Telcoin is the native gas token of the Telcoin Network, launched in 2017 by Telcoin and governed by the Telcoin Association. Telcoin is a global fintech operating in 171 countries, aiming to deliver instant, low-cost financial services to mobile phone users worldwide.

What is Telcoin (TEL)?

The Telcoin wallet supports over 100 digital assets and enables global remittances to eWallets and bank accounts. Telcoin is regulated as a Virtual Asset Service Provider in the Lithuania and Argentina a Major Payment Institution in Singapore.

Telcoin Bank, conditionally approved in Nebraska is on track to become the first U>S crypto Bank, the first regulated stablecoin issuer and the first bank authorized to connect users directly to DeFi.

The Telcoin Association, a non profit blockchain consortium, represents GSMA Mobile Networks and supports the Telcoin Networks and supports the Telcoin Network an EVM-compatible. Proof of stake blockchain secured by global telecom operators. In 2018, Telcoin become the first blockchain member of the GSMA.

Past Analysis: TEL Price History

Telcoin (TEL) has experienced price fluctuations over the past few years. Below is a table outlining its price range from 2023 to 2025:

| Year | Price Range (USD) | Note |

|---|---|---|

| 2023 | $0.001899 – $0.001292 | Start price and end price of the year. |

| 2024 | $0.001293 – $0.004987 | Start price and end price of the year. |

| 2025 | $0.004987 to Continuing | The start price is $0.0049 at the start of the year. |

