Monero was introduced in 2014, focuses on enabling fully private and anonymous digital transactions. Unlike Bitcoin, where transactions are visible and often traceable, Monero uses cutting edge cryptography to conceal the identities of both senders and receivers.

The Monero team emphasizes privacy and security as core principles, aiming to make financial freedom available to everyone regardless of technical skill. With quick low cost transactions and built in resistance to censorship, Menero stands out as a powerful tool for truly confidential payments.

Monero Price History: An Overview of XMR’s Growth

Here’s a table of Monero’s price history over the past five years:

| Year | Price Range (USD) | Note |

|---|---|---|

| 2020 | $46.50 – $167.96 | Start price and end price of the year. |

| 2021 | $157.68 – $220.65 | It began at $157.68 and finished the year at $220.65. |

| 2022 | $225 – $145.63 | Prices began at $225 and decreased to $145.63 by year-end. |

| 2023 | $145.77 – $165.76 | Start price and end price of the year. |

| 2024 | $174.59 – $190.66 | Trading start price and end price of the year. |

ATH (All-Time High): $542.33 (January 2018)

ATL (All-Time Low): $0.216 (January 2015)

Source

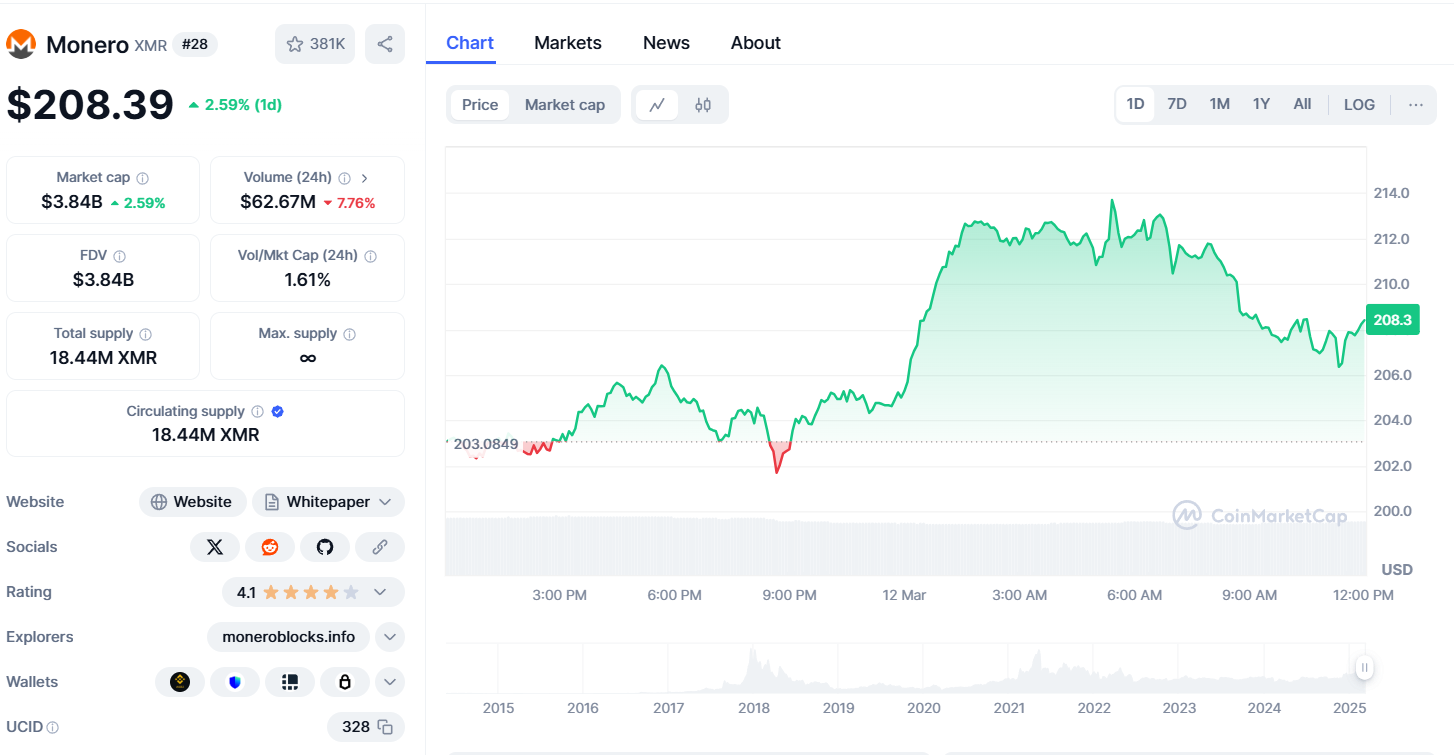

Current Market Situation & Price (2025)

Currently, Monero (XMR) is experiencing a minor increase of 2.59%, bringing its value to approximately $2O8.39 as of 2025.

Monero Tokenomics

The economics underlying the use of Mantle tokens will determine its future success and the demand for stability. Below is an intricate analysis of the monero tokenomics (XMR):

| Metric | Value |

|---|---|

| Total Supply | Unlimited (Capped by emission curve) |

| Circulating Supply | 18.44 million XMR (as of 2025) |

| Max Supply | No fixed supply cap |

| Block Reward | 0.6 XMR per block (dynamic) |

| Block Time | 2 minutes |

| Annual Inflation Rate | Declining over time |

| Mining Algorithm | RandomX (ASIC-resistant) |

| Consensus Mechanism | Proof of Work (PoW) |

| Hashing Power | Decentralized mining network |

Monero’s emission model is built to diminish over time, with an incentive tail emission kicking in after a certain threshold. This ensures long-term network security while avoiding hyperinflation.

