Mina Protocol is the lightest “succinct blockchain” designed to reduce computing power needed to run DApps efficiently. Known as the world’s lightest blockchain, its size stays fixed at just 22 KB, even as usage grows. This helps maintain strong security and decentralization.

Mina employs One of the Zero Knowledge Proofs (ZKPs) methods like SNARKs (Succinct Non-Interactive Arguments of Knowledge) to enable users to verify transactions without the need to share their data. The combination of privacy, ZKP scalability, and low costs makes Mina very appealing for dApps and other privacy-sensitive projects.

Key Features of Mina Protocol

| Feature | Description |

|---|---|

| Ultra-Lightweight Design | Mina’s blockchain size is a fixed 22 KB, making it more accessible to users on devices with minimal resources. |

| Enhanced Privacy | ZKPs allow users to validate transactions without exposing private information, ensuring user anonymity. |

| Developer-Friendly Ecosystem | Mina enables Snapps (SNARK-enabled smart contracts), which allows builders to create dApps with minimal resource usage. |

| Sustainability | Mina has an energy-efficient consensus mechanism, making it eco-friendly, unlike blockchains like Bitcoin which are energy-hungry. |

Mina has positioned itself to compete strongly with other privacy-focused blockchains like Monero and Zcash, while simultaneously going head-to-head with scalability solutions Ethereum 2.0 and Polygon.

Past Analysis: MINA Price History

Due to market trends, token unlocks, and investor sentiment, MINA has experienced notable price volatility throughout the years. Below is a brief table detailing its price history for the past three years.

MINA Price History (2023-2025)

| Year | Price Range (USD) | Note |

|---|---|---|

| 2023 | $0.4339 – $1.3554 | Start price and end price of the year. |

| 2024 | $1.3542 – $0.5733 | Start price and end price of the year. |

| 2025 | $0.5733 to Continuing | The start price is $0.5733 at the start of the year. |

ATH & ATL

- All-Time High (ATH): $9.91 (Jun 01, 2021 )

- All-Time Low (ATL): $0.2275 (Mar 11, 2025 )

Source

Current Market Situation: MINA’s Position in 2025

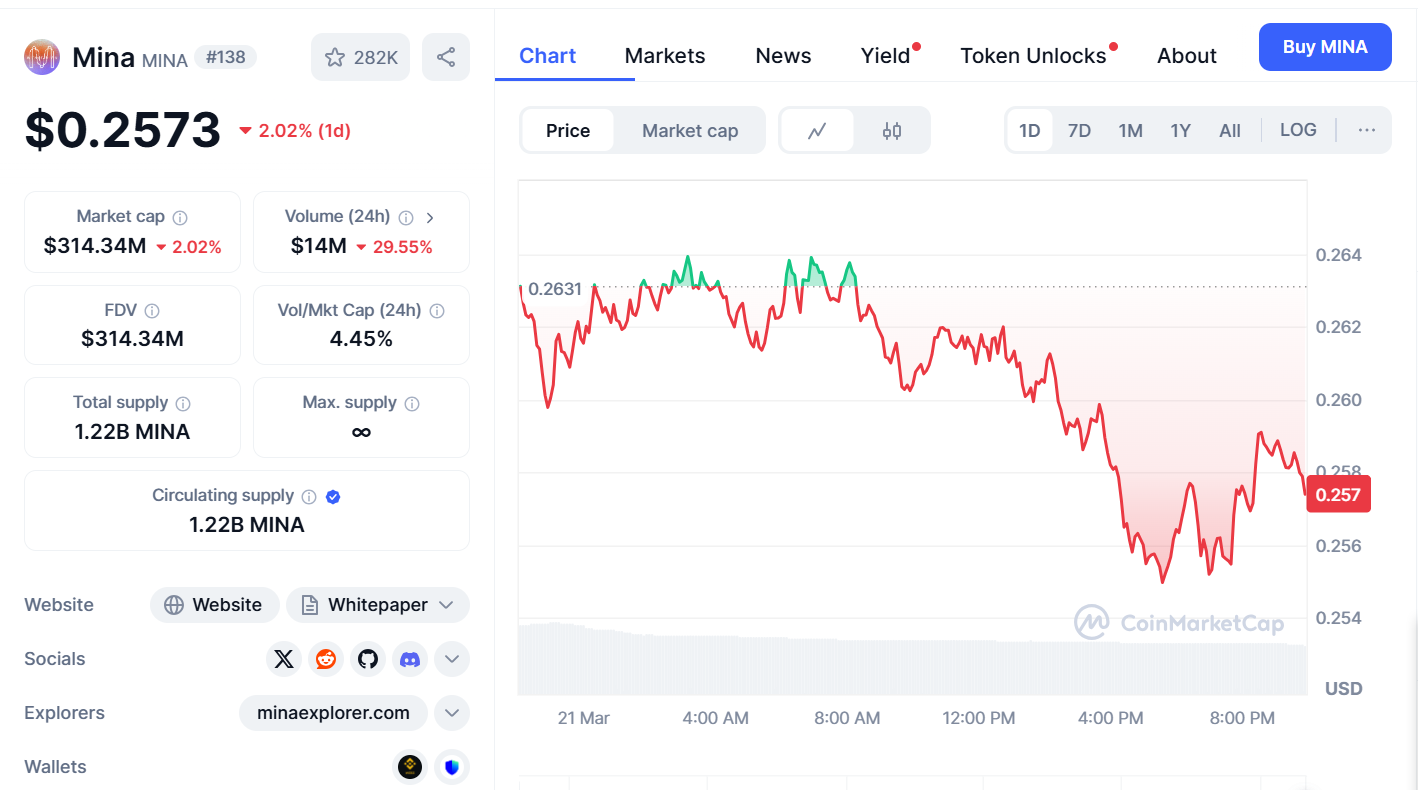

There is currently $314M dollars in market cap for Mina Protocol (MINA) which is trading at roughly 0.2573 dollars a unit. The 24-hour trading volume is at $17.9M which shows that there is a good amount of investor activity. Mina Protocol can be classified as an active investment as of this date March 21, 2025.

