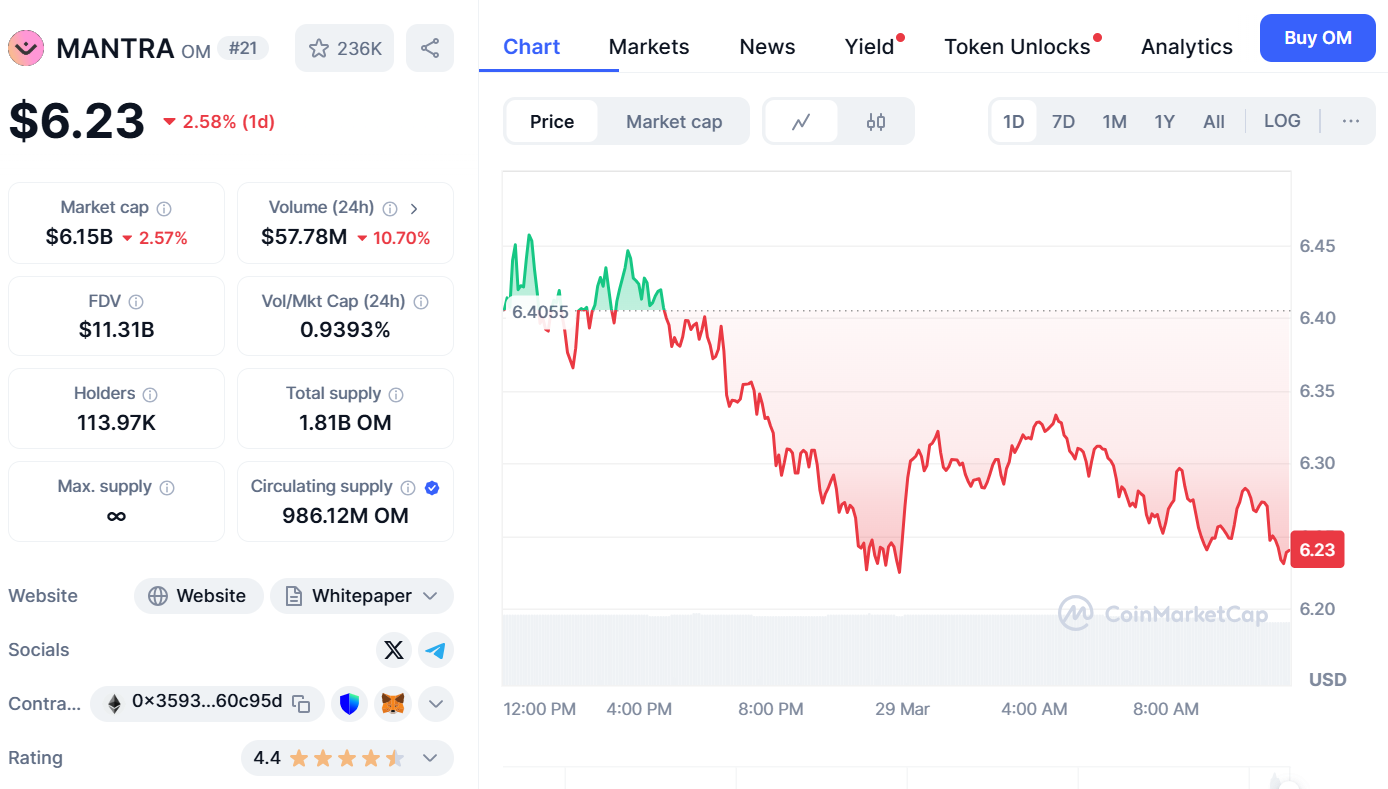

Current Market Situation & Price (2025)

The current trading price for MANTRA (OM) as of March 29, 2025 is $6.23 with a 24-hour trading volume of around $57.78 million, this is a 2.58% decrease from the previous day suggesting increased activity within the market.

MANTRA (OM) Tokenomics

| Parameter | Details |

|---|---|

| Token Name | MANTRA (OM) |

| Ticker | OM |

| Max Supply | 1.81B OM tokens |

| Circulating Supply | 984.28M OM million OM tokens |

| Initial Supply | 250 million OM tokens (Pre-sale) |

| Token Utility | Staking, governance, rewards, DAO participation |

| Governance Model | Community-driven via OM token holders’ votes |

| Staking Rewards | 10%-30% annual yield varies based on staking pools |

| Vesting Period | 1-4 years (for early investors and team allocations) |

| Transaction Fee | Varies (typically low in DeFi) |

| Deflationary Mechanism | Token burn events from transaction fees |

| Launch Date | 2020 (Initial coin offering) |

| Platform | Ethereum and Polkadot (multi-chain) |

OM is designed for governance, staking, and rewards on the platform, which makes OM the native token of the ecosystem. With 1 billion tokens available in supply, OM holders help make decentralized governance vote decisions. The staking offers rewards of 10% to 30% which is very attractive.

Factors Impacting MANTRA (OM) Price

MANTRA(OM) price can vary depending on several factors such as the market, the currency’s technological edges, and others that will greatly impact its value in the future.

Sentiment in the Market: Overarching trends in the market and whether investors are in a bullish or bearish mode relative to DeFi.

Volume Growth Ratio: Growth in participation and usage of the platform combined with staking and growing community members.

DeFi And Crypto Trading Governance: Government policies that control certain aspects of the crypto and DeFi sphere.

Partnerships And Rides: Partnering with blockchain initiatives and their respective networks.

