What is Bitget Token (BGB)?

Bitget token is the official token of the Bitget centralized exchange and Bitget Wallet ecosystem. It’s used for trading, paying fees, joining platform events and getting special benefits.

The total supply was 2 billion BGB, but on December 30, 2024, Bitget burned 800 million tokens (40%), reducing the supply to 1.2 billion. Now fully in circulation. From 2025, Bitget will start quarterly buybacks and burns, making BGB deflationary.

BGB gives access to features like token farming, staking for passive income, early entry to projects on Bitget Launchpad and Launchpool. Future uses include on chain trading, DeFi apps, paying gas fees and airdrop access. It also offers payment discounts via Bitget Pay and Card, adding more benefits for users.

Past Analysis: Bitget Token Price History

Bitget Token (BGB) has undergone significant price volatility since its inception. The table below showcases the price range for each year which illustrates some of the most important events in the token’s life cycle and market history.

| Year | Price Range (USD) | Note |

|---|---|---|

| 2021 | $0.07558 – $0.09829 | The start price was $$0.07558 at the start of the middle of the year and the end price of the year. |

| 2022 | $0.09828 – $0.1817 | Start price and end price of the year. |

| 2023 | $0.1817 – $0.5795 | Start price and end price of the year. |

| 2024 | $0.5794 – $5.96 | Start price and end price of the year. |

| 2025 | $5.9630 to Continuing | The start price is $5.9630 at the start of the year. |

ATH (All-Time High): $0.75

ATL (All-Time Low): $0.05

source

Current Market Situation & Price (2025)

