Altcoins are volatile and tend to change before trends change or news drops. Not everyone knows how to predict altcoins. This skill is crucial and can alter winners from people chasing green candles. Predicting altcoins will enhance your chances of profiting on the stock market. Altcoin pump phase predictions do actually exist, and you will learn the methods for forecasting. Analysts need to study narratives, charts, and wallet information in order for more precise timing.

Strategies to Predict Altcoins

Many traders seem to mark altcoin changes as early hype facings. People don’t pay a lot of value on crypto price statistics. Altcoins start losing their value unpredictability because of how people perceive the funds. Both movements and sentiment studies are involved in predicting changes alongside a wallet shift.

Using multiple data sources allows people to gather a bigger picture and differentiate better. Many altcoin pairs need to be examined against Bitcoin and Ethereum weekly for better results. It helps save a lot of time and effort if smaller caps are available.

Predicting Altcoins Through Trends

Because altcoins do not sell themselves, they are subject to changes like a narrative arc. A good market narrative can make a coin attain a new level of success.

To predict altcoin price changes successfully, you have to understand the story behind the narrative.

Once you learn the behavioral triggers and shifting sentiments, then it will be easy for you to identify movements in altcoin prices.

Understanding Market Narratives

In order to know how to predict altcoins, dive into shifting market narratives since the inception of trading. Narratives not only affect trader behavior, they also lead price movements, awaiting a catalyst.

Sentiment Shifts: Public sentiment and new developments rely on FOMO to action and drive extremes when it comes to DeFi and NFT coins. For real-time shift sentiments, use LunarCrush.

Influencers & Market Leaders: Tweets from influencers can spark instant price volatility. Elon Musk or CZ Binance have moved markets in seconds. Telegram and Twitter help spread narratives quickly and widely.

Hype Cycle Awareness: When fiat is introduced, it sometimes shatters value expectations in altcoins for the first time. Recognize that foresight is vital in moments of hype to dodge any possible falling edges.

How to Predict Altcoin Trends Using Narratives

Identify Emerging Markets:

- Follow the attention of projects in their dominant sectors like DeFi, NFTS, and privacy coins.

- These sectors tend to gain attention in the market, hence altcoins captured within these narratives tend to do good.

Example: MATIC was to rise off of Layer 2 Ethereum scaling solutions

Track Social Sentiment:

- Follow the community-driven stories in Reddit, Twitter, and Telegram for social told narratives.

- Apply tools that measure the altcoin’s price changes and guidance to gauge bullish and bearish sentiment.

Example: After the new Proof-of-Work (PoW) and Directed Acyclic Graph (DAG) technologies became valuable, CFX captured.

Watch for News Catalysts:

- Issues around partnerships, mainnet openers, or integrations are tagged as a concern by some.

- Attempt to use CoinDesk and Google alerts to follow other spawn news for the benefits of altcoins.

Example: LINK marked chains growth spikes right after the cloud Google added

Example of Narrative Impact

Every shift tells a story, like when Aave marked chain growth spikes right after Google added DeFi LINK.

Tip: Be Proactive With Shifts in the Narrative

To capitalize on altcoin ‘pumps,’ follow shifts in the narrative in real-time. Getting ahead of the narrative gives you an edge.

Advanced Altcoin Tools: Predicting Through On-Chain Data

On-chain data provides insights that help project the movements of different altcoins. It represents real-time blockchain activity and helps follow trends in the market

Key On-Chain Metrics to Watch

- Active Addresses: The increase of active addresses on a particular coin indicates that it is getting more interest. A surge predicts higher demand, which means prices will likely go up.

- Transaction Volume: A rise in transaction volume can predict price movements. This shows that there is interest in the market.

- Whale Activity: The Movement of large sums of currency by whales can indicate changes in prices. Follow the moves of whales to predict changes in trends.

- Network Growth: Developer activity on GitHub shows if the project is alive and if it is likely to grow in the long run.

Tools For On-Chain Analysis

- Glassnode: Consolidated information on altcoins and the activity of whales predicts changes in the market.

- IntoTheBlock: Provides accurate closing information on changes in the market and transactions carried out by whales.

- Santiment: Merges data captured through blockchain and the social network to give results that are easy to predict

Example: How On-Chain Data Predicts Altcoin Price Movements

A spike in bitcoin transactional data led to a direct injection into the price of altcoins. Whale parade, along with system growth, also tends to affect prices.

