The Conflux (CFX) blockchain is attracting new interest globally. The company’s distinct Tree-Graph consensus facilitates the rapid processing of transactions and increases scalability. Given this, CFX price prediction anticipates significant growth. This article analyzes the CFX price forecast between 2025-2030 and explores the major factors that are likely to influence it.

What is Conflux (CFX)?

Conflux is a Layer 1 blockchain with the primary aim of improving its scalability. Its Tree-Graph consensus also facilitates the processing of a greater number of transactions. This enables Conflux to facilitate thousands of transactions every second. Unlike other chain blocks, it does not jeopardize decentralization for speed.

The CFX token focuses on building security and developing a scalable platform for dApps, DeFi, and NFTs.

CFX Price History (2023-2025)

Conflux has gone through some major price changes over the last several years. Here is the price range for the previous 3 years.

| Year | Price Range (USD) | Note |

|---|---|---|

| 2023 | $0.02198– $0.1945 | Start price and end price of the year. |

| 2024 | $0.1946– $0.1561 | Start price and end price of the year. |

| 2025 | $0.1561 to Continuing | The start price is $0.1561 at the start of the year. |

ATH (All-Time High):$1.70 (Mar 27, 2021)

ATL (All-Time Low): $0.02191 (Jan 01, 2023)

Source

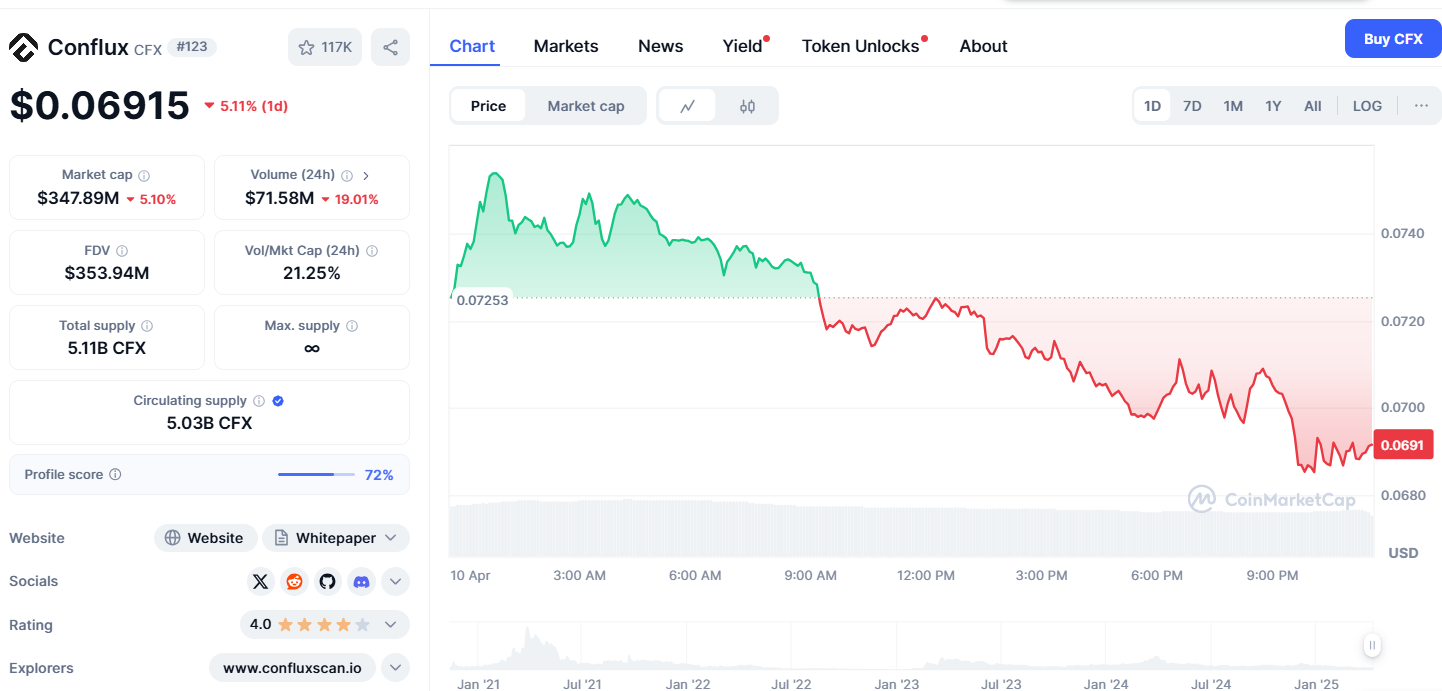

Current Market Status of Conflux (CFX)

The price of Conflux (CFX) is around USD 0.06915 and is expected to be in this range as of April 2025.

