Hedera is a decentralized public network where developers can build secure and fair applications using near real time consensus. This network is owned and governed by a council of top global companies, including Avery Dennison, Boeing, Deutsche Telekom, DLA Piper, FIS (WorldPay), Google, IBM, University College London (UCL), Wipro, LG Electronics, Tata Communications, Nomura and Zain Group.

What is Hedera?

Hedera is a public, open-source network created with the primary focus of achieving fast, cheap, and secure transactions. Unlike traditional blockchain networks, Hedera employs a unique consensus algorithm, the Hashgraph, which enables quicker transaction processing and better scalability. Outlandish prices and protracted transaction durations are some of the problems Hedera seeks to resolve that are presented in a multitude of blockchain networks.

It allows users to create and share smart contracts, which can serve a variety of purposes utilizing decentralized applications (dApps). Within the network, users partake in transactions, staking, and governance with the ecosystem’s native cryptocurrency, Hedera Hashgraph (HBAR).

Past Price Analysis

| Year | Price Range (USD) | Note |

|---|---|---|

| 2023 | $0.03643 to $0.08592 | Start price and end price of the year. |

| 2024 | $0.08593 to $0.2685 | Start price and end price of the year. |

| 2025 | $0.2685 to Continuing | The start price is $0.2685 at the start of the year. |

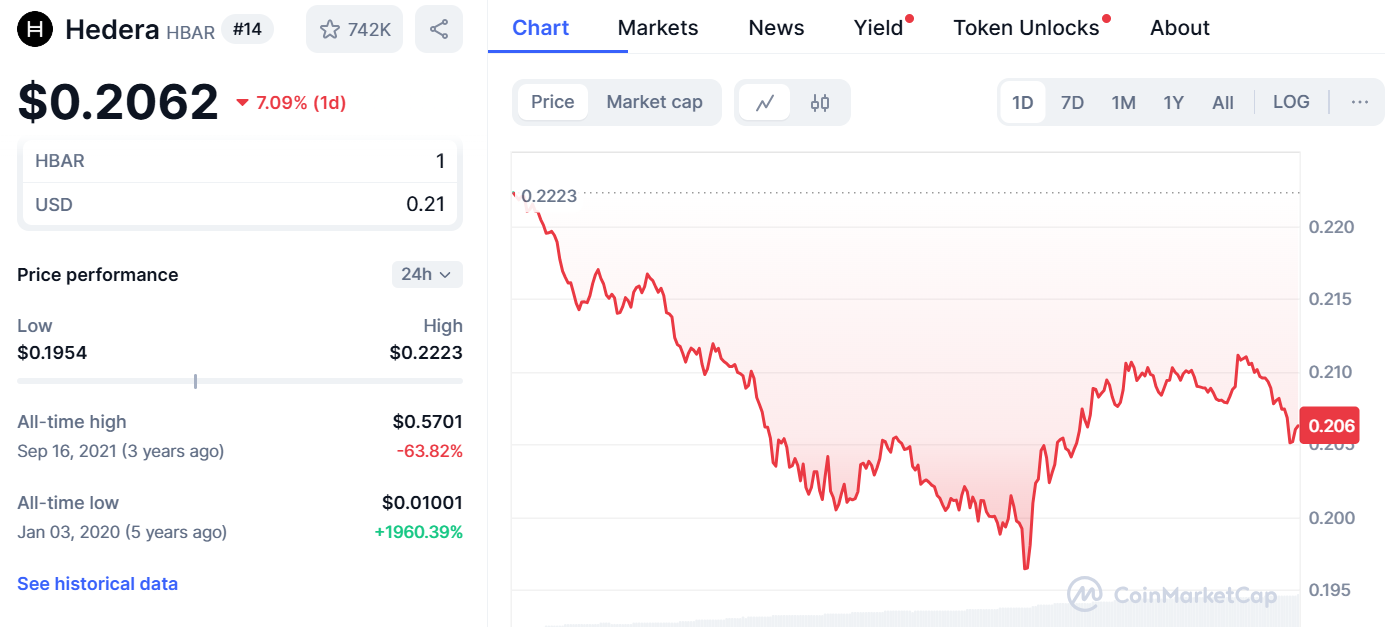

All-Time High (ATH): $0.5701 (Sep 16, 2021)

All-Time Low (ATL): $0.01001 (Jan 03, 2020)

Source

Current Market Situation & Price

The current price of Hedera (HBAR) is approximately $0.2062, and like its volume and market cap, the price too indicates that investors are active. HBAR is currently trading in a moderate range and is gradually growing. The market reflects increased interest at the moment because of its unique Hashgraph technology and real-world use cases.

Tokenomics

| Factor | Details |

|---|---|

| Token Name | Hedera (HBAR) |

| Total Supply | 50 Billion HBAR |

| Circulating Supply | Varies (Check live data) |

| Token Allocation | Percentage (%) |

| Foundation | 25.67% |

| Network Operations | 2.12% |

| Team | 15.84% |

| Community & Development | 20.19% |

| Initial Development & Licensing | 9.19% |

| Private Sale | 26.99% |

Important factors that will impact the price of Hedera

- Adoption Rate: Increased use of the Hedera network by enterprises and developers.