ATH (All-Time High): $0.0649

ATL (All-Time Low): $0.00006516

Source

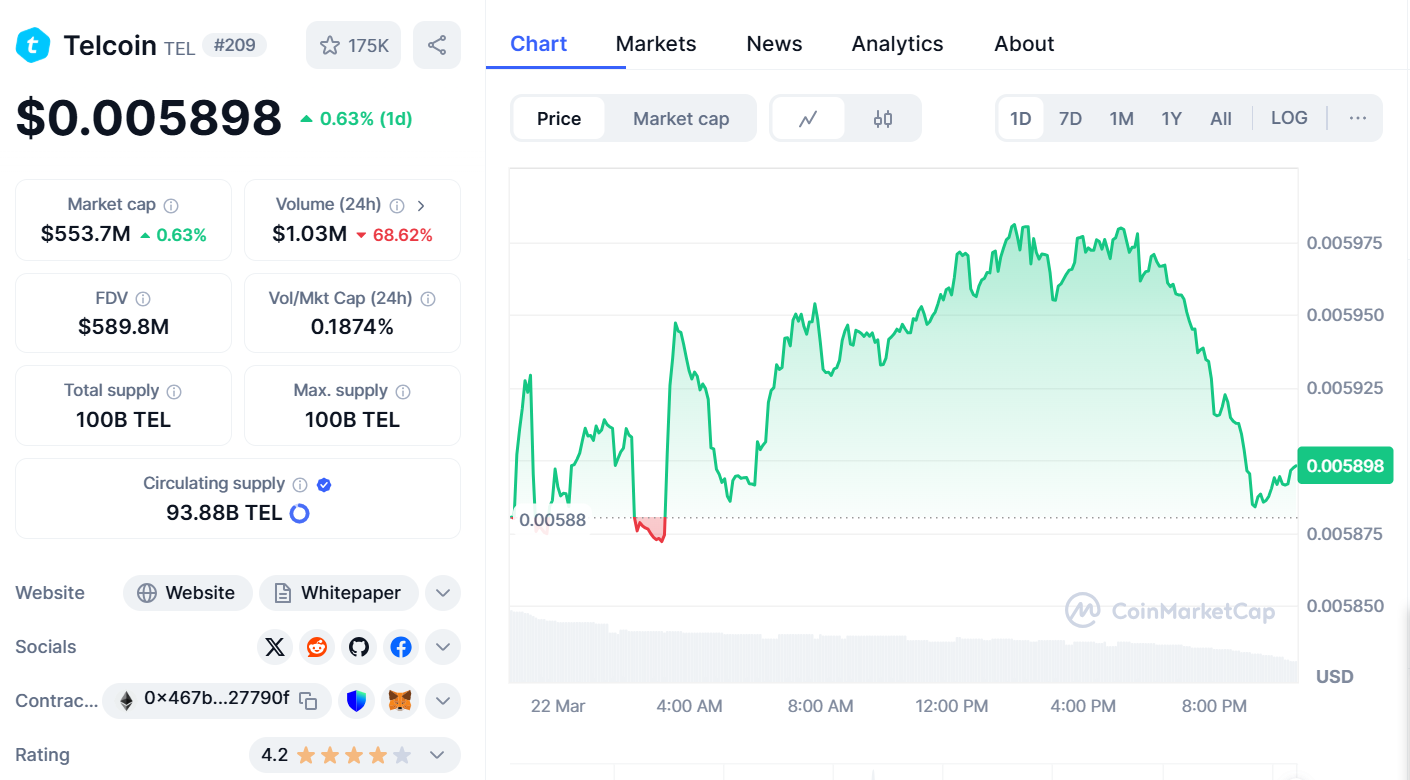

Current Market Situation & Price

As of March 22, 2025, Telcoin (TEL) is trading at approximately $0.005898 per token.

Market Capitalization: Approximately $577.57M

24-Hour Trading Volume: Around $8.45M

Over the past 24 hours, TEL’s price has increased by approximately 0.63%

Telcoin Tokenomics

| Attribute | Details |

|---|---|

| Token Name | Telcoin (TEL) |

| Blockchain | Ethereum (ERC-20) |

| Total Supply | 100 billion TEL |

| Circulating Supply | 93.88 billion TEL (approx.) |

| Max Supply | 100 billion TEL |

| Market Capitalization | Approx. $584 million (as of March 2025) |

| Initial Token Distribution | 50% to the community (staking, rewards, liquidity) |

| Team Allocation | 20% (distributed over a multi-year vesting period) |

| Advisors and Partners | 10% (locked for a set period) |

| Founders | 20% (locked for a set period) |

| Utility | Remittance, payments, rewards, staking |

| Staking Rewards | Offered to users who participate in staking programs |

| Transaction Fees | Paid using TEL tokens in network transactions |

| Use Cases | Cross-border payments, mobile payments, staking, liquidity provision |

Key Features of Telcoin (TEL)

- Mobile Payments: This lets users transfer money quickly and effortlessly through a mobile device.

- Blockchain Integration: Uses Ethereum (ERC-20), which ensures security and transparency.

- Staking Rewards: Users are able to earn rewards through staking TEL tokens.

- Cross-Border Transactions: Makes international money transfers easy and cheap.

- Community Focused: A sizeable part of the supply is reserved to incentivize the community significantly.

Key Factors Affecting Telcoin (TEL) Price

Telcoin’s price is influenced by several key factors that shape its demand and the market

price of altcoins is decided by numerous important aspects, which create their demand and the market value.

- Mobile Payment Adoption: More cross-border payments mean a higher TEL demand.

- Strategic Partnerships: Associations with telecom and other financial companies help raise reputation.

- Market Sentiment: Changes and feelings from the investors towards the overall crypto market.

- Regulations: Legal boundaries around cryptocurrency and remittance enable or control growth.

- Token Utility: The use of TEL for staking, transactions, and rewards dictates the demand and subsequently the price.

- Technological Advancements: More affordability tends to be driven by platform upgrades.

- Remittance Market Growth: Its expansion positively impacts the value of associated services.

How Telcoin’s Blockchain Transforms Cross-Border Remittances

Telcoin’s unique remittance feature makes traditional remittance services easy and quick while cutting their cost tremendously. When sending money through traditional services, there is always a fee that is charged. Usually, this fee varies between 5-10% of the entire transfer amount. Telcoin, on the other hand, keeps these fees below 2% which is incredibly cheap for sending money worldwide.

Telcoin uses the Ethereum blockchain and because of this, they are able to cut out the need for intermediaries. As a result, transactions are often settled in below 5 seconds. Because of the speed and low cost, Telcoin has become the preferred option for both individuals and businesses looking to send money across borders.

TEL Price Prediction (2025-2030)

Here’s a Telcoin (TEL) price prediction table for 2025-2030 based on potential market conditions and growth factors:

| Year | TEL Price Prediction Range (USD) | TEL Price Prediction Factors |

|---|---|---|

| 2025 | $0.01 – $0.05 | Gradual growth as adoption increases |

| 2026 | $0.05 – $0.12 | Significant growth with expanded partnerships |

| 2027 | $0.10 – $0.20 | Strong demand for remittances and mobile payments |

| 2028 | $0.15 – $0.30 | Increased global adoption and technological advancements |

| 2029 | $0.20 – $0.50 | Stable growth with mainstream market acceptance |

| 2030 | $0.30 – $0.60 | Potential for high value if network adoption continues |

This prediction relies on the anticipated expansion of Telcoin in mobile payments, partnerships, and the use of remittances globally.

