According to the Render Price Prediction and Analysis, with the increasing render GPU requirements from the creative industry, the potential for rendering (RNDR) seems to be positive. Autodesk and Unity are notable business partners, making Render a strong contender in the industry.

What is Render?

Render (RNDR) is a new rendering network aimed at facilitating digital content creation through the application of GPU processors and blockchain technology. It allows its users to economically harness the power of decentralized computing for the rendering of animations, images, and VFX ranging from simple to very complex.

Render employs the Ethereum Network in linking GPU service providers with content makers that require GPU services, thus improving cost and efficiency. This decentralized approach reduces costs and boosts rendering speeds when compared to conventional cloud rendering services.

Render Past Price Analysis

Over the years, Render (RNDR) has experienced significant price volatility. The table beneath captures its past performance:

| Year | Render Price Range (USD) | Note |

|---|---|---|

| 2023 | $0.40 – $3.00 | Start price and end price of the year. |

| 2024 | $2.50 – $6.80 | Start price and end price of the year. |

| 2025 | $6.7826 – Continuing | The start price is $6.00 at the start of the year. |

The price of Render has been impacted by the adoption levels, market interest, and trends in cryptocurrency as a whole. Past renditions do not ensure future ones, albeit looking back helps understand upcoming changes.

All-Time High: $13.60 (2024)

All-Time Low: $0.03676 (2020)

Source

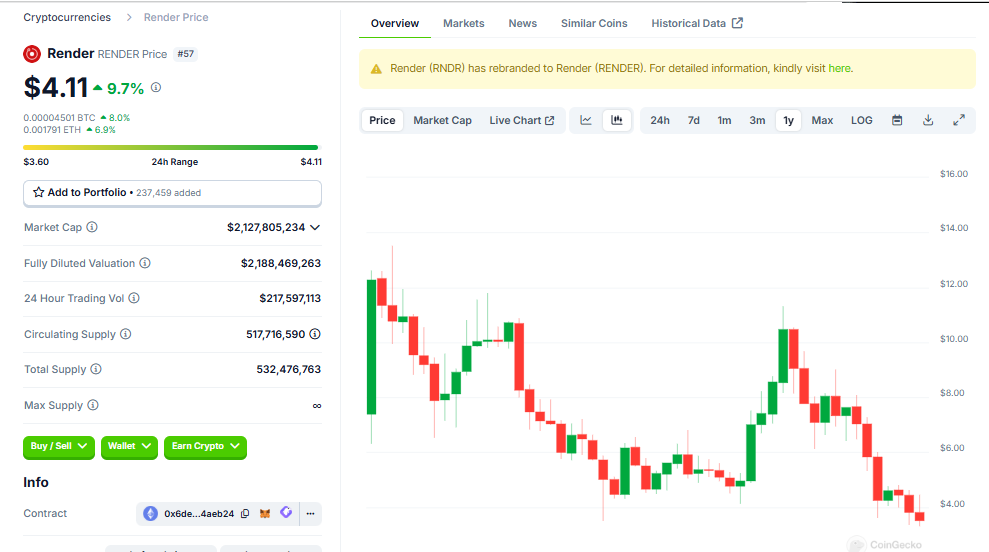

Render Current Market Situation & Price

Currently, Render (RNDR) is priced at approximately $4.11 USD, with a daily high of $4.11 and a low of $3.59.

Render is believed to hold a market cap of $1.82 billion USD alongside a trading volume of 24 hours, which amounts to approximately $114 million USD.

Tokenomics

Render (RNDR) has implemented tokenomics that encourage sustainable growth and reward those who contribute to its ecosystem. In tabular form, presented below is a summary of its token allocation and parameters:

| Aspect | Details |

|---|---|

| Total Supply | 1 Billion RNDR tokens |

| Circulating Supply | Approx. 392 Million RNDR tokens |

| Max Supply | 1 Billion RNDR tokens (fixed) |

| Team & Advisors | 20% |

| Ecosystem Development | 30% |

| Public Sale | 10% |

| Foundation & Partnerships | 10% |

| Reserve Fund | 10% |

| Staking Rewards | 20% |

| Utility | Used for payments, staking, and transaction fees on the network |

Important Functions of RNDR Tokens

- Payment for Rendering: For GPU rendering functions.

- Staking: To receive rewards and assist in securing the network.

- Transaction Charge: To address fees on the platform.

The tokenomics is tailored to reward and foster Render ecosystem activities and growth.

Key Elements Which Will Determine The Price of Render

The price of Render (RNDR) is shaped by the following factors:

1. Demand And Adoption

There is potential for the price to increase because of higher requirements for GPU rendering and accompanying services.

2. Crypto Trends And Market Sentiment

Render’s pricing is impacted by the market movements and the speculative sentiment from the investors.

3. Strategic Partnerships

Enhancements to the platform and the system’s network security increase its value.

4. Tokenomics and Render’s Price

Moderation in price volatility can be achieved from changes in demand or from staking rewards.