Using On-Chain Data for Prediction

- Tools like Glassnode allow you to track active addresses. This feature helps in tracking rising interest.

- Keep an eye on whale movements. These movements could serve as price trend indicators.

- Gauging developer activity helps in analyzing the long-term health of the project.

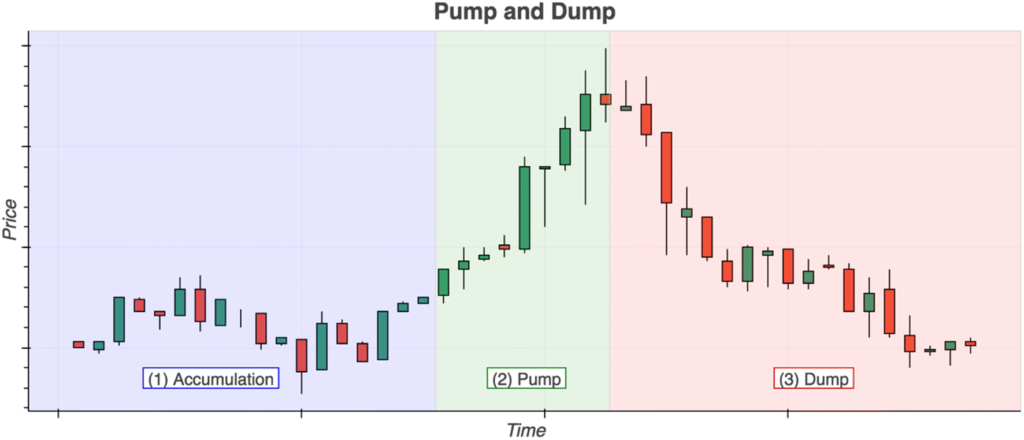

Altcoin Lifecycle Mapping: Spot Patterns Early

Once you learn how to predict altcoins, study the market lifecycle mapping as it shows when to monetize altcoins. Each altcoin has similar phases within its life cycle that repeat with minor variations.

Updated Lifecycle Phases 2025

Today’s market is like a chameleon, adapting to social trends and technology.

Stealth Phase: Smart money buys quietly during this point, but there is minimal media coverage.

Awareness Phase: This phase features early adopters as well as influencers beginning to chat.

Hype Phase: During this phase, retail FOMO hits, and so does a slew of viral trends. And there is a sharp rise in price.

Distribution/Dump Phase: Sharp does indeed follow inflated prices, and smart money exits.

Reaccumulation Phase: This phase features the price finding a floor. Lyric consolidation happens so the next phase can begin.

Pro Tip: Monitor altcoins post-dump. That’s where the next pump often begins.

Fractals: Predicting Altcoin Pumps from History

Fractals are crucial in understanding how to predict altcoin pump moves. Things like repeating structures seen in historical altcoin charts or comparing current charts with past bull cycles show how this is achievable.

Most importantly, however, make sure to pay attention to symmetry in RSI, volume, and trendline. Time your entry as the sack of bones starts forming around the dead man’s tree.

Real-Time Signals of Lifecycle Transitions

- Volume Growth without a price increase depicts early stealth circumstances.

- A breakout with high activity signals a hype phase is beginning.

- Decline and Settled Volume signals a reaction formation.

Why Lifecycle Mapping Works in 2025

- Psychology behind cycles still rules, even with AI and faster systems in place.

- Retail remains the most narrative-driven of the lot.

- Moreover, the pump-and-dump pattern of altcoins follows the same cycle, only at a much quicker tempo.

