What is MANA?

MANA describes the Decentraland cryptocurrency, which is the native currency of Decentraland. The platform provides a VR version operated on the Ethereum blockchain. Users can buy, sell, and develop virtual pieces of land, interact with different digital assets, and participate in the metaverse’s economy.

MANA Past Price Analysis (2023-2025)

MANA has seen some volatility in the last couple of years due to the movements of the market, advanced changes in technologies and the overall attitude of investors. This is a summary of how it performed.

MANA Price History Overview

| Year | Price Range (USD) | Note |

|---|---|---|

| 2023 | $0.30 – $0.80 | MANA had erratic movements and mostly traded for under a dollar. |

| 2024 | $0.50 – $1.00 | Metaverse project has investment interest which helped with price stabilization. |

| 2025 | $0.99 to Continuing | Possible collaborations and new ventures might boost the price, and coming rivals could prove to be a threat. |

All-Time High (ATH): $5.85 on November 25, 2021.

All-Time Low (ATL): $0.00923681 on October 31, 2017.

Source

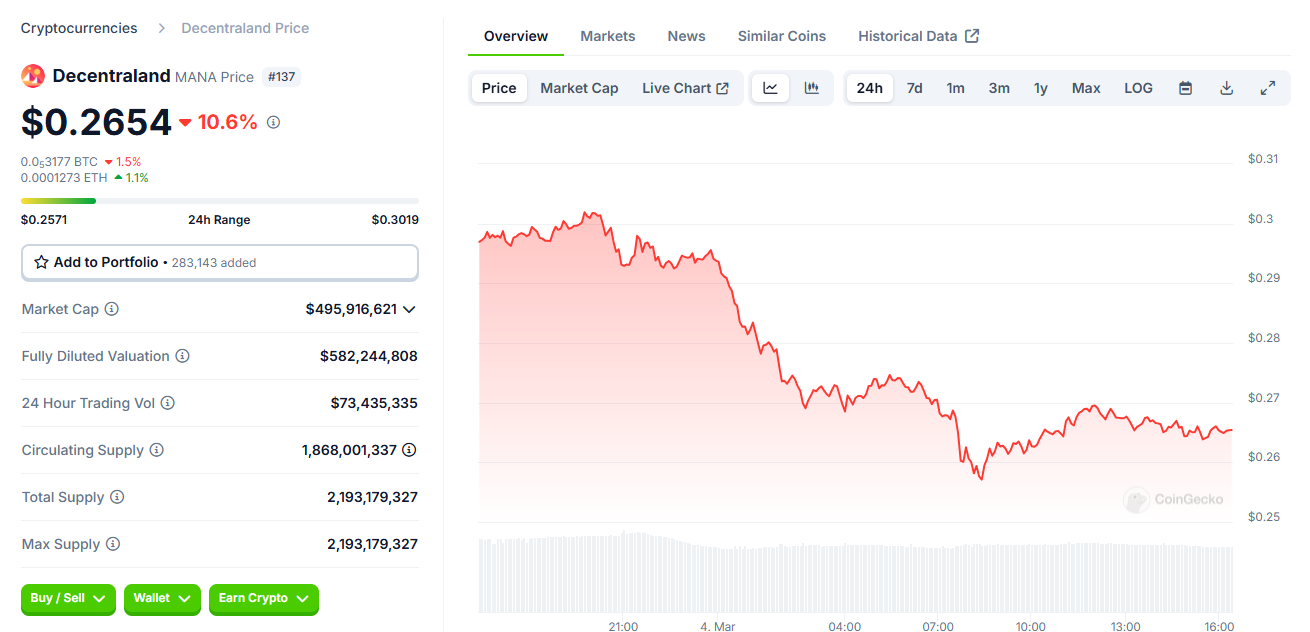

MANA Current Market Situation & Price

MANA, Decentraland’s primary currency, was valued at $0.2654 on March 4th, 2025. This reflects a drop of 10.6 percent when compared to the previous trading day.

So far, trading activity in the last 24 hours has been approximately $71.46 million USD, which at the time was. The trading activity of MANA has a total market cap of $516.92 million USD, with a circulating supply of 1,942,255,184 MANA tokens.

MANA Tokenomics Overview

| Category | Details |

|---|---|

| Token Type | ERC-20 (Ethereum-based) |

| Total Supply | 2,805,886,393 MANA |

| Circulating Supply | ~1.9 billion MANA |

| Utility | Purchasing LAND, in-world transactions, governance |

| Governance | Decentraland DAO (voting rights for holders) |

| Burn Mechanism | MANA is burned when LAND is purchased |

| Staking | Some platforms offer staking for passive income |

| Initial Distribution | 40% ICO, 20% Foundation, 20% Community, 20% Early Investors |

Important Insights

- Deflationary Economics: Buying a LAND MANA is associated with the irreversible burning of MANA tokens which decreases the total supply over time.

Staking and Passive Earnings: In Decentraland there is no direct form of staking, there are other platforms that allow users to stake MANA and earn rewards.

Important Factors That Will Impact the Price of MANA

- The Increase in Decentraland’s usage leads to increased demand for the MANA token.

- SALE of virtual LAND drives the demand for MANA tokens and affects its price.

- MANA usually moves in the same direction as Bitcoin or Ethereum price changes.

- Market perception plays a role in its bullish or bearish movements.

- The user demand is increasing because there is more attention to social digital platforms.

- Collaborative businesses raise brand reputation as well as supply and demand.

- Updates boost user numbers.