5. Litigation and Legislation

Price can be affected by government restrictions or lawsuits.

6. Market Activity

Increased trading activity and new stock market listings may index the value.

Render Price Prediction (2025 to 2030)

Below is an updated table that outlines the Render Price Prediction projections from the years 2025 to 2030:

| Year | Render Price Prediction Range (USD) | Key Drivers |

|---|---|---|

| 2025 | $6.00 – $12.50 | Adoption gaps are reduced, and the platform is receiving updates. |

| 2026 | $12.50 – $18.00 | Wider use cases, more strategic partnerships, and better scalability of the Render network. |

| 2027 | $18.00 – $24.00 | Stronger market sentiment, stable crypto market, and enhanced tokenomics. |

| 2028 | $24.00 – $30.00 | Mainstream adoption, network stability, and broader industry recognition. |

| 2029 | $30.00 – $35.00 | Significant demand for decentralized rendering and advanced network technology. |

| 2030 | $35.00 – $42.00 | Market maturity, widespread use in creative industries, and integration into more platforms. |

These estimates are based on current market trends, but like all cryptocurrencies, Render’s price remains highly volatile and influenced by multiple factors.

Render Ecosystem and Strong Projects

Render (RNDR) is part of a decentralized ecosystem that centers on GPU rendering. Some of the major constituents are:

1. Render Network Ecosystem

- Decentralized rendering: supplies GPU power from anywhere in the world at a cheaper rate.

- RNDR token: Serves as the method of payment, staking, and fees.

- Community Driven: Functions on the provision of GPU suppliers and clients which enables an open system.

2. Prosperous Businesses

- Otoy is a system designer and focuses on cloud rendering and virtual reality (VR) development for Render.

- GPU providers include miners and other large companies that serve as the suppliers of the processing power for the construction work.

- Those who work as graphics artists, animators, and designers in the video gaming industry make use of Render.

3. Partner Relations

- Autodesk Integrates: Render into its 3D designing applications.

- Unreal Engine and Unity: Software for video games and digital world design, where the render function is applied.

This contributes to the broader adoption of Render within the fragmented rendering marketplace.

Market Risk Factors of Render Coin

- Market Fluctuations: Price changes are caused by shifts in the cryptocurrency market.

- Increasing Use But Also Completion Risk: Growth of adoption in decentralized rendering is still insufficient.

- Legal Risks: The impact of state regulations on these activities.

- Technology Risks: Downtime of the platform and scalability of the platform.

- Tokenomics: The risk involves changes in the liquidity of tokens and supply of the tokens.

- Competition: highly competitive with centralized cloud rendering services.

All of these factors lower the overall price and market stability for Render.

The Influence of Policies on Render

Different countries have different rules for cryptocurrency. If a country bans the use of RNDR, its price may go down. RNDR company may need to follow new government rules. This can increase their costs and reduce their profits.

Render Vs. Others

| Platform | Decentralized | Token Usage | Cost | Flexibility | Network/Partnerships |

|---|---|---|---|---|---|

| Render (RNDR) | Yes | RNDR Token for payments, staking, and rewards | Lower cost by using unused GPU power | High flexibility with a decentralized approach | Strong partnerships with Autodesk, Unity, and others |

| Traditional Platforms (AWS, Google Cloud) | No | No native token | Higher fixed costs based on usage | Fixed infrastructure, less flexibility | Limited partnerships, typically more corporate-focused |

| Other Decentralized Platforms (e.g., Cudos, Golem) | Yes | Varies | Generally lower cost but depends on network | Varies by platform, less flexibility than Render | Smaller networks, but some have similar creative industry focus |

This table shows how Render’s decentralized model, flexible pricing, and creative industry focus differentiate it from other platforms.

Read More: Chiliz Price Prediction and Future Outlook

Are Render (RNDR) Tokens a Trending Investment?

To summarize Render (RNDR), consider the following reasons supporting or opposing it as an investment opportunity:

Benefits

- Ever-increasing Opportunities:

- Specialized Market Focus: The Render network developed a market niche for GPU rendering, making it possible for a multitude of digital artists, animators, and game developers to meet the demand.

- Strategic Alliances: Render has established strong alliances with Autodesk and Unity, which enhance credibility and expand market reach.

- Cost-effective Solutions: Compared to centralized cloud services, a decentralized structure offers scalability and efficiency, making it an attractive solution.

Drawbacks

- Uncertain Marketing Policies: The unclear borderline suggests shifts in this area, potentially harming both attackers and defenders.

- Adoption Rate:

- Other Challenges: Decentralized platforms along with traditional cloud services are other Render network competitors.

Conclusion

As RNDR contributes to a decentralized GPU Render solution that meets the increasing need in the creative field, Render Price Prediction foresees strong potential growth. Render leverages robust partnerships with Autodesk and Unity to outperform competitors.

[…] Read More: Render Price Prediction: Key Drivers and Future Potential […]