As an open source protocol, IOTA empowers individuals, Businesses and institutions to build decentralized applications and systems. Working alongside its staging network Shimmer, IOTA aims to create a secure, permissionless infrastructure to drive the digital economy forward. Through Ethereum compatible smart contacts. Advanced consensus and incentive models it supports a wide range of Web3 innovations.

Past Price Analysis

IOTA underwent price shifts depending on how the market operated and the rate of adoption. Here’s an overview of its recent performance and price activities:

| Year | Price Range (USD) | Note |

|---|---|---|

| 2023 | $0.1692 to $0.3108 | Start price and end price of the year. |

| 2024 | $0.3108 to $0.2804 | Start price and end price of the year. |

| 2025 | $0.2804 to Continuing | The start price is $0.2804 at the start of the year. |

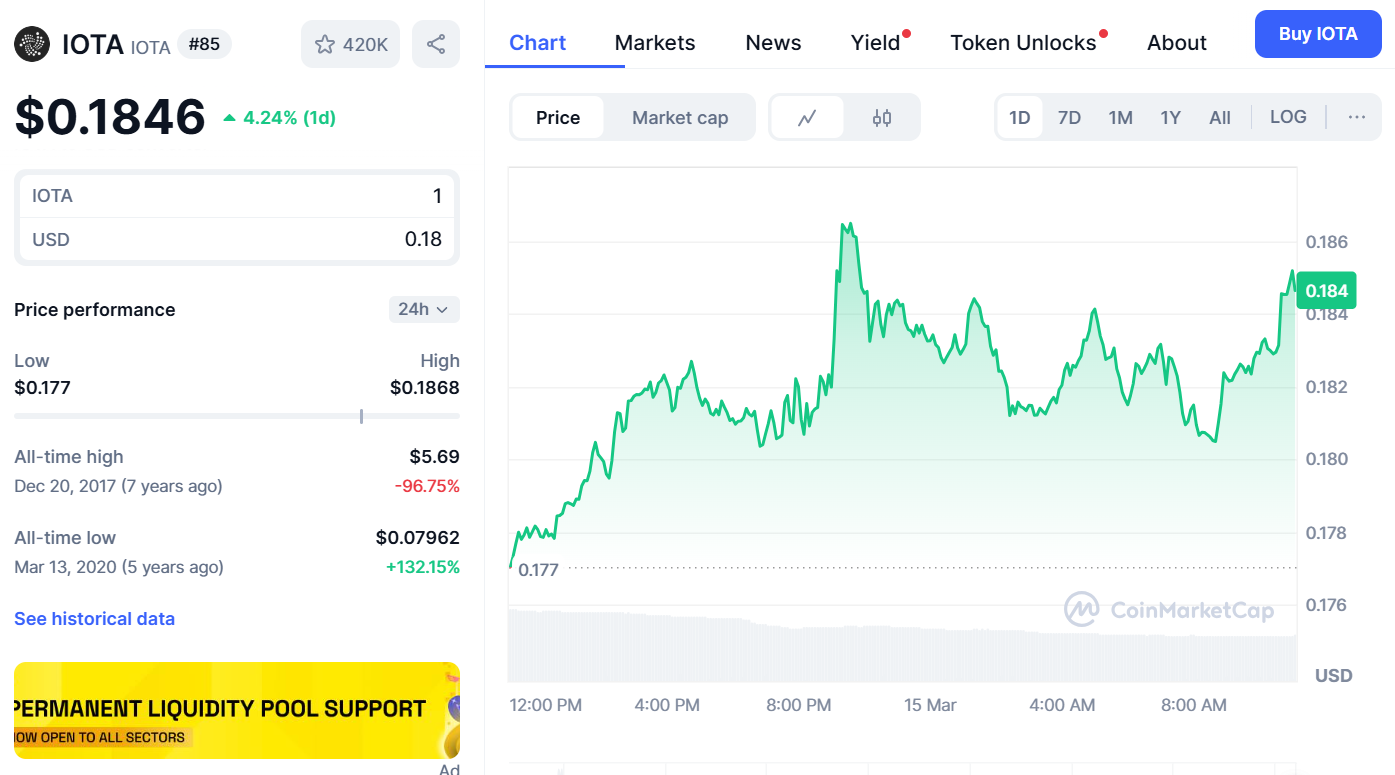

All-Time High (ATH): $5.69 (December 2017)

All-Time Low (ATL): $0.0796 (March 2020)

Source

Current Market Situation & Price

IOTA is currently trading at approximately $0.1846 as of March 15, 2025. In the last day, it has seen a minor upswing of 4.24%, having a high of $0.1868 and a low of $0.177 during the day.

Tokenomics

| Feature | Details |

|---|---|

| Total Supply | 2,779,530,283 MIOTA |

| Circulating Supply | 100% of total supply already in circulation |

| Legacy Supply | 55.25% |

| Tangle Ecosystem Association | 12% |

| UAE Entity | 12% |

| IOTA Foundation | 7.08% |

| ASMB Investors | 3.52% |

| IOTA Airdrop | 3.5% |

| Non-migrated Legacy Tokens | 3.82% |

| DAO Treasury | 1.36% |

| New Investors Pool | 1.15% |

| ASMB IF Members | 0.32% |

IOTA’s value is directly related to the rate of adoption and ecosystem expansion due to the limited supply of the tokens and their strategic distribution.

