Kava is a rapidly expanding blockchain built for DeFi that provides low fees and Ethereum. The platform’s features like lending, staking, and decentralized trading, provide a great opportunity for growth.

Although competition and market volatility pose challenges, Kava’s never-ending innovation and expanding ecosystem make it easier for Kava to remain a strong contender within the crypto space.

What Is Kava?

Kava’s DeFi platform is uniquely designed and highly customizable. It is developed on the Cosmos SDK, and as a Layer-1 network, it allows seamless functionality between different blockchain networks.

Kava rewards users by letting them borrow and lend multiple cryptocurrencies in addition to stablecoins and even staking. Kava is a major building block for the DeFi ecosystem. The platform has a dual-chain architecture that merges the Ethereum smart contract capability with the rapid technological advancement of the Cosmos blockchain.

Kava Past Price Analysis

With the fluctuation in price, Kava has moved significantly with time because of the market shifts and made iterations within its own ecosystem. The table below summarizes Kava’s past performances throughout the years:

| Year | Kava Lowest Price (USD) | Kava Highest Price (USD) | Key Highlights of Kava Coin |

|---|---|---|---|

| 2020 | $0.29 | $5.51 | Launched a cross-chain lending platform |

| 2021 | $1.40 | $9.12 | Defi adoption and ecosystem expansion |

| 2022 | $0.65 | $5.42 | Market downturn affected crypto prices |

| 2023 | $0.50 | $1.28 | Bear market recovery began |

| 2024 | $0.42 | $1.40 | Increased staking and network upgrades |

Kava price history reveals growth market cycles and corrections within Kava prices which have been largely influenced by the overall crypto market conditions and DeFi adoptions.

All-Time High (ATH): $9.19 (Reached on September 8, 2021)

All-Time Low (ATL): $0.30 (Recorded on March 13, 2020)