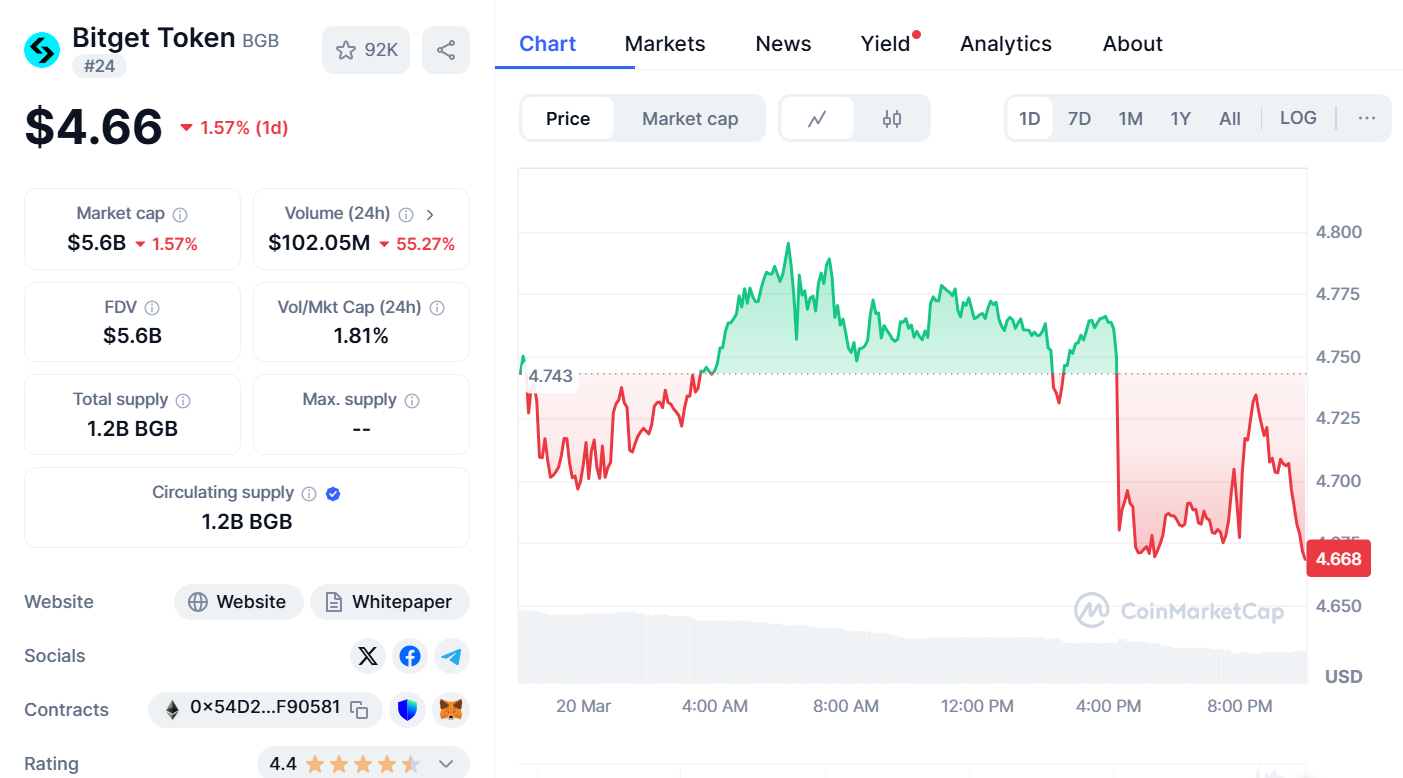

On March 20, 2025, Bitget Token (BGB) traded at about $4.66, a figure that shows an increase of around 0.70% over the last 24 hours. With approximately $5.06 billion worth of market capitalization, the token has a trading volume of around $243.35 million in the last 24 hours.

Bitget Token (BGB) Tokenomics

The Bitget Token (BGB) has strong tokenomics to improve its utility and facilitate growth. Its supply, distribution, and usage are summarized in the table below.

| Aspect | Details |

|---|---|

| Total Supply | 1.2B BGB |

| Circulating Supply | 1.2B BGB |

| Max Supply | 2B BGB |

| Initial Offering Price | $0.05 |

| Launch Date | 2021 |

| Token Type | ERC-20 and BEP-20 compatible |

| Use Cases | Trading fee discounts, astaking, governance, rewards, token sales |

| Staking Rewards | Up to 25% annual return |

| Governance Participation | BGB holders can vote on platform proposals |

| Burn Mechanism | Regular token burns to reduce supply and increase scarcity |

| Vesting Period | 12–24 months for early investors and team |

| Partnerships & Ecosystem Incentives | Reserved for strategic partners, marketing, and ecosystem growth |

Bitget Token Price Prediction (2025-2030)

The following table presents a speculative price prediction for Bitget Token (BGB) based on current market trends, adoption rate, and potential future developments.

| Year | Bitget token price prediction Range (USD) | Bitget Token Price Prediction Factors |

|---|---|---|

| 2025 | $4.00 – $4.50 | Continued platform growth, increasing staking rewards, and rising adoption. |

| 2026 | $5.50 – $10.20 | Strong market position, expanded ecosystem, and partnerships. |

| 2027 | $12.20 – $15.50 | Increased use of Bitget’s DeFi and derivative services. |

| 2028 | $15.00 – $20.00 | Possible integration into more financial systems and global adoption. |

| 2029 | $25.00 – $30.00 | Higher demand due to the overall crypto market growth and mass adoption. |

| 2030 | $30.00- $35.00 | Established as a leading exchange token, widespread global usage. |

Bitget Token Ecosystem and Strong Projects

Bitget Token (BGB) interconnects multiple important activities within the Bitget ecosystem to increase its functionality and value. Some well-known initiatives include the following:

- Copy Trading Platform: BGB fee discounts and allowances are available in copy trading and shall be extended to other Bitget services and to derivatives trading.

- Staking and Yield Programs: Users are heretofore able to stake BGB and earn passive income which decreases supply while rewarding holders.

- Bitget Launchpad: Demand and utility of the token is further increased as BGB holders are granted first priority to the token sale/event.

- Partnerships & Ecosystem Growth: These collaborations with blockchain projects and DeFi platforms enhances the supply and utility of BGB.