Market Overview:

- Market Cap: Roughly $ 350.41 M.

- 24 Hour Volume: Close to $ 78.9 M.

- Total Supply Circulation: Around 5.03B CFXt tokens.

Note: The cryptocurrency markets are at extreme risk. The pricing in these markets can change within very short periods of time.

CFX Technical Analysis: Price Movements and Indicators

Conflux (CFX) has support at 0.45 and resistance at 1.10. A bullish breakout is seen above 1.10 while a bearish drop below 0.45 signals a potential decline.

Traders apply RSI or Relative Strength Index to identify overbought or oversold situations. RSI value over 70 is said to be overbought, while a value of 30 suggests oversold.

Trend direction can be analyzed with moving averages MAs in particular the 50-day and 200-day MA. Golden crosses demonstrate strong markets while drops beneath the 200-day MA show weakness.

The strength of the trend can be backed by volume analysis. Increased volume signals strong demand, whereas reduced volume suggests declining interest.

Trend determination can be made by chart patterns, with the most known and facilitating bullish flags and head and shoulder patterns. Flags show continuation while head and shoulder indicate change.

To wrap it up, all assessment done under CFX technical analysis helps track price changes. To make an accurate price prediction, you must monitor key indicators.

CFX Tokenomics

CFX is the native token of the blockchain-based Conflux ecosystem. It serves a variety of purposes like paying for transaction fees, staking, and governance.

Total Supply and Allocation:

Total Supply: The pre-mined CFX tokens’ total supply is up to 5 billion.

Allocations:

- Ecosystem Fund: 40%, which scores 2 billion. This is planned for countering reduction and the development of the network.

- Genesis Team: 36% (1.8 billion CFX), which will be vested over four years.

- Private Equity Investors: 12% (600 million CFX), which will be vested over two years.

- Community Fund: 8% (400 million CFX) allocated toward community and marketing projects.

- Public Fund: 4% (200 million CFX), released gradually over two years every month.

Utility and Mechanism

- Transaction Charges: As maintenance fees, CFX tokens are paid to miners and withdrawn from the network as transaction fees.

- Staking and Rewards: Token holders that are CFX staking their tokens can earn rewarding returns while attaining consensus.

- Governance: CFX token holders are free to vote and decide on the governance proposals of the network, which will determine policies and major upgrades of the network.

These participatory tokenomics models encourage participation in the network, improve the security of Conflux, and drive growth.

Key Factors Affecting CFX Price

Numerous elements are going to impact the prediction of CFX price.

- Regulatory Compliance: Conflux is the only compliant blockchain in China, which turns out a regulatory disadvantage.

- Strategic Partnerships: The partnership with BSN adds reputation, as well as collaborations with Litentry.

- Technological Advancements: Improvement in scalability along with speed is done through the Mets Tree-Graph consensus.

- Market Sentiment: The demand for crypto assets fuels adoption and regulations. The public sentiment towards these assets is also very important as they have a huge influence over their usage.

- Expansion in Dubai Globally: Conflux’s offices in Europe are aimed towards international investment.

- Integration of NFT and DeFi: The concept of doing projects in the NFT and DeFi sector increases the demand for the token.

These considerations influence the demand and supply of CFX and its market price.

Conflux (CFX) Price Forecast for 2025 to 2030

Analysts vary with their predicted estimates for CFX price prediction over the next decade. Here is a statement of the anticipated price estimates.

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

|---|---|---|---|

| 2025 | $0.15 – $0.40 | $0.30 – $0.45 | $0.50 – $0.70 |

| 2026 | $0.20 – $0.60 | $0.40 – $0.65 | $0.70 – $0.95 |

| 2027 | $0.30 – $0.90 | $0.50 – $0.80 | $0.90 – $1.10 |

| 2028 | $0.40 – $1.00 | $0.60 – $0.90 | $1.00 – $1.50 |

| 2029 | $0.50 – $1.50 | $0.80 – $1.10 | $1.50 – $2.10 |

| 2030 | $0.60 – $2.00 | $1.00 – $1.50 | $2.00 – $3.00 |

Note: These estimates are based on projections and may change with market dynamics. Investments in cryptocurrency come with personal risks.

Risks and Challenges of Investing in CFX

Putting money in Conflux (CFX) has a share of risks, such as:

- Regulatory Risks: Blockchain regulations provide challenges for Conflux as China’s state-sponsored blockchain.

