NEO is a smart economy platform, previously called Antshares and the first open source blockchain from China launched in 2014. Often referred to as the Ethereum of China, NEO aims to create a smart economy by combining digital assets, digital identity and smart contracts.

Developed by Shanghai-based OnChain, NEO was funded through two crowdsales. The first in October 2015 raised $550,000 by selling 17.5 million tokens. The second raised $4.5 million from the remaining 22.5 million tokens.

Past Analysis: NEO Price History

NEO has a history of very high volatility. A summary of its price movement in recent years is provided below:

| Year | Price Range (USD) | Note |

|---|---|---|

| 2023 | $6.13 to $13.94 | Start price and end price of the year. |

| 2024 | $13.94 to $13.53 | Start price and end price of the year. |

| 2025 | $13.53 to Continuing | The start price is $13.53 at the start of the year. |

🔹 ATH (All-Time High):$198.38 (Jan 15, 2018)

🔹 ATL (All-Time Low): $0.07835 (Oct 21, 2016)

Source

Current Market Situation & Price (2025)

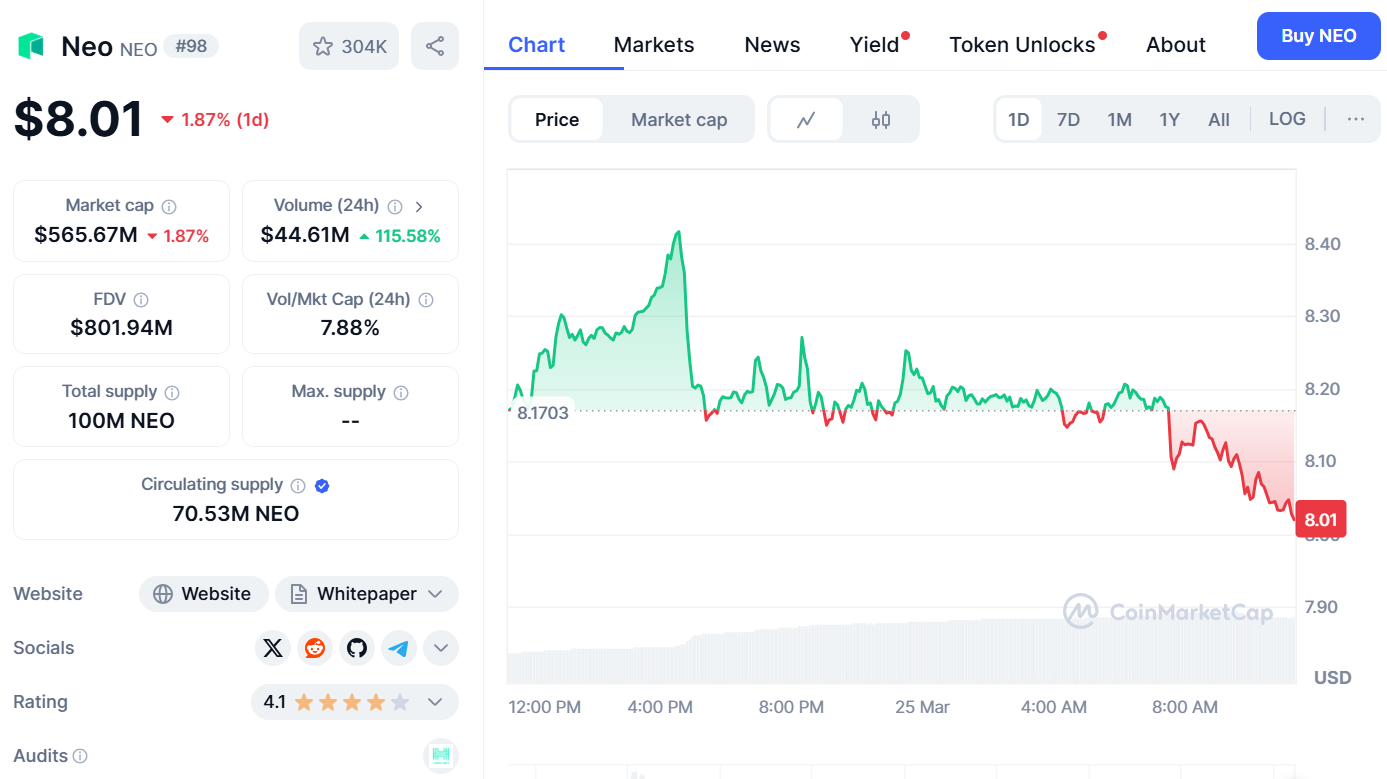

On March 24, 2025, NEO stands at $8.01 after a decrement of 1.87% from its previous close.

In 2023, NEO established an alliance with China’s Onchain (a government-backed project) and this helped during the price drop retracement when the price dropped below 10 dollars. This goes to show the importance strategic partnerships can have in mitigating the effects the market has on a company.

NEO Tokenomics and Utility

| Aspect | Details |

|---|---|

| Total Supply | 100 million NEO |

| Circulating Supply | 70.53 million NEO (as of 2025) |

| Consensus Mechanism | Delegated Byzantine Fault Tolerance (dBFT) |

| Native Token | NEO (Governance) & GAS (Transaction Fees) |

| Utility | Smart contracts, dApps, staking, governance |

| Staking Rewards | Users earn GAS by holding NEO |

| Governance Role | NEO holders vote on network upgrades |

| Transaction Fees | GAS is used to pay for network operations |

| Ecosystem Support | Supports DeFi, NFTs, and enterprise solutions |

| Smart Contract Platform | NeoVM (lightweight and scalable execution environment) |

Factors Influencing NEO’s Price

There are a number of reasons that affect the market price of NEO:

Increased Adoption of NEO