- Network Upgrades: Greater scalability, security, and speed improvements could create higher interest.

- Market Sentiment: General trends within the crypto ecosystem and investor sentiment will affect price.

- Partnerships: Increased credibility and usage come from collaborating with large companies such as Google and IBM.

- Regulations: Laws from a government body regarding cryptocurrency can influence Hedera’s position in the market.

- Supply and Demand: Increased demand paired with a capped supply of tokens can escalate the price.

- Technological Developments: Changes in the value of Hedera are caused by innovation and development in its infrastructure.

Hedera Price Prediction

| Year | Hedera Price Prediction Range (USD) | Key Drivers |

|---|---|---|

| 2025 | $0.20 to $1.75 | Increased adoption, growing enterprise use |

| 2026 | $1.75 to $3.28 | Technological advancements, more partnerships |

| 2027 | $3.28 to $4.10 | Expanding ecosystem, institutional adoption |

| 2028 | $4.10 to $5.40 | Strong demand, improved scalability |

| 2029 | $5.40 to $7.71 | Market growth, enterprise use |

| 2030 | $7.71–$11.13 | Global mainstream adoption, tech innovation |

Ecosystem and Strong Projects

- Hedera Hashgraph: Offers a core public ledger with fast, secure, and scalable transactions.

- Hedera Token Service (HTS): Enables easier creation and management of tokens within the Hedera network.

- Hedera Consensus Service (HCS): Delivers fully decentralized ordering service for any application.

Strong Projects:

- Google: Manages data with Hedera for security purposes.

- IBM: Works together on supply chain and other enterprise solutions.

- T-Mobile: Works together to develop applications that use 5G technology.

- LG Electronics: Participates in IoT initiatives and blockchain technology.

- Decentralized Applications (dApps): An ever-increasing number of dApps focusing on finance, gaming, and not only.

Hedera Coin (HBAR) Risk Factors:

- Regulatory Risks: The growth and adoption of Hedera may be impacted by government regulations.

- Market Volatility: The nature of cryptocurrencies will always have an impact on the price of HBAR.

- Adoption Rate: Lack of adoption by developers and businesses can stifle growth.

- Network Security: The ecosystem can be hurt by any weaknesses existing in the Hashgraph technology.

- Competition: Other blockchain and DLT ventures’ aggressive marketing might reduce Heera’s market share.

- Centralization Concerns: There is probably concern about a loss of decentralization with governance by large corporations.

Regulatory Impact on Hedera:

- Global Regulations: The compliance of a government with cryptocurrency regulations can impact the usage and operations of Hedera.

- Market Compliance: In order to escape legal trouble, Hedera must comply with changing laws over time.

- Institutional Adoption: Unambiguous regulations may support usage from institutions, whereas ambiguous regulations may be a hindrance.

- Security Compliance: The existing legal structure for security and privacy of data may have an effect on development by Hedera.

- Investor Relations: Actions taken by regulators may because changes in the confidence of investors in HBAR.

Hedera (HBAR) vs Other Coins

| Feature | Hedera (HBAR) | Bitcoin (BTC) | Ethereum (ETH) | Solana (SOL) |

|---|---|---|---|---|

| Consensus Mechanism | Hashgraph | Proof of Work (PoW) | Proof of Stake (PoS) | Proof of History (PoH) + PoS |

| Transaction Speed | 10,000+ transactions per second | 7-10 transactions per second | 30+ transactions per second | 65,000+ transactions per second |

| Transaction Fees | Extremely low | High fees | Medium to high fees | Low fees |

| Scalability | High scalability | Low scalability due to PoW | Medium scalability | High scalability |

| Energy Efficiency | Eco-friendly | Energy-intensive (PoW) | More energy-efficient than BTC | Energy-efficient |

| Decentralization | Governance by Hedera Governing Council | Fully decentralized | Decentralized, but some centralization concerns | Decentralized with some centralization concerns |

| Use Cases | Enterprise solutions, dApps, DeFi | Store of value, digital gold | Smart contracts, dApps, DeFi | Fast transactions, DeFi, dApps |

Is a good investment?

- Powerful Technology: Hedera operates on Hashgraph which allows for quick, safe, and scalable transactions.

- Strategic Partnerships: Supported by large institutions such as Google and IBM which enhances its reputation.

- Developing Ecosystem: Widening network with applications in enterprise solutions and DeFi.

- Investment Horizon: With increased acceptance, HBAR could experience good price appreciation.

- Headwinds: Regulatory concerns and competition from other blockchain initiatives.

Conclusion

Hedera price prediction is optimistic because of its exclusive Hashgraph technology that guarantees fast, secure, and scalable transactions. Its evolving ecosystem, marked by Google and IBM’s guidance, and real-world use cases provide value to the market. However, it is crucial to factor in regulatory risks, market volatility, and competition from other blockchain projects. If adoption rates increase, Hedera will most likely experience an increase in prices, although the best Hedera investors must still be looking for potential risks.

[…] Significant price increases are bound to happen to HBAR when adoption […]

[…] Hedera is built for speed and businesses, not quantum risk. […]