The BEAM token powers the BEAM network a next gen gaming ecosystem governed by the BEAM DAO. Designed for gamers and developers, BEAM offers tools like the BEAM SDK, enabling seamless integration of blockchain elements into games.

BEAM serves as the networks native currency, required for all transactions, asset transfers and smart contracts interaction ensuring smooth, immersive gameplay. Beyond its utility role, BEAM is central to governance, giving holders the power to shape the future of the BEAM DAO established in 2021 to delay and decentralize the gaming industry.

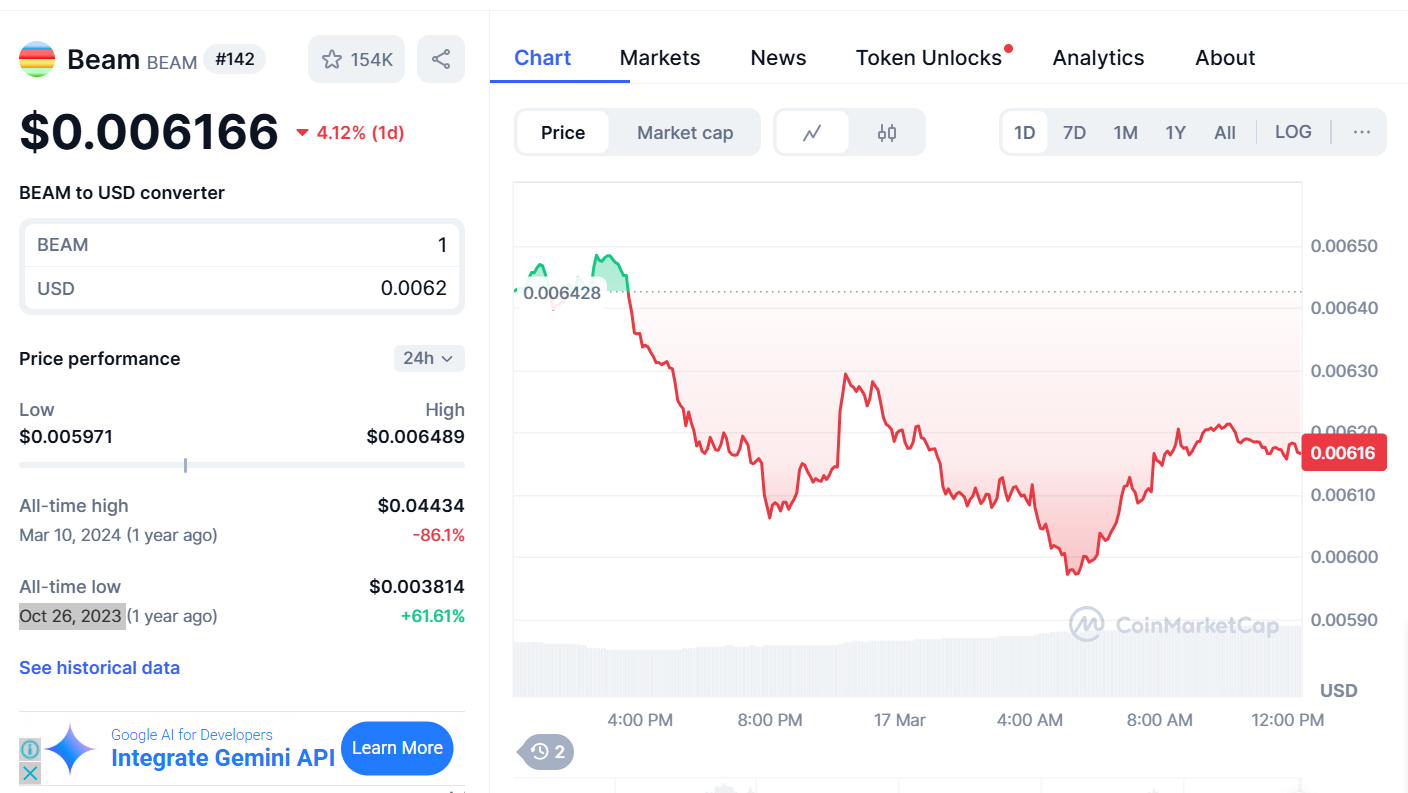

BEAM Past Price Analysis

| Year | Price Range (USDT) | Note |

|---|---|---|

| 2023 | $0.004787 to $0.01713 | Start price Oct 27, 2023 and end price of the year. |

| 2024 | $0.01715 to $0.0251 | Start price and end price of the year. |

| 2025 | $0.0251 to Continuing | The start price is $0.0251 at the start of the year. |

All-Time High (ATH): $0.04434 (Mar 10, 2024)

All-Time Low (ATL): $0.003814 (Oct 26, 2023)

Source

Current Market Situation & Price

Currently, BEAM is at around $0.006166, while its trades over the past day have fluctuated to a low of $0.00597 and a high of $0.00648, showing it is declining little by little. The market continues to be calm, with price volatility being very low and with price following above support levels.