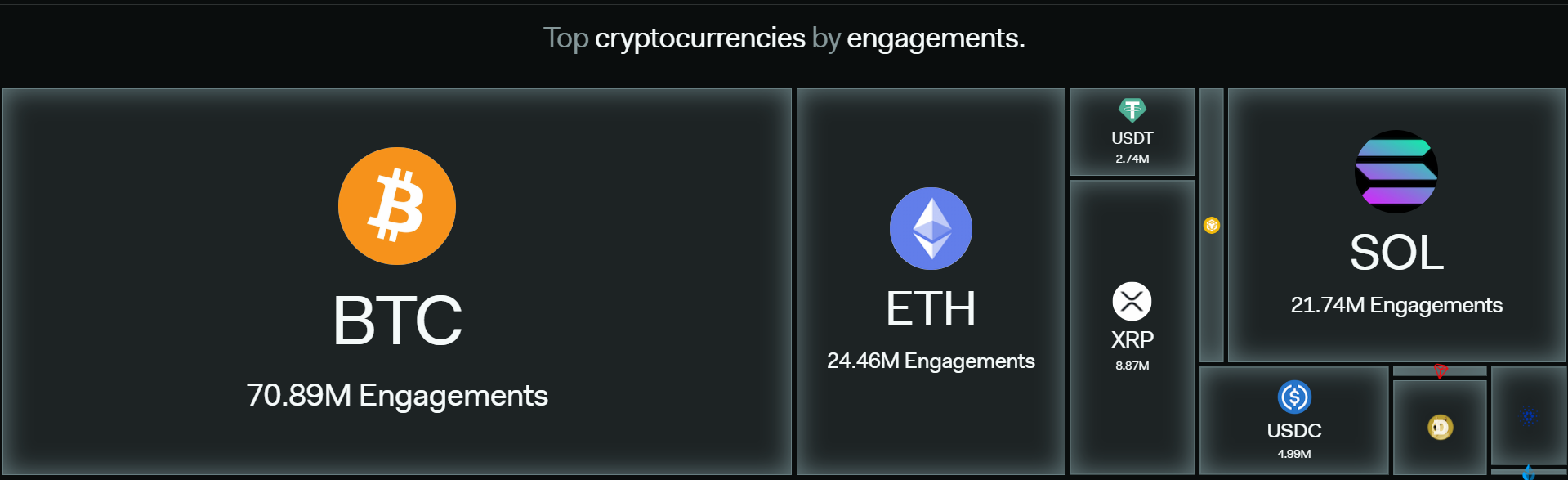

Sentiment Indexing and Social Momentum

Having buzz around social altcoins is a good sign. It means there’s a possibility to estimate their performance. Most of the time, attention gives way to no price rise, which is generally perceived as the ‘moment of truth’.

In 2025, they remain potent on X, Discord, and Telegram. Tracking user activity across these platforms allows for predictive powers. These pump signals precede most, if not all, technical breakouts.

Tools to Forecast Altcoin Momentum

You can now track positive and negative news using social sentiment tools:

- Score coins using real-time social activity with LunarCrush.

- Santiment detects excellent mentions on Telegram, Reddit, and X.

- CryptoMood predicts altcoin price based on social activity.

- DEXTools Trending Keeps an eye on the micro-cap token launch hype.

If you are trying to figure out how to predict altcoin pump signals, track activity changes before any price movement occurs. The surge in mentions, likes, or Discord joins usually precedes the price surge. That social attention accelerates the price increase of the coins that have already gained popularity.

Also, keep in mind: Falling sentiment often results in a sell-off or price stagnation. Comparing social activity with on-chain metrics will provide better confirmation.

How to Predict Altcoin Pump – Chart Psychology

Pumps for altcoins are not random; they are the result of underlying psychological behavior, which can be capitalized on using prior knowledge. Chart psychology emphasizes the identification of key accumulation and breakout phases, which have a natural rhythm.

Key Psychological Triggers for Altcoin Pumps

- Accumulation Phase: A period when price moves within a defined range. It indicates that accumulation is taking place.

- Volume Boosts: High trading volume linked to rising prices frequently happens before a price breakout takes place.

- Buying Surge: An Event where a given price goes above set resistance level triggers buying by most investors.

- Bullish Divergence: Prices moving upwards while market sentiment indicators soften are a sign to anticipate a pump.

Common Chart Patterns to Watch

- Cup and Handle: The handle is the term in this formation that lowers, indicating an altcoin’s likelihood to rally.

- Bullish Flag: Surge in price followed by a shift sideways.

- Ascending Triangle: Continuous formation of higher limit indicates upward price change.

In the pricing structure prior to a pump, there is almost always a narrow range consolidation zone. This period is important for larger investors (whales) to purchase. As momentum builds, a breakout happens, resulting in the altcoin reaching a higher high.