Telcoin’s Ecosystem and Key Partnerships

Telcoin has developed a comprehensive ecosystem with several projects focused on promoting financial inclusion around the world.

- Telcoin Remittances: Enables mobile network operators to provide instant cross-border remittances at affordable rates.

- Telcoin App: A mobile wallet application that allows for interaction with crypto-supporting transactions, staking, and decentralized finance (DeFi) activities.

- TELx Network: A decentralized liquidity engine serving as the backbone of Telcoin’s financial services.

- DeFi Products: Decentralized lending, payments, and remittance services.

Strategic collaboration with telecom companies is vital for Telcoin’s growth. In some countries within Southeast Asia and Kenya, Telcoin partnerships with local telecom providers have resulted in tremendous growth of users and transaction volumes.

Regulatory Impact on Telcoin

Government policies are one of the factors that will determine the adoption and growth of Telcoin. Stringent laws surrounding crypto and remittances may be detrimental to its operations in key markets, which may affect transaction volumes. Compliance needs may add to operational costs and make cross-border payments uncompetitively.

On the other hand, adoption can be stimulated by positive regulations in areas that seek to foster blockchain-enabled financial services. Telcoin’s ability to navigate regulatory landscapes will determine its adoption and success globally in the long term.

Telcoin (TEL) vs. Other Payment-Focused Cryptos

Below is a comparison of Telcoin (TEL) with similar blockchain-based payment and remittance solutions:

| Feature | Telcoin (TEL) | Ripple (XRP) | Stellar (XLM) | Celo (CELO) |

|---|---|---|---|---|

| Blockchain | Ethereum (ERC-20) | XRP Ledger | Stellar Blockchain | Celo Blockchain |

| Main Use Case | Mobile remittances & DeFi | Bank and institutional payments | Low-cost cross-border payments | Mobile-first financial services |

| Transaction Speed | Fast (5 sec) | Very Fast (3-5 sec) | Fast (5 sec) | Fast (5 sec) |

| Transaction Fees | Low | Very Low | Very Low | Low |

| Decentralization | Medium | Low (Ripple controls XRP Ledger) | High | Medium |

| Regulatory Risk | High (Crypto remittance laws vary) | High (Ongoing SEC case) | Medium | Medium |

| Staking & Rewards | Yes (DeFi staking) | No | No | Yes (CELO staking) |

| Adoption Level | Growing (Telecom-based) | High (Used by banks) | Moderate (NGO & payment use) | Growing (Mobile finance focus) |

| Smart Contracts | Limited | No | No | Yes |

While Telcoin (TEL) is focusing on mobile-centric remittances, Ripple (XRP) maintains its overwhelming share of institutional transactions, making it the go-to option for banks.

Although Stellar (XLM) aims at inexpensive P2P payments, it does not have such Telcoin DeFi interoperability.

Mobile finance has strong room to grow with Celo (CELO), but the adoption rate has been slower than expected.

TEL has a unique competitive advantage over other providers due to its ability to link with telecom networks in emerging markets.

Is Telcoin (TEL) a Good Investment?

Telcoin is extremely promising considering how innovative its telecom-centric remittance model is, alongside low fees and adoption in mobile finance. Its partnerships with telecom providers improve accessibility, while staking and DeFi options add value, making Telcoin a great candidate for long-term investments.

Should Telcoin obtain more partners and find a way through legal difficulties, the upside potential is considerable; however, the risks do need to be considered before investing.

Where to Buy Telcoin (TEL)

Telcoin (TEL) has a variety of listed exchanges. Some of the best platforms are:

- Binance

- KuCoin

- Gate.io

- Uniswap (decentralized trading)

- Bitfinex

These exchanges support major cryptocurrency trading pairs with USD, making the purchase easier. Please double-check the fees and available payment options beforehand.

Conclusion

Telcoin (TEL) has a great opportunity for growth, especially because of its telecom-based remittance model and low fees. However, the TEL price prediction charts a steady growth of value, but regulatory constraints and competition remain challenging problems. Decisions should be made based on how quickly Telcoin is adopted and how regulators legislate.