Source

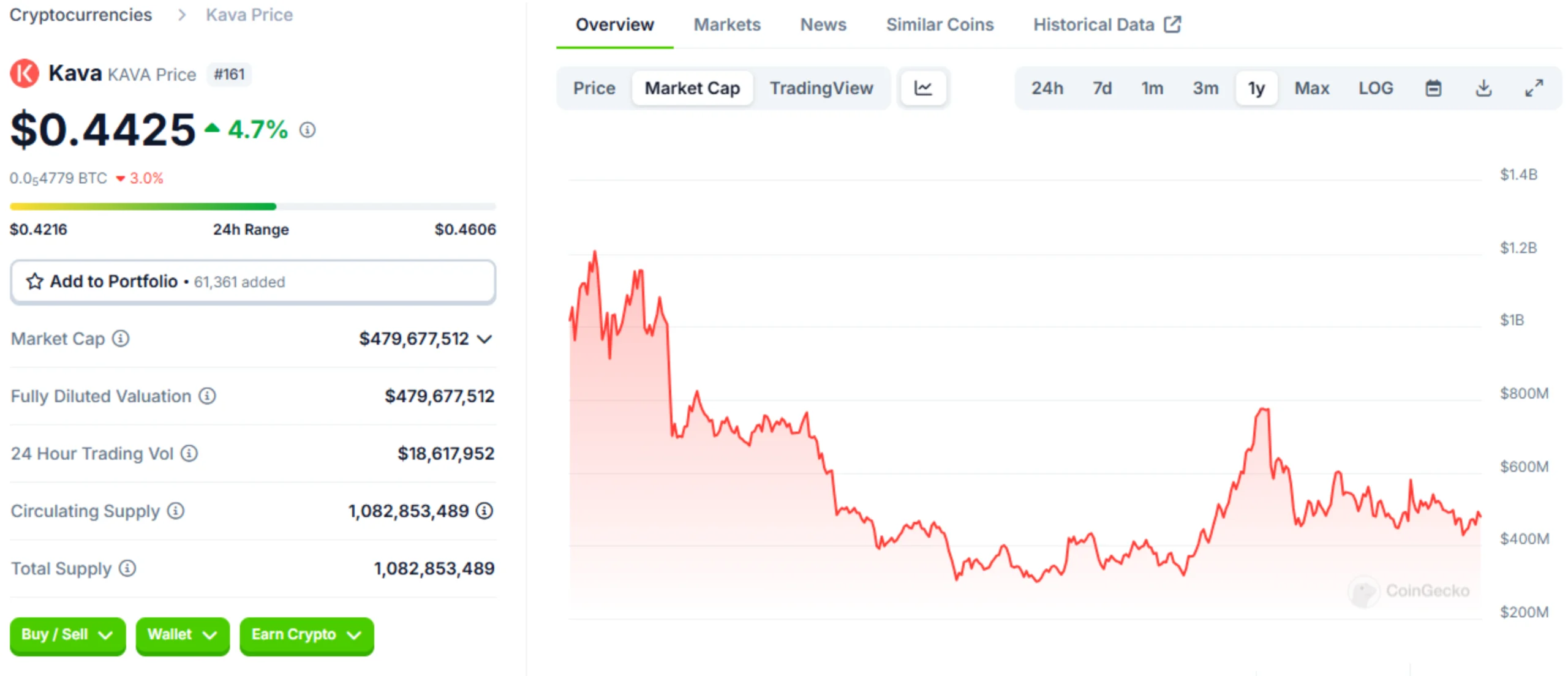

Kava Coin Current Market Situation & Price

According to the latest market report, Kava (KAVA) trades at roughly $0.4425 per token.

On the last day alone, Kava’s price grew by 4.99%, and the trading volume reached $20,730,865 within that time.

As reported, Kava sits at a market capitalization of approximately $479,764,108, placing it at the 126th position.

Always take into account that the price of cryptocurrencies is subject to large shifts at any given time. For the most accurate information, check real-time financial platforms or exchanges.

Kava Tokenomics

Kava (KAVA) has defined tokenomics to support its ecosystem, staking, and governance activities. Here are the details:

| Category | Allocation (%) | Amount (KAVA) | Description |

|---|---|---|---|

| Total Supply | 100% | 1,000,000,000 | Maximum supply of KAVA tokens. |

| Circulating Supply | ~100% (as of 2025) | ~1,000,000,000 | Currently in circulation. |

| Community Incentives | 48.00% | 480,000,000 | Rewards for staking, liquidity mining, and ecosystem growth. |

| Team & Developers | 25.00% | 250,000,000 | Reserved for the Kava development team and core contributors. |

| Investors & Private Sales | 20.00% | 200,000,000 | Allocated to early investors and private funding rounds. |

| Reserve Fund | 7.00% | 70,000,000 | Held for future development, partnerships, and unforeseen needs. |

Kava Price Prediction From 2025 to 2029

Kava Price Prediction depends on its adoption in DeFi, blockchain upgrades, and the overall crypto market movements. Here is a projected price range based on performance history, adoption patterns, and market conditions.

| Year | Kava Price Prediction Range | Key Drivers |

|---|---|---|

| 2025 | $0.60 – $1.50 | Market recovery, DeFi growth, staking demand |

| 2026 | $1.20 – $2.80 | Increased adoption, ecosystem expansion |

| 2027 | $2.00 – $4.50 | Stronger DeFi integrations, institutional interest |

| 2028 | $3.50 – $6.00 | Cross-chain advancements, regulatory clarity |

| 2029 | $5.00 – $10.00 | Mass adoption, global crypto market maturity |

Our experts give the Kava Price Prediction charts for 2025 to 2029. They always try to give their best.

Kava Ecosystem Overview

The Kava Ecosystem seamlessly enhances DeFi applications by incorporating cross-chain transactions and scaling solutions.

- Kava Lend: A crypto-backed loan marketplace where users can lend and borrow against crypto assets.

- Kava Swap: An interchain DEX that allows the trading of assets between different blockchain networks.

- Kava Earn: Users can stake their assets and earn interest through liquidity mining.

- Kava Rise: An incentive fund for developers building new applications on the Kava network.

- Kava Network: An Ethereum and Cosmos dual-chain providing fast DeFi services.

- USDX (Stablecoin): The Kava ecosystem’s native stablecoin which is used for lending and borrowing in the ecosystem.

The Kava ecosystem is one of the fastest-growing ecosystems in the DeFi space.

Coin Risk Factors

The crypto market is already very risky. Just like any coin, there is always a chance that the price might drop. Even though Kava is built on both the Ethereum Blockchain and Binance Smart Chain, some people may still hesitate to invest in it because of strict rules.

So, it’s best to carefully analyze the market and invest only after fully understanding it.

Should You Invest In Kava?

We all know a little about market volatility. But Kava has still managed to stay in the competition with other coins. Kava is famous for its cross chain feature. Not only that, it also gives access to a decentralized exchange. Without a doubt, Kava can be a very good option for long term investors.

Conclusion

Among DeFi crypto projects, Kava holds a strong position. Its growth and scaling potential efficiencies help it maintain a powerful place in the market. Kavas ecosystem and low cost fees have made it very popular. However, like all coins it is also part of a volatile market. So, along with the chance of making a profit, there is also a small amount of risk.

[…] For more crypto Predictions, check out: Kava Price Prediction- Analysis and Ecosystem […]