Improvements on the Platform: New features and updates to the current system aimed at making it more user-friendly.

Periodic Reduction of Tokens: The total number of tokens drastically lowered via regularly scheduled burns.

Various Ways Of Creating Crypto: Using online services to earn money that will impact how people utilize cryptocurrencies.

MANTRA Price Prediction (2025-2030)

The general consensus for the price of MANTRA(OM) is bullish for the next few years as an increase of users on DeFi platforms, increasing diversity of applications, as well as self-management of the community will all have a positive effect.

| Year | MANTRA price prediction Range | MANTRA price prediction Key Factors |

|---|---|---|

| 2025 | $0.90 – $1.50 | Market recovery, increased adoption of DeFi, positive platform updates. |

| 2026 | $1.30 – $2.00 | Enhanced staking rewards, strategic partnerships, and higher governance participation. |

| 2027 | $1.80 – $2.80 | Increased demand for OM tokens, platform expansion, and new use cases. |

| 2028 | $2.50 – $4.00 | Broader mainstream adoption of decentralized finance and OM’s strong ecosystem growth. |

| 2029 | $3.50 – $5.00 | High-staking returns, further token burns, and a solid user base. |

| 2030 | $4.50 – $7.00 | Continued DeFi dominance, potential listings on major exchanges, and high community engagement. |

Ecosystem and Strong Projects MANTRA

Ecosystem employs a decentralized approach toward finance ( DeFi) and also community moderation. Key projects include:

MANTRA DAO: A governance platform in which users can actively participate in voting for policies under decentralized proposals if they own OM tokens.

Staking Pools: A platform where participants can stake OM and/or other tokens to earn rewards.

MANTRA Finance: It has lending and borrowing, also liquidity mining functions in the realms of DeFi.

Social Impact Projects: Deal with sustainability and finance inclusion.

Cross-Chain Collaborations: Works with Polkadot and Ethereum for a better user experience.

MANTRA (OM) vs. Other Competitors

Together with social action, community governance, and social initiatives, MANTRA (OM) has integrated a new strategy to participate in the DeFi market. It is provided below a comparison with principal competitors.

| Feature | MANTRA (OM) | (AAVE) | (Uniswap) |

|---|---|---|---|

| Staking Rewards | 10%-30% annual yield | 5%-15% annual yield | 0%-5% (liquidity pools) |

| Governance | Community-driven via DAO | Token-based governance | Community governance (DAO) |

| Cross-Chain Support | Yes (Polkadot, Ethereum) | No (Ethereum-based) | Yes (Ethereum and Layer 2) |

| Social Impact Focus | Focus on sustainability | No focus on the social impact | No focus on the social impact |

| Platform | DeFi, Staking, Lending, Governance | Lending, Borrowing | Decentralized exchange (DEX) |

| Liquidity | Moderate liquidity in pools | High liquidity in lending markets | High liquidity (DEX) |

| Token Utility | Staking, Governance, Rewards | Staking, Borrowing, Lending | Liquidity providing, Trading |

Staking rewards: Compared to AAVE or Uniswap, MANTRA (OM) provides better staking incentive rewards.

MANTRA (OM) Coin Risk Factors

In the same way, any cryptocurrency, Mantra (OM) also has its fundamental risks that affect its price and sustainability in the long run. Below are the key risk factors to consider from your perspective:

Market Risks: High price changes due to trend patterns in the market.

Regulatory Risks: Possible effect of new rules within the DeFi framework.

Liquidity Risks: Low investor activity leads to a diminished ability to sell assets.

Technological Risks: Threats to system security and bugs in the platform.

Competition: Risk from major other competition DeFi Platforms.

Adoption Risks: Slow growth in users can result in a low possibility of achieving success within the ecosystem.

Token Inflation: Available to the market through vesting periods and huge token launches combined can cause price dysfunctional pressure.

Regulatory Impact on MANTRA’s Future

There are several ways regulations could support or hinder compliance with legal obligations, token history, and expansion in other countries. Adoption could be higher with straightforward rules, whereas harsh regulations would likely decrease growth and decentralization. Additionally, the OM token’s market classification and country regulations will determine how other countries will bear the token and how cross-border business will be conducted. In order to succeed in the long term, MANTRA must understand and cope with these dynamics.

The Problems in Security: Smart Contracts Vulnerabilities

The problems in security for smart contracts in MANTRA are as follows:

Reentrancy Attacks: Taking advantage of the bugs in the contract to empty the wallet.

Code Vulnerabilities: Logical errors that can be exploited by a malicious user.

Upbaarheid Issues: Challenges related to changing the contract to remove the security holes.

Oracle Attacks: Wrong/inaccurate information leading to a faulty conclusion of the contract.

How to Buy

OM tokens are traded on centralized crypto exchanges. The most active exchange is Toobit, where the OM/USDT pair recorded a 24-hour trading volume of $5,287,179. Other popular platforms include Binance and MEXC.

Is MANTRA a Good Investment?

Investing in MANTRA (OM) offers potential benefits, including staking rewards, community governance, and cross-chain compatibility with Polkadot and Ethereum.

However, risks such as regulatory changes, market volatility, and smart contract vulnerabilities should be considered. Overall, MANTRA is a strong DeFi candidate for those seeking profit while supporting social causes, but careful risk management is essential.

Conclusion

Due to staking incentives, cross-chain features, and governance usage, MANTRA Price Prediction remains highly optimistic. Only time will tell how the market evolves, and with it, the regulatory uncertainty and security issues will be challenging factors. Generating power and peril should always be on the same scale for proper investment decisions.