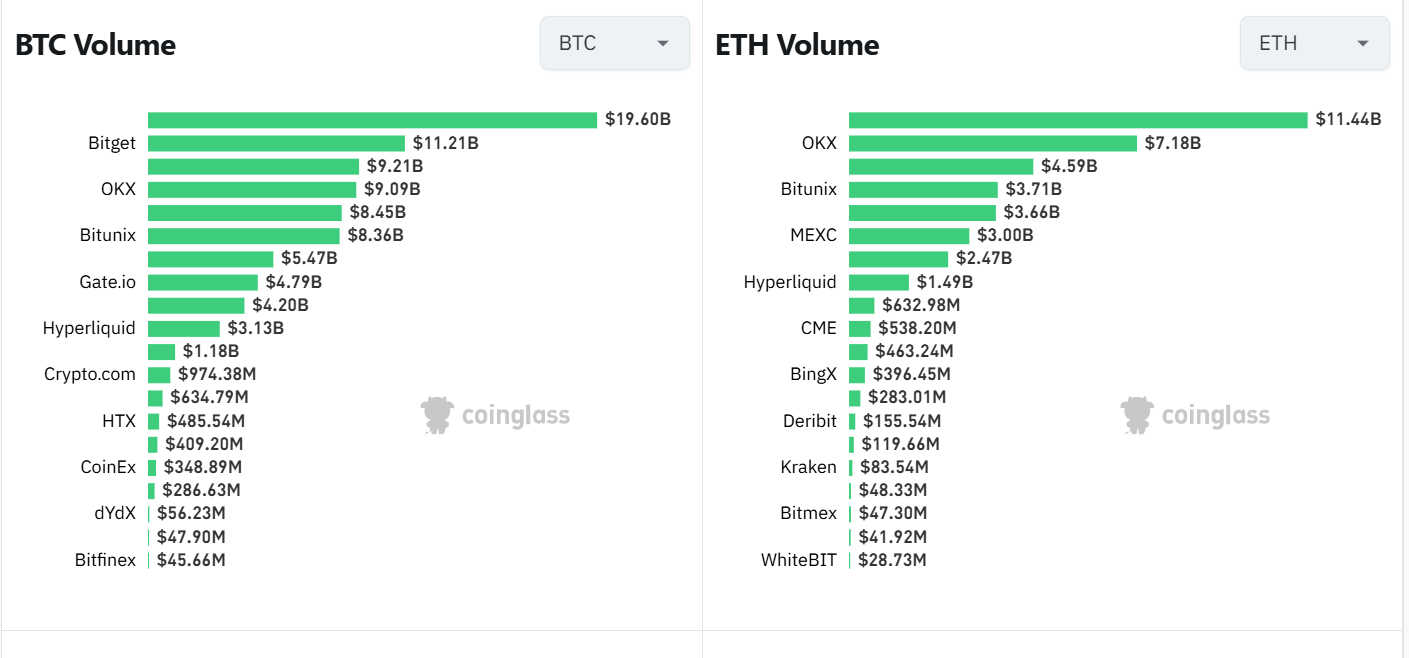

Volume Analysis for Predicting Pumps

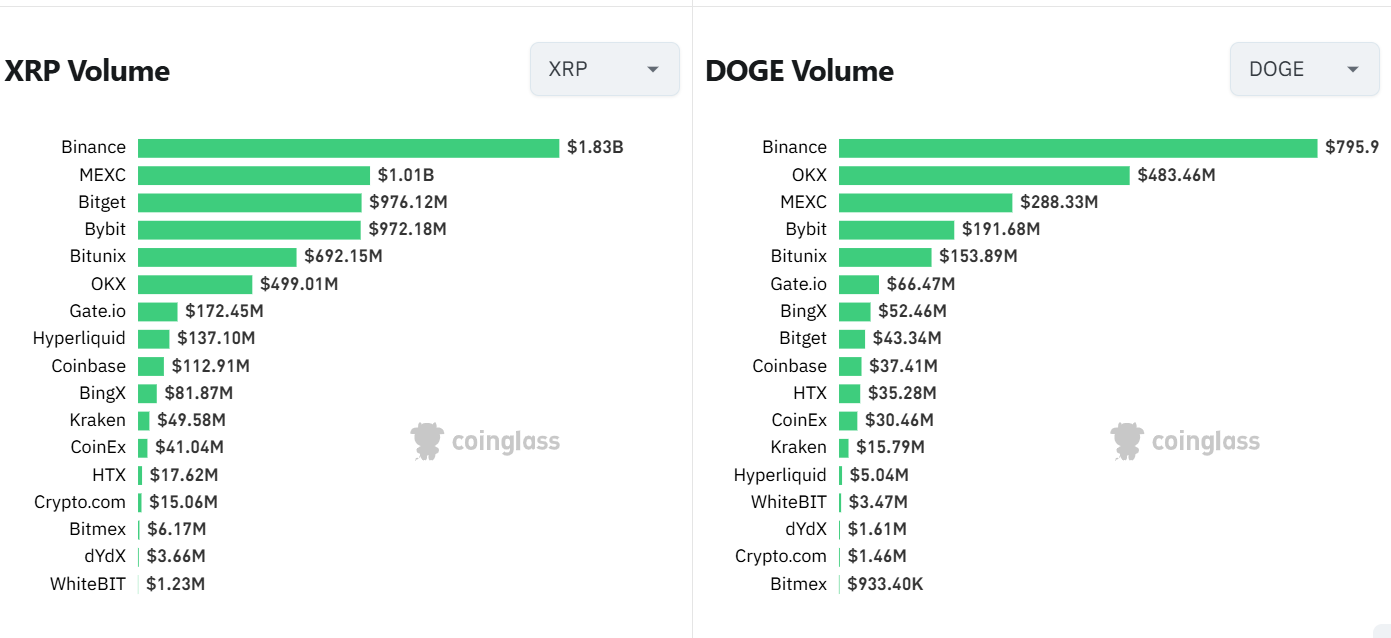

XRP and Doge Volume Analysis

- Low Volume Breakouts: An altcoin that breaks resistance with little volume typically ends with failure.

- High Volume Breakouts: This signifies genuine market interest, which often results in an extreme movement in price.

Pro tip: Always confirm price action in relation to volume for more accurate prediction.

Can Altcoin Charts Predict Bitcoin Movement?

Yes, if it is during the period of Reaccumulation. When altcoins tend to express market sentiments. Recoveries of certain altcoins tend to signal the next phase of momentum in Bitcoin. The reason behind this is not random but the market environment and volatility.

Altcoins as Leading Indicators for Bitcoin

Knowing how to forecast altcoins helps in determining Bitcoin’s shifts. Altcoin shows signs of recovery earlier than Bitcoin, implying that altcoin market sentiment captures key indicators fast.

- Shift in Dominance of Altcoins: A reduction in dominance of Bitcoin indicates flow of money into altcoins. This change is often followed by stronger short-term altcoin performance.

- Rapid Response to Changes in Sentiment: Compared to Bitcoin, altcoins are faster to move because of the high volatility and low liquidity. Emotion-driven changes happen quicker to altcoins than to Bitcoin.

- Tracking Bitcoin-Altcoin Pairs: BTC pairs are essential, as they indicate the moments when altcoins traditionally spearhead movements ahead of Bitcoin. A good number of altcoins jump the gun during Bitcoin’s pauses or corrections.

