Pendle is a protocol that enables the tokenization and trading of future yield. By introducing a unique AMM that supports assets with time decay. Pendle allows users to gain greater control over their future yield, offering both optionality and new opportunities for its utilization.

In this guide, We will discuss Pendle crypto price prediction 2025 to 2030. We will analyze the data available, together with technological advancements, and expert insights. If you are planning on investing, this article is surely going to help you.

What is Pendle (PENDLE)?

Pendle is a protocol within the decentralized finance ecosystem that focuses on tokenizing and trading future yield. It introduces an innovative approach by allowing users to separate ownership of a yield generating asset from its future yield, enabling the creation of new tradable financial instruments.

At the core of Pendle is a custom automated market built to support assets with time decay an essential feature for accurately pricing future yield tokens. This design addresses the complexity of valuing future yields, which vary with market conditions and the performance of the underlying assets.

Pendles focus on future yield tokenization marks a major innovation in DeFi, offering tools that enhance earnings potential and risk control in a decentralized environment. As always, users should behaviour through research and assess their financial position before engaging with any DeFi protocol.

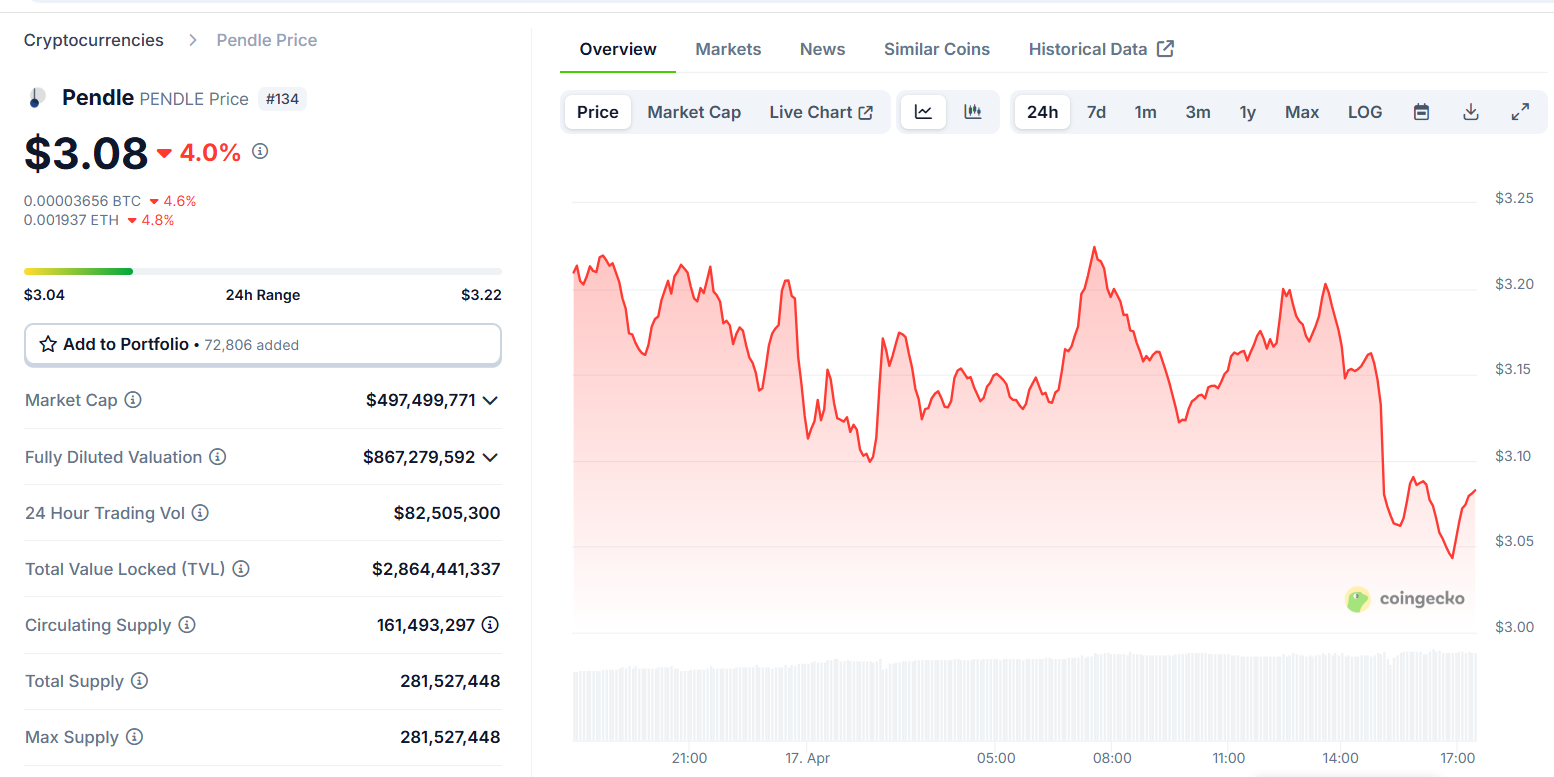

Current Market Situation & Price of Pendle (2025)

Pendle is currently trading within the range of $3.21 (as of April 2025). Pendle’s market cap is at a whopping 507.23 million. It has a trading volume of roughly 52.78 million over the past 24 hours.

Pendle Technical Analysis

On the 16th of April 2025, Pendle was trading at $3.21, a 0.75% drop.

Key Indicators:

- RSI (14-day): 56.47 – Sentiment towards the market is neutral.

- Moving Averages: Short Term(SMA 50) and Long Term(200 SM) show neutrality.