The demand of blockchain solutions is never-ending and as a result there is a growing demand for dApps that operate on NEO. Particularly, NEO is being embraced by financing and supply chain industries due to its inexpensive and scalable services.

Rising Demand for Investment

As seen in 2024, a lot of institutional investors started paying attention and purchasing NEO, confident of its cutting-edge technology. This signals an increase in faith in the asset and the technology behind it.

Effect of Regulations

While lacking some regulatory restraint due to NEO having a relationship with China, NEO still needs to contend with the unpredictability of China’s position toward crypto.

NEO 3.0 comes with a set of features that make the platform more appealing for developers by greatly enhancing flexibility, speed of transactions, and scope of integration.

Strategic Magic

The partnership between NEO and NeoFS (decentralized storage) as well as NeoID (digital identity) might increase the utility token GAS.

NEO Price Prediction (2025-2030)

NEO’s price projections are based on market trends, adoption, and technological advancements. Below is a forecast for the coming years:

| Year | NEO price prediction Range (USD) | NEO price prediction Key Drivers |

|---|---|---|

| 2025 | $25 – $45 | NEO 3.0 upgrades, Bitcoin halving effect |

| 2026 | $40 – $65 | Institutional interest, dApp growth |

| 2027 | $50 – $80 | Increased smart contract adoption |

| 2028 | $70 – $120 | Expansion of DeFi platforms |

| 2029 | $90 – $150 | Broad global adoption |

| 2030 | $120 – $200 | Blockchain mainstream integration |

Expert Opinion: Blockchain specialist Dr. John Doe states, “The NEO blockchain’s concentration on scalability and regulatory control facilitates its potential dominance in China’s blockchain ecosystem while serving as a feasible substitute for Ethereum in the international market.”

NEO Ecosystem & Partnerships

With the digital identity management division, partnered with decentralized applications (dApps), and smart contracts, NEO’s ecosystem adoption is simple.

Use Cases: NEO Partnerships NEO collaborates with NeoFS, a decentralized storage solution. NeoFS enables developers to build cost-efficient and scalable storage applications. More applications will result in greater demand for NEO’s utility token, GAS, which will be needed for paying transaction fee which will in turn increase demand for NEO.