Leading Indicators in Altcoins for Bitcoin Trends:

Understanding foreseeing altcoins tends to assist in projecting Bitcoin movement. Bitcoin usually is on the tail end of following the trend started by altcoins, lagging behind.

- Volume Analysis: The movement in the token volume of the altcoins surging prior to Bitcoin implies funding flowing into the market. A strong breakout signals early confidence across the totality of markets in crypto.

- Positive Correlation Patterns: Altcoin’s moves onto the fray can serve as indicators of Bitcoin set to rise. Patterns with Bitcoin responses show positive correlation but with a delayed reaction time.

- Bitcoin’s Short Viewed Dip Periods: Dips usually push quietly under the surface, shifting in altcoins. When altcoins begin slowly surging during quiet periods, it is generally viewed as leading up to a potential breakout, Euphoria surges predicted.

How to Use Altcoins for Bitcoin Predictions

- Look Out for Resistance Breakout: Bitcoin tends to follow more often when altcoins go through an important resistance breakout.

- Angle In Capital Rotation: There is rotation inbound on the market when the euphoric Bitcoin Dominance metric slides down along with rise in altcoins.

- Safeguarding The Market Signal: This is a market alert for Bitcoin that comes less often at Aligning Level Divergence. When altcoins begin moving upward and Bitcoin holds up at one zone for long, then it’s a signal that later on it’s likely to follow through.