Important Factors That Will Impact The Price Of Monero

- Regulations

Demand and price are highly dictated by strict or favorable regulations on privacy coins. - Application

As the real-world application and activity in defile increases, demand for Monero will soar, thereby increasing its price. - Market Sentiment

Market movement as a whole has an impact on investor confidence in Monero and its pricing, which is either bullish or bearish. - Technology

Monero’s value will greatly increase with improvements in its privacy and scalability features. - Mining & Security

Changes in the incentive structure of mining and network security alter supply, changing the price. - Competition

Monero’s market share can be altered by competing privacy coins such as Zcash and Dash. - Macro-Economic Factors

Inflation or economic downturns increase activity and demand for privacy coins, bumping Monero’s pricing.

Monero Price Prediction 2025: Factors Driving Growth

Here’s a table showing Monero’s predicted prices for different scenarios from 2025 to 2030:

| Year | Monero Price Prediction (Low) | Monero Price Prediction (High) | Factors Driving Price |

|---|---|---|---|

| 2025 | $180 – $220 | $250 – $300 | Adoption, utilization of market, and privacy. |

| 2026 | $220 – $260 | $350 – $400 | Adoption, economy and lack of clear policies. |

| 2027 | $250 – $290 | $400 – $450 | Growth of decentralized finance (DeFi) and privacy. |

| 2028 | $300 – $350 | $450 – $500 | Growing Institutional interest and scalability. |

| 2029 | $350 – $400 | $500 – $550 | Rising interest from institutions and the ability to scale. |

| 2030 | $400 – $450 | $550 – $600 | World problems on privacy issues result in the need for privacy coins. |

Monero Ecosystem and Key Projects

Monero’s ecosystem is built on privacy, decentralization, and security, supported by several key initiatives:

- Monero Core: A dedicated team that works to improve features continually and protect Monero’s privacy and security.

- RandomX: A Proof of Work algorithm with ASIC resistance that enhances mining decentralization.

- Wownero: A fork of Monero created for memes that playfully accentuates Monero’s focus on privacy.