- MACD: It has met the threshold for signaling a potential buy 0.024.

Support & Resistance Levels:

- Support: $2.45 (S1)

- Resistance: $3.70 (R1)

Market Sentiment: The market’s mood remains bearish as 76.47% of the indicators are triggering the sell signal. Pendle, in particular, is facing mixed technical analyses. Some indicators, such as MACD, do point towards buying opportunities, but the overarching bearish sentiment, along with neutral moving averages, suggests taking a step back.

Pendle Past Price History (2023-2025)

Pendle underwent critical price volatility since its inception. Here is a snapshot of Pendle’s price range over the past 3 years:

| Year | Price Range (USD) | Notes |

| 2023 | $0.04559 – $1.1864 | Start price and end price of the year. |

| 2024 | $1.1870 – $4.8569 | Start price and end price of the year. |

| 2025 | $4.8569 to Continuing | The start price is $4.8569 at the start of the year. |

ATH (All-Time High): $7.52 (Apr 11, 2024)

ATL (All-Time Low): $0.03349 (Nov 10, 2022)

Source: CoinMarketCap

Note: The price fluctuations of Pendle are common for increasing DeFi projects.

Pendle Crypto Price Prediction 2025 – 2030

Here is the estimated Pendle price range for the next few years, provided by analysts, along with an analysis of the existing trends.

| Year | Min Price (USD) | Avg Price (USD) | Max Price (USD) |

| 2025 | $2.50 | $3.10 | $3.80 |

| 2026 | $3.20 | $4.00 | $5.00 |

| 2027 | $4.50 | $5.30 | $6.50 |

| 2028 | $5.50 | $6.50 | $8.00 |

| 2029 | $7.00 | $8.00 | $10.00 |

| 2030 | $8.50 | $10.00 | $12.50 |

Warning: As stated earlier, these Pendle finance price predictions are solely based on market data and expert analysis as of now. But there is always the possibility of rapid changes in the market climate. Please ensure you do sufficient research before finalizing any investments.

Expert Opinions and Market Sentiment for Pendle Coin Price Prediction

Pendle (PENDLE) is currently trading at $3.21, a decline of 0.71%.