- Privacy Worries: Concerns with security gaps because of prior issues with the Ethereum Virtual Machine (EVM) make Conflux face worries.

- Market Competition: Competing with other blockchain platforms requires perpetual attention towards shifts in focus for changes.

- Network Synergy: Levels of adoption outline success for Conflux. Conversely, without the promise it holds could be deeply harmful for growth.

- Price Volatility: CFX prices have faced volatility as traders shift their perception of the market.

- Technological Risks: Conflux will face new challenges with emerging unknown technological risks.

- Security Concerns: Guarding and unlocking user assets needs constant care even after the implementation of fixes.

Treating CFX as an investment and crypto asset entails looking beyond simple metrics.

Ecosystem and Notable Projects Behind Conflux

Conflux is developing an ecosystem with DeFi and NFT projects. These contribute to the utility of CFX tokens and their future price appreciation.

Key Projects:

- Swappi (AMM/DEX): A decentralized exchange allowing efficient token swaps.

- Nucleon (Liquid Staking): A service that keeps tokens liquid while earning staking rewards.

- Co-Mint: A project that unifies all the blockchain bridges into one for decentralized liquidity.

- Goledo: Lending protocol for collateralized loans built on Aave.

- Neko (Maneki-Meow): An academic NFT project that tokenizes digital art ownership records.

- Dragon Cult: An inflation-resistant treasury token.

- MoonSwap: A DEX with high speed and no gas fees for trading on Ethereum Layer 2.

- NitFee: NFT marketplace for CFX trading.

- Nucleon: Dual token staking with xCFX and NUT.

Strategic Initiatives:

- PayFi Stack: Drives consumer-facing Web3 payments.

These projects emphasize Conflux’s broad focus on decentralized finance, NFTs, and cross-chain innovation.

CFX vs. Other Cryptos: How Does It Compare?

To other cryptocurrencies, Conflux has several differing points of interest, both advantageous and challenging.

| Feature | Conflux (CFX) | Ethereum (ETH) | Solana (SOL) | Cardano (ADA) |

|---|---|---|---|---|

| Launch Year | 2018 | 2015 | 2020 | 2017 |

| Consensus Mechanism | PoW + PoS Hybrid | PoW (Transitioning to PoS) | Proof of History + Proof of Stake | Proof of Stake |

| Transaction Speed | 6,000 TPS | 30 TPS | 65,000 TPS | 250 TPS |

| Market Capitalization | $500 million (approx.) | $200 billion (approx.) | $10 billion (approx.) | $10 billion (approx.) |

| Primary Use Case | Cross-chain Interoperability | Smart Contracts & Decentralized Apps | Scalable dApps and NFTs | Smart Contracts & DeFi |

| Transaction Fees | Low | High | Low | Low |

| Ecosystem | Growing dApps & DeFi | Large DeFi & NFT Ecosystem | Fast-growing dApps | Developed DeFi Ecosystem |

| Token Utility | Governance, Staking | Gas, Staking | Staking | Staking, Governance |

This table illustrates the key differences between Conflux and other major cryptocurrencies.

Conflux is steadily gaining global attention due to its unique consensus mechanism and regulatory support in China. As the blockchain space evolves, projects like Conflux aim to solve scalability issues while staying decentralized a mission shared by other emerging cryptocurrencies. If you are exploring similar high-potential assets, you might also be interested in our detailed Kaspa Price Prediction or the latest insights on Beam Price Forecast, both of which highlight fast-growing networks with innovative technologies.

Is CFX a Good Investment?

Conflux (CFX), as China’s state-endorsed blockchain, has its unique potential. It scales well and maintains low fees for decentralized applications. However, it struggles with regulatory risks and competition from Ethereum and Solana. While it holds promise, volatility in the crypto market adds an extra layer of risk. Investors need to weigh these considerations along with performing extensive research before investing.

Where to Buy and Store CFX

Here are the top options to buy and store Conflux (CFX):

Where to Buy CFX:

- Binance – Global exchange with CFX trading pairs.

- KuCoin – Another platform for buying CFX.

- Bitpanda – European exchange offering CFX.

Where to Store CFX:

- Hardware Wallets (Ledger, Trezor) – Secure offline storage.

- Software Wallets (MetaMask, Trust Wallet) – Convenient for everyday use.

Conclusion

With the continued evolution of blockchain technology, Conflux’s increasing adoption and its unique approach to scalability position it for future growth. CFX price prediction shows strong potential, but like any investment, it carries risks. Stay informed, but be mindful and assess the risks and rewards before investing.