- Marketplace: Exclusive access to the drops special promotions of NFT is given to BGB holders on Bitget’s NFT platform.

With these projects underway, BGB stands out as a primary contender in the rapidly developing Bitget ecosystem which will further increase its value and adoption over time.

Bitget Token (BGB) vs. Other Competitors

Like competitors and exchange tokens such as Bitget Token (BGB), Binance Coin, or Huobi Token – BNB, HT, and KCS, there is rivalry within the field. The table below shows some of the main contrasts.

| Aspect | Bitget Token (BGB) | Binance Coin (BNB) | Huobi Token (HT) | KuCoin Token (KCS) |

|---|---|---|---|---|

| Total Supply | 2 billion BGB | 200 million BNB | 500 million HT | 200 million KCS |

| Circulating Supply | 900 million BGB | 160 million BNB | 165 million HT | 92 million KCS |

| Token Type | ERC-20 & BEP-20 | BEP-2 & BEP-20 | ERC-20 & HT blockchain | ERC-20 & KCC (KuCoin Chain) |

| Use Cases | Trading discounts, staking, rewards | Discounts, staking, governance | Discounts, staking, governance | Discounts, staking, rewards |

| Annual Staking Reward | Up to 25% | Up to 20% | Up to 12% | Up to 30% |

| Market Position | Growing, focused on derivatives | Market leader | Strong in Asia | Innovative features |

| Unique Features | Focus on copy trading & derivatives | Extensive ecosystem | Buyback & burn programs | Profit-sharing & governance |

- Supply: BGB’s circulating supply is greater than that of BNB and HT.

- Staking: Compared to HT and BNB, BGB offers the greatest annual staking rewards of up to 25%.

- Utility: BGB is focusing on derivatives and copy trading.

- Blockchain: Unlike BNB that uses Binance Chain, BGB is compatible with ERC-20 and BEP-20.

- Position: While BGB is relatively new but emerging compared to BNB, HT and KCS which are more established.

Bitget Token (BGB) Risk Factors

- Liquidity Risk: BGB is vulnerable to price volatility and liquidity risks which can cause significant changes and even attempt manipulation.

- Platform Dependency: Bitget having issues as a platform could affect BGB’s price in the market.

- Liquidity Risk: BGB is vulnerable to price volatility and liquidity risks, which can contribute to substantial changes and even attempt manipulation.

- Competition: Other competing tokens such as BNB and HT may reduce the market share of BGB.

- Security Threats: BGB is susceptible to cyber warfare and even smart contract breaches.

Regulatory Impact on BGB’s Future

- Investor’s Confidence: Boosting regulatory clarity increases trust, while uncertainty reduces it.

- Operations of the Exchange: Bitget may be unable to provide services in specific areas due to tighter policies.

- Stability of the Market: Sudden changes can disrupt prices while clear regulations can decrease volatility.

- Growth & Adoption: Clear policies can enable the use of BGB but restrictions can hinder growth.

- Expansion Needs: For long-term sustainability, Bitget must comply with the constant changes to regulations.

Security Threats: Weaknesses in Smart Contracts

As a result of bad coding, poor audits, or both, smart contracts become prone to exploitation which can result in monetary losses and reputation damage to the project. To enhance security and mitigate such dangers, thorough auditing, testing, and monitoring is imperative.

Is Bitget Token a Good Investment?

Bitget Token (BGB) has significant usefulness in the Bitget ecosystem thanks to its trading and staking benefits, but they may be offset by market volatility and regulatory risks. As always, investors need to exercise caution.

How to Buy

BGB tokens are traded on centralized crypto exchanges. The most active platform is Bitget, where the BGB/USDT pair had a 24-hour trading volume of $37,595,388. Other available exchanges include GroveX and Ourbit.

Conclusion

In conclusion, the potential of the Bitget ecosystem and its utility provide strong reasons for Bitget token price prediction optimism. On the other hand, competition, volatility, and regulatory issues are factors to caution about. Much of its future rests on the development of the platform alongside the macroeconomic context.