- Integrations planned down the line, like AI and VR, could alter its value.

- Policies set on cryptocurrency affect the trust investors have in the asset.

- Token burning decreases supply, which may heighten demand.

- Reasonable staking makes holding more attractive.

MANA Price Prediction

MANA, the native token of Decentraland, has had drastic price movements throughout the years. Following is a price prediction based on the market’s adoption, and trends, and also a technical analysis.

MANA Price Prediction

| Year | MANA Price Prediction Range (USD) | Key Drivers |

|---|---|---|

| 2025 | $0.99 – Continue | Market recovery, metaverse adoption, LAND sales increase |

| 2026 | $1.50 – $2.30 | NFT & gaming sector expansion, corporate partnerships |

| 2027 | $2.80 – $4.00 | Increased virtual land demand, enhanced VR integration |

| 2028 | $4.50 – $6.20 | Mainstream adoption, global Web3 development |

| 2029 | $6.50 – $9.00 | Potential bull market, large-scale metaverse integration |

| 2030 | $10.00+ | Fully developed metaverse ecosystem, institutional adoption |

Our experts give the MANA Price Prediction charts for 2025 to 2030. They always try to give their best.

Elements Determining Upcoming Prices

- Additional Reality Development – Increased preference towards the ownership of virtual real estate may boost MANA’s fame.

- Bitcoin alongside the Market Changes – The price of MANA often follows the value of Bitcoin and the overall cryptocurrency market.

- Technological advances – AI, VR, and blockchain infrastructure improvement in Decentraland may raise the value.

- Changes in the Government – Framing more regulations controlling cryptocurrencies will probably attract huge investors.

MANA Ecosystem and Strong Projects

The partnership projects are helping fuel the growth of virtual experiences, gaming, NFTs, and even metaverse-centric business solutions which are driving the expansion of Decentraland’s ecosystem.

Fundamental Elements of the MANA Ecosystem

- Virtual Parcels and Real Estate – Use of MANA enables users to purchase, trade, and improve LAND as prominent corporations develop virtual branches.

- NFT Marketplace – The collection of unique memorabilia makes their interaction with wearable items, assets, and virtual real estate more interesting through the engaging marketplace.

- Gaming and P2E (Play to Earn) – Rewarding participants by winning events, contests, and through in-game economies within the blockchain games.

- DeFi Incorporation – Users can lend, stake, or create liquidity pools for farming and passively earning income with MANA.

Foresight into the MANA Ecosystem Innovations

- Digital events and remote working virtual environments expansion

- Integrated adoption by international corporations

- Enhanced sophistication in ‘gamification’ and social as well as economic services

Thanks to strong partnerships and constant innovation, Decentraland continues to be one of the most influential companies in the development of the metaverse.

MANA vs Other Metaverse Tokens

MANA has competition from various other metaverse tokens, each providing distinct functionalities and services.

MANA vs Competitors

| Feature | MANA (Decentraland) | SAND (The Sandbox) | AXS (Axie Infinity) |

|---|---|---|---|

| Blockchain | Ethereum | Ethereum/Polygon | Ronin/Ethereum |

| Use Case | Virtual world, real estate, gaming | User-generated gaming metaverse | Play-to-earn gaming |

| Governance | Decentraland DAO | Sandbox DAO | Axie DAO |

| Land System | Limited LAND parcels | User-created land | No virtual land |

| NFT Marketplace | Yes | Yes | Yes |

| Token Utility | Buying land, items, governance | Transactions, land ownership | Breeding, staking, governance |

| Adoption | Used by brands & businesses | Popular among gamers & creators | Strong in P2E gaming |

1. Market Risk

- The cryptocurrency market affects MANA and gives a positive or negative reaction depending on how the market for crypto is going.

- The price of MANA is subject to change along with Bitcoin or other cryptocurrencies and their overall market value.

2. Competition Within the Metaverse

- SAND (The Sandbox) and APE (Otherside) can easily snatch users away from us.

- Competitors can steal the market from Decentraland who possess advanced technologies.

3. Uncertainty Regarding Regulations

- Such policies affect the crypto ecosystem along with NFTs and thus can affect MANA’s growth.

- Greater control may result in lesser or more restrictive adoption.

4. User Growth and Adoption

- Demand may diminish due to a lack of activity from users and businesses.

- Innovation and investment stagnation may result due to technical barriers.

5. Smart Contract and other Security Risks

- There’s the potential for hacking in Decentraland’s marketplace and its smart contracts.

- MANA could be impacted by security flaws on the Ethereum Network.

Regulatory Impact on MANA

The development and adoption of Decentraland highly depend on the government’s policies concerning cryptocurrency, NFTs, and other virtual assets.

Is MANA Worth Investing In?

Unlike its competitors, MANA has carved out a niche for itself within the metaverse, however, investment remains hampered by other pertinent aspects.

Reasons to Consider MANA

Growth of the Metaverse

- Increase in adoption for real estate and digitalized experiences.

- Heavy investment from big corporations into Decentraland.

Strong Ecosystem

- Demand from the NFT marketplace, gaming, and virtual events.

- User control through decentralized governance (DAO).

Scarcity and Utility

- The value of LAND increases with time due to its limited quantity.

- MANA in governance and transactions.

Conclusion

In his lectures, he explores the role of MANA as a spatial and economic planner. Their transformation is justified by MANA’s capacity to facilitate trade and govern a D-City in Decentraland, where a metaverse is built. The MANA price prediction suggests an increase in the future.