Tokenomics

| Category | Details |

|---|---|

| Total Supply | 262.8 million BEAM |

| Emission Model | Deflationary (block reward halving) |

| Block Reward Halving | Every 4 years |

| Initial Distribution | Fair launch (no ICO or pre-mine) |

| Allocation | Miners, Development, Community |

| Mining Mechanism | Proof-of-Work (Mimblewimble-based) |

BEAM Price Prediction (2025 to 2030)

| Year | BEAM Price Prediction Range (USDT) | Note |

|---|---|---|

| 2025 | $0.006 – $0.16 | Gradual recovery, stable market conditions. |

| 2026 | $0.16 – $0.55 | Slow growth with increasing adoption. |

| 2027 | $0.55 – $0.80 | Boost expected if privacy coins gain popularity. |

| 2028 | $0.80 – $1.12 | Growth driven by stronger ecosystem and utility. |

| 2029 | $1.12 – $1.39 | Continued exposure and user base expansion. |

| 2030 | $1.39 – $2.45 | Potential peak if adoption and development accelerate. |

These projections are based on current trends and future possibilities. They offer a rough guide for understanding long-term BEAM Price Prediction.

Ecosystem and Strong Projects

The ecosystem of BEAM emphasizes privacy, scalability, and practical implementations. Its foundation on Mimblewimble enables blockchain to perform optimally while maintaining the confidentiality of transactions. Its objective is to also allow the development of dApps and smart contracts with privacy features included. These factors, along with a robust community and developer support for increasing ecosystem value, make it a continually evolving project.

BEAM Coin Risk Factors

Like any cryptocurrency, BEAM has its fair share of risks. The price volatility is high, which makes short-term investments very uncertain. Regulatory scrutiny on privacy-driven coins may undermine their value in the future. Adoption is slow, and the competition from other privacy projects dampens growth. Furthermore, low trading volume could negatively affect liquidity.

Regulatory Impact on BEAM

Like BEAM, privacy coins usually encounter regulations. A lot of governments consider private transactions a security threat, which can result in restrictions or removal from exchanges. These steps can reduce availability and hamper use. Adoption is further delayed due to such actions. Continued regulation is still one of the main reasons affecting BEAM price predictions in the future.

BEAM Vs Other Coins

| Feature | BEAM | Monero (XMR) | Zcash (ZEC) | Bitcoin (BTC) |

|---|---|---|---|---|

| Privacy Protocol | Mimblewimble | RingCT | zk-SNARKs | Transparent |

| Transaction Privacy | Fully confidential | Fully private | Optional privacy | Public |

| Supply Limit | 262.8 million | No fixed supply | 21 million | 21 million |

| Mining Algorithm | Proof-of-Work | Proof-of-Work | Proof-of-Work | Proof-of-Work |

| Speed & Scalability | Lightweight, scalable | Moderate | Moderate | Slower, high fees |

| Ecosystem Focus | Privacy + dApps | Privacy | Privacy + Compliance | Digital Payments |

Read More: IOTA Price Prediction: Growth Potential in the IoT-Driven Future

Is BEAM a Good Investment?

For long-term investors, BEAM is appealing due to its strong privacy features, limited supply, and growing ecosystem. Nevertheless, low adoption, competition in the market, and risks associated with regulations are still obstacles. It is best for people who have faith in privacy-centric technologies and can endure volatility. Remember, no matter what, thorough research is needed before making any choices.

Conclusion

Taking risk into consideration, BEAM Price Prediction indicates a probability of long-term growth. Further, BEAM remains a contender in the crypto space due to its potent privacy measures, expanding ecosystem, and deflationary tokenomics. In spite of the challenges posed by limited adoption along with regulatory uncertainty, heightened market interest and continuous development may aid price appreciation. However, investors carefully researching and being risk-aware may find BEAM appealing, especially those interested in early-stage projects and privacy tech.

[…] Beam (BEAM) […]