Expert Analysis

- AMBCrypto has noted Pendle’s remarkable YTD growth of 355% and its TDL sitting at 3.39B. A close above 6.3 may put the ATH of $7.52 in jeopardy.

- DigitalCoinPrice has Pendle forecasted to reach $4.67 by March 2025, a projected growth of 117.24%, signaling an increase.

- Analytics by NullTX spot the resilience of Pendle as it is down by 2.5%, observing further downgrowth to a 30% rise over 7 days, and whale accumulation suggests bullish trends reaching towards Pendle.

Market Sentiment

- Coinbase tracks the sentiment around Pendle as 18.81% bullish on Twitter with a rating of 4.2/5, suggesting positive sentiment.

- AMBCrypto discusses the diminishing exposure from whales, hinting at possible price drop scenarios.

- The Index indicates the level of fear dominating the market stands at 37.05, which showcases intense fear among the investors.

Use Cases Of Pendle Token

Pendle allows trading using fixed yields with DeFi assets. Users can lock in a future yield without having to worry about price changes. It attracts investors who want stable, predictable returns. Additionally, users can also speculate on interest rate movements with Pendle since it allows interest rate speculation.

Pendle captures derivatives of yield-bearing assets in two parts. PT encapsulates the base value while YT encapsulates the future yield. This structure offers better capital efficiency and control for the users. This platform helps in strategizing optimization in DeFi. Users can stack Pendle with LRTs or LSD platforms and receive higher returns through inventive yield farming.

Allows other users to hedge risks with volatile APY assets while strapping passive income to fix income upfront. Pendle allows for yield arbitrage between the DeFi tokens. This helps take advantage of rate mismatches that occur across different protocols. Large holders who are otherwise stuck can free up staked capital using PTs. This enables users to dividend-shift while maintaining positional frameworks.

The protocol is live on Ethereum and L2s. Besides Mantle and Arbitrum, Pendle also recently launched curated markets through Pendle Prime, which provides vetted yield-bearing assets at a greater level of security.

All in all, Pendle allows high-level DeFi operations with minimal resistance. Pendle is changing the way the yield is being traded on-chain today.

Pendle (PENDLE) Tokenomics

The tokenomics of Pendle is structured for sustainable growth and to uphold value. Below is a summary of its key token metrics:

| Metric | Details |

| Circulating Supply | 161.62M PENDLE (as of April 2025) |

| Total Supply | 281.52M PENDLE |

| Emission Model | Linear emissions over 5 years to control inflation |

| Allocation | 50% for liquidity, 20% to the team, 15% for investors |

| Utility | Governance, staking, and yield tokenization |

Pendle’s emission model helps ensure long-term stability. The token allocation supports development and liquidity growth.

Pendle’s Partnerships & Ecosystem Growth

Strategic DeFi Collaborations

- Pendle’s DeFi growth was amplified by investment from Binance Labs.

- The precision of the price feed was improved with Chainlink integration.

- The liquidity partnership with Ondo Finance transcended the $500 M mark.

- Support was extended for the assets from Aura, Balancer, Lido, and RocketPool.

Multichain Integrations and Layer 2

- Service expansion to Arbitrum allowed for lower service costs.

- To reach out to additional users, the BNB Chain is initially launching.

- now supports Ethereum, Arbitrum, BNB Chain, and Optimism.

Ecosystem Traction and Developer Activity

- TVL amounted to Pendle’s $2.7B.

- Over $25.6b in total trading volume was recorded.

- Public examples of the code are available on the active GitHub Pendle repository.