Technical Indicators:

- Mina’s Relative Strength Index (RSI): Mina is neither overbought nor oversold at the moment and is instead in a neutral position at 28.9.

- Moving Averages: Bearish price action for Mina is shown as the price is below every X exponential moving average on the daily chart.

- MACD (Moving Average Convergence Divergence): This is a lagging indicator. It shows the average price of a security over some time providing the opportunity to notice some shifts in momentum which may make one consider retracing price changes.

MINA Tokenomics: The Supply-Demand Dynamics

Tokenomics is essential in determining the value of MINA in the long run. The protocol is set up in a way that integrates the economic structure with supply and demand, which affects price stability.

| Metric | Details |

|---|---|

| Total Supply | 1 billion MINA tokens, with inflation due to staking rewards. |

| Circulating Supply | X million MINA tokens as of 2025. |

| Inflation Rate | Initially, it was high but reduced over time, stabilizing the reward structure. |

| Staking Rewards | MINA incentivizes users to stake their tokens, ensuring network security and participation. |

| Developer Grants | Mina offers grants to developers to foster ecosystem growth. |

The protocol’s staking rewards are essential for maintaining a healthy and secure network while attracting more participants. Additionally, developer grants are crucial for expanding the Mina ecosystem and increasing its utility in various sectors.

Key Factors Affecting MINA’s Price

Considering some factors, it can be determined how MINA’s price will behave for an expected analysis and price targets. Let us go through the factors that have the most impact on MINA’s price trajectory.

Bitcoin Market Movements

With Bitcoin changing MINA prices are also influenced and sometimes dictated by it. Due to the fact that Bitcoin is the biggest coin in the crypto space, it is reasonable to think that it has control over all of the market. If Bitcoin decides to have an upward rally, then MINA will also appreciate in price. In contrast, an overall market correction will result in the opposite effect due to the price fallout.

Partnerships and DApps Integration

Ecosystems are the most responsible for parts of Mina’s growth. Key partnerships with other blockchain projects such as Ethereum and Polygon or new Integrations with dapps could affect the supply and demand for MINA greatly.

Regulatory Issues

As with any privacy-oriented blockchain, MINA finds itself struggling with endless regulatory issues. Unfortunately, no legislation will come out focused on helping privacy technologies become more widely available. Such new rules can cripple the adoption and sentiment of investors towards MINA. Nevertheless, some of these regulations may be alleviated due to Mina’s proprietary blend of ZKPs which shields data. It enables compliance while maintaining privacy.

Technological Advancements

The development strategy of Mina ensures constant improvement in the project’s scalability, and expanding the functionality of developer’s and user’s privacy. Builders of zkApps enable (SNARK-contracts) suggest to widely open the doors for many practical possibilities to the use of MINA, hence resulting in greater demand for the token.

MINA Price Prediction (2025-2030)

Predictions for MINA’s price differ from one expert to another and depend on their sentiment, trend, and technical analysis. Following are some of the predictions for MINA price over the next several years.

| Year | MINA Price Prediction Range (USD) | MINA Price Prediction Key Factors |

|---|---|---|

| 2025 | $0.50 – $8.00 | Regulatory hurdles, adoption rate, institutional interest, market conditions |

| 2026 | $1.00 – $12.00 | Increased developer activity, ecosystem growth, and integration with DeFi |

| 2027 | $2.00 – $15.00 | Expansion of zkApps, more privacy-focused projects |

| 2028 | $3.00 – $18.00 | Growing adoption in enterprise use cases, strong developer community |

| 2029 | $4.00 – $22.00 | Enhanced scalability features, government regulation clarity |

| 2030 | $8.00 – $30.00 | Full mainstream adoption, strong partnerships, and global regulatory support |

Bearish scenario: Now regulatory challenges and delays in adoption could push the price down to $0.50 in 2025, though it could recover to $2 by 2030.

Bullish scenario: Greater adoption and institutional interest could accelerate MINA’s rise to $4 in 2025 and $12 by 2030.

Realistic Scenario: Waiting for passive growth and increased development MINA could reach $8 by 2025 and $30 by 2030.

Challenges and Risks for MINA’s Future Growth

With all the unique selling points of MINA, there are many challenges and obstacles to overcome:

Market Risk: Cryptocurrency markets are very volatile, and MINA is no exception. Its value could change drastically due to other prevailing factors in the market.

Adoption and Scalability: Although MINA is designed to solve scalability problems, the adoption of the cryptocurrency is still in its infancy. It will take some time before the network achieves its full cap.

Legal Risk: With a focus on privacy, MINA becomes vulnerable to excessive regulation, which could limit the project’s growth and further price appreciation.

How to Buy

MINA tokens are traded on centralized crypto exchanges. The most popular platform is Binance, where the MINA/USDT pair had a 24 hour trading volume of $1,889962. Other options include LBank and OKX.

Conclusion:

MINA Price Prediction highly hinges on the blockchain’s privacy and scalability attributes, positioning its value as a distinct asset in the increasing ecosystem. Yet, their success is interdependent on the growth of the ecosystem, changing market conditions, and regulatory factors.

For long-term investors, MINA presents an intriguing opportunity that comes with considerable risk. Like with every investment, detailed analysis and precaution are necessary.

[…] Read More: MINA Price Prediction: What’s Next for the Blockchain Project […]