- Monero GUI & CLI Wallets: Simple-to-use wallets that allow the user to manage transactions.

- Monero Research Lab: Conducts research in advanced cryptography for enhancing privacy features in Monero.

- Tails OS Integration: Allows anonymous secure transactions over an operating system designed for privacy.

- Monero Atomic Swaps: Enables trustless exchange of XMR for other currencies directly without any intermediary.

Monero Vs other privacy coins

| Privacy Coin | Privacy Mechanism | Pros | Cons |

|---|---|---|---|

| Monero (XMR) | Ring Signatures, Stealth Addresses | Strong privacy, decentralized, robust security | Scalability issues, regulatory scrutiny |

| Zcash (ZEC) | zk-SNARKs | Optional transparency, strong privacy | Privacy is optional, centralized founders |

| Dash (DASH) | CoinJoin (PrivateSend) | Fast transactions, governance model | Weaker privacy, not fully anonymous |

| Pirate Chain (ARRR) | zk-SNARKs | 100% privacy, fully shielded transactions | Smaller network, less adoption |

| Beam (BEAM) | MimbleWimble | Scalable, strong privacy | Lower adoption, less established |

Monero and Other Coins

Monero: Monero stands out for its strong privacy features with no transparency option, making it the top choice for privacy-oriented users.

Zcash: It has optional transparent transactions and thus offers privacy, which allows users to enjoy either privacy or traceability.

Dash: It focuses on fast transactions and governance but provides weaker privacy compared to Monero.

Pirate Chain: Privacy-focused soldiers of zk-SNARKs Monero coin with full privacy features but a smaller network.

Beam: Adopts Mimble Wimble offers Multi-dimensional scalable privacy, but with comparatively less adoption.

Key Risks and Opportunities for Monero

These are the main risks associated with Monero (XMR)

Monero Risks: Increased surveillance while trying to loosen up privacy and possibly banning traditional Monero privacy coins would make the use and price of Monero more difficult.

Wage Conduct Restrictions: Adoption gaps nearing the zero mark, especially in Corporative Construction Systems, can stifle non-linear expansion.

Price Instability: Monero, like other coins, can suffer from capricious deflation which alters its characteristics and equilibrium.

Overcentralized Mining: The concentration of mining, despite XMR being ASIC-proof, enables XMR to escape the promise of decentralization while reducing network security.

Underdevelopment: Frail RandomX goldrush implementation and encryption may be exploited in ways that endanger privacy and security.

Competition: More serious forms of copycat private coins and other competitors employing different concepts of privacy may take away considerable shares of XMR market.

These kinds of risks highlight the issues regarding Monero, while its value-stabilizing features guarantee its privacy.

Security Threats: Cracks in Smart Contracts

Monero does not utilize Ethereum’s smart contracts, but other privacy coins may carry the risks concerning smart contracts. Here are some weaknesses that could impact any privacy coin ecosystem with smart contract features:

- Vulnerabilities: A bug capable of being exploited in the contract could be compromised.

- Interoperability Risks: Interaction with smart contract ecosystems could put confidential data at risk.

- Oracle Problems: Erroneous or corrupt external information can compromise security.

- Code Complexity: The more sophisticated the contract, the greater the number of possible errors or undesired actions.

- Increased intelligence: Authorities must enforce policies dealing with these integrative contracts more vigorously.

At this moment, Monero is safe; however, these threats can change with the use of smart contracts.

For people who focus on privacy and decentralization, Monero (XMR) is a great option. Its strong volatility in price and regulatory risk, however, creates concern. This coin excels for users focused on privacy but may not suit risk-averse investors.

Conclusion

As previously stated, the Monero price prediction for 2025 appears to be incredibly strong, primarily due to greater adoption alongside its unrivaled privacy features. Although regulatory risks and market volatility persist, Monero remains a leader among privacy coins due to its decentralization and strong technology.

[…] Read More: Monero Price Prediction: Future Outlook & Growth […]