PEPE price changes are largely a response to social media and community engagement PEPE hype, Bitcoin’s price, and whale movements determine its price AIPEPE has no mid-term potential and is a high-risk investment as long as its utility remains low and supply high Despite the lack of support regulation and adoption for the coin, community support can keep it alive PEPE is as volatile as they come and very unpredictable, but short-term opportunities do exist.

PEPE Past Price Analysis

| Year | PEPE Price Range (USD) | Note |

|---|---|---|

| 2023 | $0.00000000019 to $0.000001296 | Start price on Apr 15, 2023 and end price of the year |

| 2024 | $0.000001296 to $0.00001994 | Start price and end price of the year. |

| 2025 | $0.00001994 to Continuing | The start price is $0.00001994 at the start of the year. |

ATH (All-Time High): $0.00002825 – Dec 09, 2024.

ATL (All-Time Low): $0.00000000019 – Apr 14, 2023.

Source

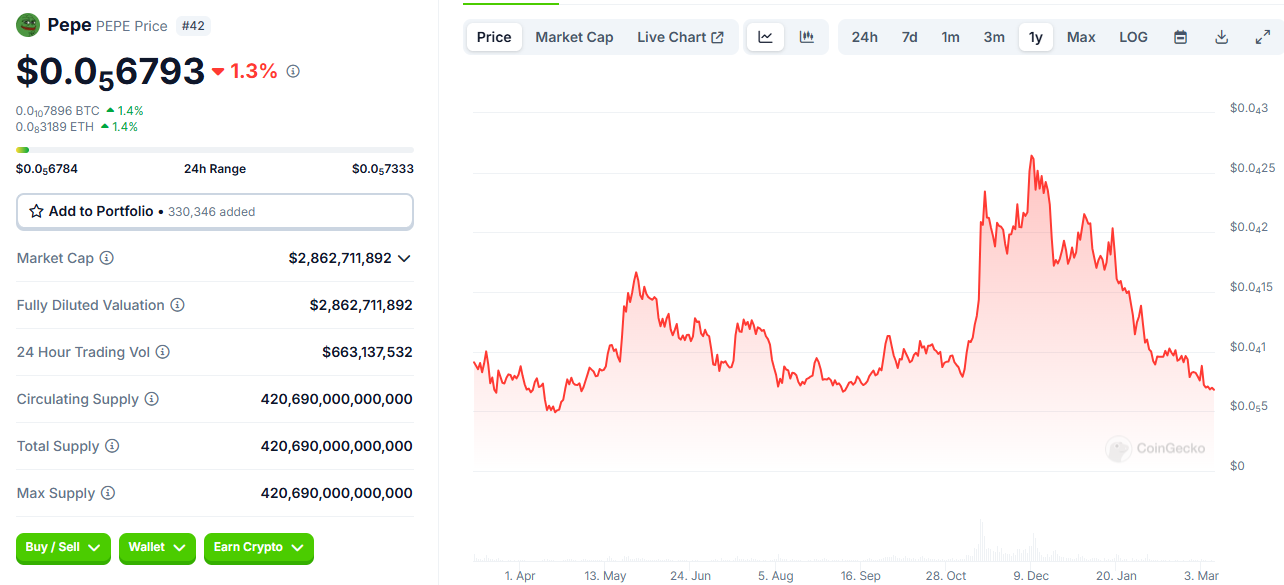

Current Market Situation & Price

Currently, the price of PEPE sits at about $0.00000679 USD. Its trading volume over the last 24 hours is somewhere close to $612 million USD which saw its value decrease slightly by 0.85%.

PEPE Tokenomics

| Category | Details |

|---|---|

| Total Supply | 420,690,000,000,000 PEPE |

| Circulating Supply | 420,689,899,653,544 PEPE |

| Max Supply | 420,690,000,000,000 PEPE |

| Market Cap | $2.87 billion USD |

| Burn Mechanism | No tax, no burn mechanism |

| Liquidity | Locked liquidity in pools |

| Token Type | ERC-20 (Ethereum-based) |

| Use Case | Meme coin, community-driven |

| Team Holding | 6.9% |

| Initial Liquidity | 93.1% |

Important Factors That Will Impact the Price of PEPE

Market Sentiment: Hype, social media trends, especially on platforms like Twitter and Reddit, and community activity play a major role in PEPE’s price movements.

Bitcoin & Crypto Market Trends: PEPE, like most altcoins, follows Bitcoin’s price trends. If BTC rises, PEPE may see bullish momentum.

Adoption & Utility: Increased use cases, partnerships, and exchange listings can positively impact PEPE’s price.

Whale Activity: Large holders (whales) buying or selling can cause significant price fluctuations.