Important Factors Which Will Impact The Price Of IOTA

- IoT Adoption: An increase in the usage of smart devices could facilitate a demand surge.

- Market Trends: Overall market attitude towards crypto is fundamental in determining the movement of prices.

- Partnerships: affiliation with large technology firms enhances their reputation, which can be beneficial.

- Regulations: The level of government policy and lawmaking has significance for investor trust.

- Technological Upgrades: Adoption is likely to be fueled by developments in Tangle technology.

- Supply & Demand: Prices could increase due to rising demand, especially considering the limitation in supply.

- Macroeconomic Factors: The level of investment relies on inflation, interest rates, and the security of the international economy.

IOTA Price Prediction (2025 to 2030)

The future of IOTA’s price strongly correlates to its adoption, market forces and tech progress. A projected price forecast is provided below:

| Year | Expected Price Range (USD) | Potential Growth Factors |

|---|---|---|

| 2025 | $0.50 – $0.90 | Rising IoT adoption, ecosystem expansion |

| 2026 | $0.80 – $1.20 | Strategic partnerships, network development |

| 2027 | $1.00 – $1.50 | Increased real-world use cases |

| 2028 | $1.30 – $1.80 | Stronger adoption in smart cities & industries |

| 2029 | $1.50 – $2.20 | Mainstream recognition, demand growth |

| 2030 | $2.00 – $3.00 | Widespread adoption, market stability |

Ecosystem and Strong Projects

With new projects and real-world applications, IOTA’s ecosystem is expanding. Some of the innovations that are developing and strengthening the network are:

- Tangle Technology: A system with unique scalability and zero fees for IoT transactions.

- Shimmer (SMR): A staging network that allows the first stages of testing IOTA’s upgrades.

- Assembly (ASMB): An IoT-based decentralized smart contract platform.

- Partnerships: Working with international companies in the areas of supply chain, mobility, and data management.

- Smart Cities & IoT Integration: IOTA technology is being tested in different smart city projects for data security and automation purposes.

- Sustainable Solutions: Supporting low-energy-consuming eco-friendly blockchain innovations.

IOTA Coin Risk Factors

IOTA, like any cryptocurrency, has risks that potential investors should keep in mind. These aspects may affect the immediate results as well as the future IOTA price prediction years down the line.

- Technical Difficulties: IOTA’s reliance on the Tangle can impact performance and trust when bugs or flaws occur.

- Regulatory Changes: Investment and market value of IOTA can be affected by new changes in cryptocurrency regulations.

- Rivalry: Other blockchain and IoT centered projects pose strong challenges and competition for IOTA.

- Implementation Timeframe: IOTA’s growth could be hindered if the implementation of IoT solutions in the real world is not adopted quickly.

- Cryptocurrency Volatility: IOTA’s price, like most cryptocurrencies, can change dramatically based on investor sentiment or market trends.

- Network Vulnerabilities: The credibility of the network could be lost due to past attacks or future potential vulnerabilities.

Regulatory Impact on IOTA

IOTA is impacted by the regulation of the market. One of the major reasons government politics can either facilitate or restrict the growth and adoption of cryptocurrencies like IOTA is due to national laws regarding cryptocurrency.

Reasonable regulations like legal frameworks, proactive acceptance, and innovation-oriented policies can build trust for investors and lead to greater institutional investment. This would greatly affect the positive increase in IOTA Price Prediction.

Tough regulation or no regulation at all can stagnate adoption, restrict use cases, or hinder partnerships. All of these outcomes would have a negative effect on the IOTA price performance.

IOTA Vs Others

Tangle Technologies: Has a scalability system that does not incorporate blockchain. Fees are optimal for micropayments and data work. Eco-Friendly: Uses less energy than Bitcoin’s network. Focuses on IoT: Designed strictly for Internet of Things purposes.

Specialized Case: Unlike other networks that focus on DeFi and NFTs, IOTA concentrates on the IoT.

Is IOTA a Good Investment?

Due to feeless transactions, high energy efficiency, and an IoT focus, IOTA has strong potential. Its growing ecosystem and real-world use cases enhance its value further. Still, risks from competition, adoption speed, and regulations persist. For long-term investors with convictions regarding IoT growth, IOTA could be a worthwhile option.

Conclusion

The IOTA price prediction suggests that the project has a brilliant future amidst the changing landscape of the Internet of Things (IoT). IOTA clearly stands out in the crypto world due to its innovative Tangle technology alongside its growing ecosystem. Although risks like market volatility and regulatory uncertainty exist, the ongoing focus on real-world adoption and IoT integration makes it a very attractive project for the long term. With increasing global demand for connected devices, IOTA might experience consistent increases in its utility and value.

[…] Read More: IOTA Price Prediction: Growth Potential in the IoT-Driven Future […]

[…] Read More: IOTA Price Prediction: Growth Potential in the IoT-Driven Future […]