Pendle vs Other DeFi Tokens

Pendle stands out with real yield and fixed income use cases.

| Feature | Pendle | Aave | Uniswap | Curve |

| Core Utility | Yield split | Lending | Swap fees | Stable swap |

| Real Yield | Yes | No | No | Yes |

| Fixed Income Tool | Yes | No | No | No |

| Chain Support | Multi-chain | Multi-chain | Ethereum | Multi-chain |

| Governance Token | Yes | Yes | Yes | Yes |

| Protocol Revenue | High | Medium | Medium | Low |

| User Growth (2025) | Surging | Stable | High | Slowing |

Key Factors Affecting PENDLE’s Price

This week saw larger holders withdrawing PENDLE from exchanges. That is generally a positive indicator that they do not mean to sell. One wallet, however, did send 1.1M tokens to Binance, and that’s indicative of a short-term dip coming. TVL, the value fell sharply from 6.7B to 3.3B this week, primarily due to pools hitting maturity.

We also saw short EMAs cross below long ones with this dip, which is bearish. The RSI index fell below 30 and remains in oversold territory. We may see some DeFi funds being diverted to Ethereum ETFs. Pendle continues to show growth on Arbitrum.

Risks and Challenges

Pendle does create new and exciting possibilities within the DeFi space, but there are some troubles every investor needs to understand.

Smart Contract & Security Risks

- Penpie Hack (September 2024): Yield optimiser Penpie, which is Pendle-based, suffered an exploit leading to approximately 27.3 million losses. Pendle froze contracts and acted swiftly to stem further loss and was able to secure over 105M.

- Security Audits: Pendle’s smart contracts do undergo some form of audits. Ackee, Dedaub, Dingbats, Code4rena do some of those. There is, however, always the chance of weak spots remaining in DeFi systems after audits.

Competitive Landscape

- Market Position: Pendle operates within a highly dynamic DeFi ecosystem. To remain competitive, it provides yield and tokenization services. Staying ahead is an outcome of partnering and continuous innovation.

Market Volatility & Regulation

- TVL Fluctuation: Pendle’s Total Value Locked (TVL) is volatile. Recently, it dropped from 6.2B to 3.7B in a week due to market sell-offs. This also liquid staking’s maturation contributed to the drop.

- Regulatory Environment: DeFi is constantly trying to defend itself from the ever-changing legal frameworks and restrictions. Pendle is affected by regulatory shifts around the world. These rules impact Pendle’s user growth and engagement.

Recent Developments

- Spartan Capital Investment (November 2023): Pendle received continued backing from crypto venture capital firm, Spartan Capital, which did a follow-on investment in Pendle aimed at boosting on-chain yield trading.

- Community Launch & Pendle Prime Market (March 2025): To create more investment vehicles, Pendle launched Community Launch. Pendle Prime market was created for more tailored investments. It increases security and rewards partner protocols.

Considerations for Investment in Pendle

Pendle is suitable for investors who look for a DeFi yield strategy. If you are interested in yield that is tokenized, Pendle has certain advantages, but potential investors need to be cautious due to volatility. Avoiding risks means entry points should be well planned.

To minimize exposure risk for new entrants, the portfolio should be diversified. Pendle has the potential to play a tactical role in the balanced DeFi allocation strategy. A great risk management strategy must always be in place.

Mid-term traders may find Pendle’s price action interesting. But long-term investors will appreciate Pendle’s growth potential. Pendle’s growth potential is underpinned by its robust ecosystem and partnerships. In the case of Pendle, diversification along with other DeFi assets is crucial.

How to buy

You can trade PENDLE tokens on centralized crypto exchanges. The most popular platform to buy and trade Pendle is Binance, where the PENDLE/USDT pair recorded a 24 hour trading volume of $18,500,598. Other most popular options include HTX and LBank.

Conclusion

Pendle’s unique approach to DeFi makes it stand out with significant growth prospects. The Pendle crypto price prediction 2025 is fairly optimistic. With the growing adoption, Pendle is bound to reap benefits out of its innovations. Still, risks do remain, like high market volatility and issues surrounding smart contracts. Long-term portfolio investors need to look closely at Pendle. Its ongoing developments and partnerships are what will determine success. Before making any investments, always do thorough research and control the risks.