Token Supply & Demand: PEPE has a large supply, and demand needs to outpace it for price appreciation.

Regulatory Developments: Crypto regulations in different countries can affect PEPE’s trading volume and price stability.

Macroeconomic Conditions: Inflation rates, interest rates, and global financial stability can indirectly impact investor sentiment in crypto markets.

PEPE Price Prediction (2025-2030)

Here’s the PEPE Price Prediction table from 2025 to 2030, including estimated price ranges and key factors influencing the price:

| Year | Price Range (USD) | Key Drivers |

|---|---|---|

| 2025 | $0.000007 – $0.000015 | Market recovery, whale activity, BTC halving impact |

| 2026 | $0.000010 – $0.000025 | Increased adoption, meme coin hype |

| 2027 | $0.000008 – $0.000020 | market correction, crypto regulations |

| 2028 | $0.000015 – $0.000035 | Bullish cycle, growing PEPE ecosystem |

| 2029 | $0.000012 – $0.000030 | Institutional interest, macroeconomic factors |

| 2030 | $0.000020 – $0.000050 | Mainstream adoption, potential burn mechanisms |

PEPE Ecosystem and Strong Projects

PEPE operates within the meme coin sector, gaining traction due to its strong community and viral appeal. While it lacks a traditional utility, several projects support its ecosystem:

- DEX & CEX Listings: PEPE is available on major exchanges, increasing accessibility and liquidity.

- Staking & Yield Farming: Some platforms offer staking options for passive income.

- NFT & Gaming Integration: Potential collaborations with NFT and play-to-earn projects.

- Community-Driven Initiatives: Social media campaigns and grassroots movements boost engagement.

- Layer 2 Adoption: Expanding to cheaper, faster networks can improve transaction efficiency.

PEPE Coin Risk Factors

- High Volatility: PEPE’s price is highly susceptible to market swings, causing unpredictable movements.

- Regulatory Uncertainty: Potential regulations in major markets could limit its growth or cause price declines.

- Lack of Utility: As a meme coin, PEPE lacks real-world use cases, which can limit long-term growth.

- Whale Manipulation: Large holders can significantly impact the price by buying or selling large amounts.

- Market Sentiment: PEPE’s value is closely tied to community interest and social media trends, making it prone to hype-driven fluctuations.

Regulatory Impact on PEPE

- Legal Uncertainty: Government regulations, especially in major markets like the U.S. and the EU, could restrict trading or investment, impacting PEPE’s value.

- Exchange Delistings: Stricter regulations might lead to PEPE being removed from exchanges, reducing liquidity.

- Taxation: New tax laws on cryptocurrencies could deter investors and affect PEPE’s market demand.

- Compliance Costs: Regulatory compliance could increase operational costs for projects in the PEPE ecosystem.

- Market Sentiment: Negative regulatory news may result in price declines or increased volatility.

PEPE vs. Other Coins

- Market Position: PEPE is a meme coin with no real utility, while established coins like Bitcoin and Ethereum offer use cases and technological value.

- Volatility: PEPE experiences higher volatility compared to more stablecoins like Bitcoin, which are seen as safer investments.

- Community Driven – PEPE thrives on social media and community hype, unlike coins with strong development teams and roadmaps.

- Liquidity: PEPE’s liquidity is lower than major coins, making it more prone to manipulation.

- Longevity: Unlike established projects, PEPE’s long-term viability depends on continuous hype and community support.

Read More: Sui Price Prediction: Comprehensive and Analysis

Is PEPE a Good Investment?

- High Risk: PEPE is a meme coin, subject to extreme volatility and market sentiment. It’s a high-risk investment.

- No Real Utility: Unlike major cryptocurrencies, PEPE lacks a clear use case, which may limit long-term value.

- Community-Driven: Its value is largely driven by community engagement and hype, making it unpredictable.

- Potential for Gains: If the community continues to grow and hype persists, there may be short-term gains.

- Uncertainty: Regulatory risks and market changes could impact its price drastically.

While PEPE can offer quick profits during bullish periods, it’s a speculative investment and not suitable for conservative investors.

Conclusion

PEPE price prediction is highly speculative, as it is a meme coin driven by community engagement and market sentiment. While it offers the potential for short-term gains, it lacks real utility and faces significant risks, such as regulatory uncertainty and price manipulation. Its value fluctuates based on social media trends, Bitcoin’s movements, and whale activities. PEPE’s future depends on continued hype, but its long-term success remains uncertain.

[…] Study: A number of people targeted the Pepe (PEPE) token when it first launched on Uniswap back in 2023. It initially gained hype before being listed […]

[…] Read More: PEPE Price Prediction: High Risk and Unpredictable Future […]