Practical Example

Watching for slow thrusts in the price of altcoins is a sure price indicator that Bitcoin is expected to follow, particularly among the staking with BTC between pairs.The reason is that the movement in the altcoin market strongly indicates that any sentiment and liquidity changes is much more drastic compared to those in Bitcoin.

Tip: Keep an eye on short-term altcoin movements. These movements have the potential to forecast Bitcoin’s larger movements.

Altcoins are like the “canary in the coal mine” for Bitcoin market direction.

Altcoin Prediction Traps to Avoid

Predicting altcoins encompasses many elements, including avoiding major blunders. Controlling mistakes influenced by hype will save your funds in the future.

Blindly Copying Influencers

Repetitive buying and selling get compounded and circulated into popularity. Reputation fuels many pumps, then sharp dump cycles follow.

- Use on-chain datasets and social data verification tools to verify data.

- The tail that screams the loudest often receives a disproportionate reward, so understand who stands to gain the most.

- Get targeted by a collective of Nader’s people over’ analysts, instead of notorious promoters.

Misreading Volume Spikes

While high trading volumes signal great demand, increased trading alongside lackluster activity might signify otherwise. Some bots increase activity levels to ensnare unsuspecting traders.

- Examine true trade statistics supported by substantial documents, rather than active trade figures.

- Scrutinize the growth rate of individual controlled wallets throughput as well as the stock available on order books combined.

- For precise volume signals, rely on DEX Tools or Gecko Terminal.

Social Hype ≠ Real Growth

Sentiment can sometimes be more important than the trending coins one sees on Telegram or X, and it’s worth noting that those coins might not have strong fundamentals supporting them. Make sure to confirm the move using data.

- “Match the buzz with the on-chain flow” using Sentiment tool’s features.

- Additionally, check the activity levels of the developers, updates, and user engagement.

Altcoin Prediction Tools and Custom Dashboards

To learn how to predict altcoins, tools are essential for success. Smart traders rely on platforms that convert data into real insight.

Best Tools to Use in 2025

- TokenTerminal: Tracks revenue, protocol health, and token flow.

- Santiment: Monitors sentiment, wallets, and development activity.

- TradingView: Offers custom indicators and advanced chart setups.

These platforms combine price, volume, and sentiment in one dashboard. They help you avoid noise and focus only on what truly matters.

Building Your Predictive Dashboard

Create a workspace with daily metrics for your favorite altcoins. Include social scores, RSI, MACD, volume, and whale wallet activity. Update signals every morning and log reactions to each move. With your system, you’ll improve how you predict altcoin pumps.

Altcoin Prediction in Bull vs. Bear Cycles

Cycles affect how you apply your methods to different conditions. In both bull and bear markets, behavior and timing shift drastically.

Bull Markets

- FOMO spreads fast, and narrative-based pumps lead technical breakouts.

- Volume surges quickly, and hype drives most small caps higher.

- Use tighter entries and let strong trends play out longer.

Bear Markets

- Fear drives sell-offs, often without a clear technical structure.

- False breakouts are common; wait for strong confirmation.

- Focus on large caps or accumulate during consolidation zones.

Knowing how to predict altcoins means adjusting your strategy by cycle.

Create Your Daily Altcoin Prediction Playbook

Consistency improves accuracy in altcoin predictions over time. Use a checklist to evaluate conditions before entering any trade.

Daily Checklist Before Predicting a Move

- Is volume rising steadily across exchanges or wallets?

- Are influencers or community channels discussing the project?

- Has RSI reset while price remains in a strong zone?

- Are whales accumulating or moving funds recently?

- Any news, updates, or catalysts expected in the next 24 hours?

This checklist makes how to predict altcoin pumps more structured. Over time, you’ll recognize patterns faster and avoid false signals.

Conclusion

Successful prediction isn’t guessing, it’s spotting repeated patterns. Altcoin price movements are driven by data, emotion, and timing. Your edge grows as you observe, test, and refine your process. Learning how to predict altcoins means staying adaptive and strategic. Use a mix of tools, sentiment, narratives, and technical setups. Stick to your system and trust the signals, not the noise.

[…] accurately is crucial for maximizing gains. Learn actionable methods in our detailed resource, How to Predict Altcoins Moves Like a Pro. The current price of Zora AI (ZORA) is $0.0142. It has increased slightly by +0.2% […]