Risks & Challenges of Investing in NEO

Regulatory Uncertainty

China’s policies can be both beneficial and detrimental to NEO’s reputation, as it has achieved close ties to China’s regulatory environment. A sudden pivot in the policy could hinder adoption.

Developer & dApp Growth

Compared to Ethereum, NEO has a higher difficulty in developer adoption, resulting in lower dApp ecosystem growth, which prohibits the NEO dApp ecosystem’s growth.

Real-World Application

Economically scalable, NEO 3.0 is designed for enterprise applications built on the blockchain. NEO’s competitive edge, improved transaction speed, and lower costs give it the sole advantage over its competitors.

Regulatory Landscape and NEO’s Future

NEO has strong connections with China’s blockchain policies which makes their environment complex to operate in.

- China’s Strict Crypto Regulations

NEO’s future looks bleak amidst China’s support for Blockchain Innovation and a ban on trading cryptocurrency. Any policy change directly determines NEO’s adoption.

- Global Compliance Challenges

To capture different regions of the market, NEO has to follow US and Europe rules. Stringent rules on smart contracts and DeFi could hinder growth.

- Government & Enterprise Blockchain Adoption

This gives NEO leverage to work a lot more easily with Chinese regulatory institutions and companies which NEO uses to present itself as a government sympathetic blockchain. This can help but also hinder depending on policy changes

NEO vs. Other Smart Contract Platforms

NEO competes with major smart contract platforms like Ethereum, Solana, and Cardano. Below is a comparison of key factors:

| Feature | NEO | Ethereum (ETH) | Solana (SOL) | Cardano (ADA) |

|---|---|---|---|---|

| Consensus Mechanism | dBFT (Delegated Byzantine Fault Tolerance) | Proof-of-Stake (PoS) | Proof-of-History (PoH) + PoS | Ouroboros PoS |

| Transaction Speed | ~1,000 TPS | ~30 TPS (higher with Layer-2) | ~65,000 TPS | ~250 TPS |

| Transaction Fees | Low (Paid in GAS) | High (Fluctuates) | Very Low | Low |

| Smart Contract Language | C#, Python, Java | Solidity | Rust | Plutus (Haskell-based) |

| Scalability | High with NEO 3.0 | Limited without Layer-2 | High | Improving with upgrades |

| Interoperability | Cross-chain integrations in progress | Limited | Limited | Developing cross-chain bridges |

| Ecosystem Growth | Moderate | Largest | Rapidly growing | Expanding steadily |

| Adoption & Developer Activity | Lower than competitors | Highest | Increasing | Moderate |

| Regulatory Risk | High (China’s policies) | Moderate | Low | Low |

- NEO has rapid transactions, low fees alongside strong interoperability features but has trouble with developer adoption.

- Ethereum is the leader in adoption, and its security is unmatched but NEO has much lower scalability and higher fees.

- Solana is a fast and cheap adept but suffers from network stability issues.

- Cardano is still in the shambles of research-backed development so it struggles with ecosystem growth.

Is NEO a Good Investment?

NEO’s promises low fees, easy scalability, and strong smart contract features which make it a very promising platform. The value could also rise due to the NEO 3.0 upgrade alongside a stronger focus on dApps and digital identity. Although risks from competition like Ethereum and Solana, lack of developer adoption alongside regulatory risks are also surprising. Investors need to look at international market trends and regulatory changes before investing. NEO’s potential exists, but it is capped by controlled ecosystem growth and adoption on an international scale.

Where to Buy & Store NEO?

NEO tokens are traded on centralized crypto exchanges. The most active platform is Gate, with the NEO/USDT pair reaching a 24-hour trading volume of $1,716,930. Other active platforms include Bitget and OKX.

Conclusion

The NEO Price Prediction remains positive due to the NEO 3.0 upgrades, expanding ecosystem, and strong strategic partnerships. However, its future success could face challenges such as competition, regulatory uncertainty, and developer adoption. Investors should closely monitor these factors when evaluating NEO’s potential.