In this article, we look at PYTH Price Prediction, Pyth Network stands as the largest and fastest growing first party oracle network. It supplies real time market data to financial dApps across 40+ blockchains and offers over 380 low latency price feeds for cryptocurrencies, equities, ETFs, FX pairs and commodities.

Leading exchanges, market makers and financial institutions including Binance, OKX, jane Street, Bybit and Cboe Global Markets contribute their own price data directly to the network. The Pythoracle program aggregates this data on chain to safeguard against inaccuracies and manipulation. Users can pull the latest price data onto their blockchain whenever needed.

In under a year since launching the cross chain pull oracle, the network secured more then $1B in total value. Over 250 applications have used the Pyth Network to enable $100B in trading volume. Integration with Pyth Price Feeds remains fully permissionless.

Past Analysis: Pyth Network (PYTH) Price History

Pyth Network’s price history shows how capricious and yet profitable the cryptocurrency market is. Here’s a summary of its price movements over the past three years:

PYTH Price History (2023-2025)

| Year | Price Range (USD) | Note |

|---|---|---|

| 2023 | $0.2817 – $0.3241 | Start price on Nov 21, 2023 and end price of the year. |

| 2024 | $0.3258 – $0.3523 | Start price and end price of the year. |

| 2025 | $0.3523 to Continuing | The start price is $0.3523 at the start of the year. |

ATH: $1.15(Mar 16, 2024)

ATL: $0.1289 (Mar 11, 2025)

Source

Current Market Status of Pyth Network (PYTH) (2025)

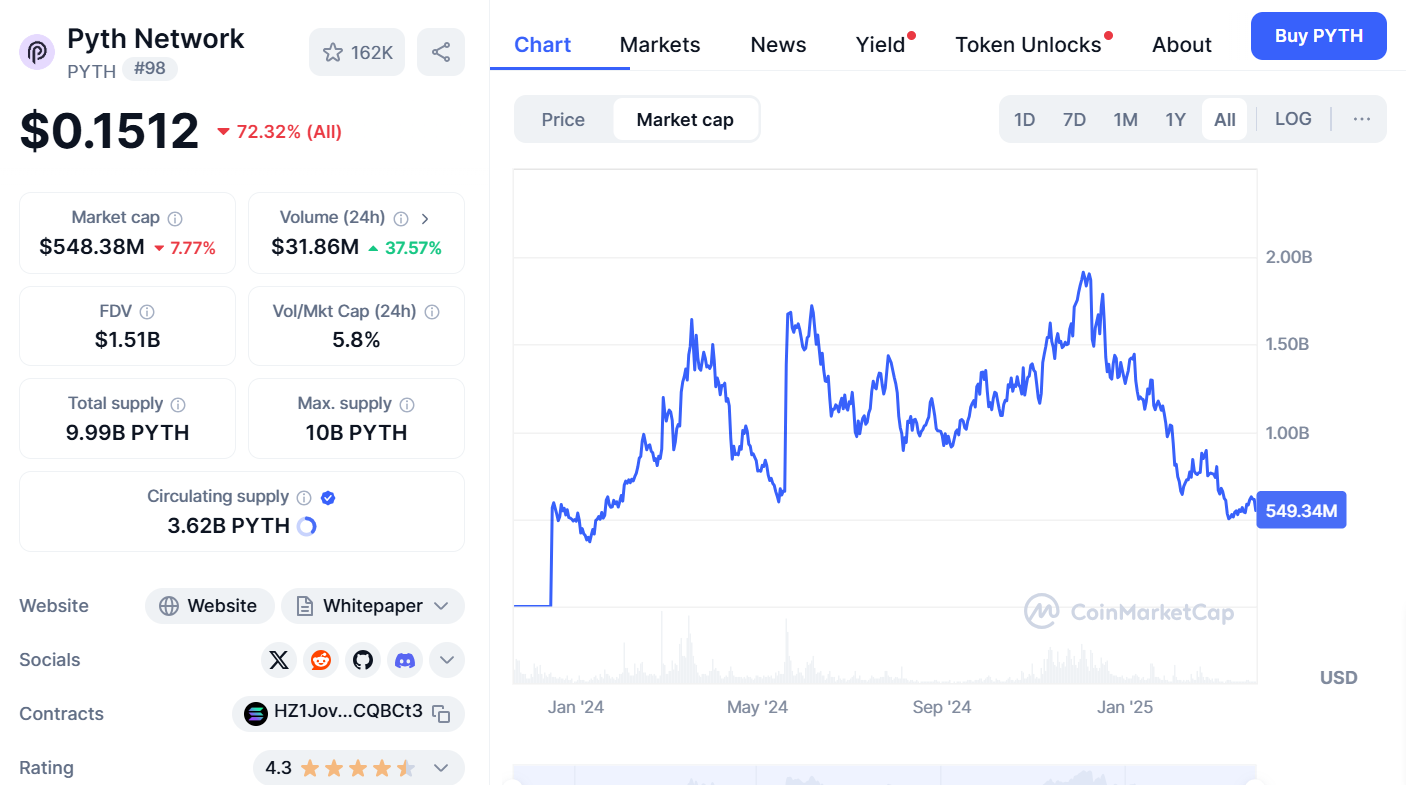

As of March 29, 2025, PYTH is trading at $0.1512, down 72.32% in the last 24 hours.

Pyth Network (PYTH) Tokenomics and Utility

PYTH Tokenomics Overview

| Category | Details |

|---|---|

| Token Name | Pyth Network (PYTH) |

| Total Supply | 9.99B PYTH |

| Circulating Supply | 3.62B PYTH (as of 2025) |

| Market Cap | $568.36M (as of 2025) |

| Consensus Mechanism | Decentralized Oracle Network |

| Utility | Data verification, governance, staking, rewards |

| Main Use Cases | DeFi, trading platforms, smart contracts |

Key Utilities of PYTH Token

- Payment of Fees: Unlocking premium financial data.

- Governance: Protocol votes are held by token owners.

- Incentives & Rewards: Granted to support and participants of the network.

- Interoperability: Attends to multiple blockchains for the purpose of cross-chain data assimilation.

The Pyth token’s strong tokenomics alongside real-world applications consolidates its value within the Defi ecosystem

Key Factors Affecting Pyth Network (PYTH) Price

Some aspects resonate in unison with Pyth Network (PYTH) price oscillations within the crypto market Pyth Network operates in:

- Integrating into DeFi & TradFi: Greater integrations into decentralized finance along with traditional finance increase its demand.

- Partnerships & Integrations: Collaboration with major projects is boosting its ecosystem and utility.

- Market Trends & Sentiment: Other factors concerning the crypto market and the attitude of investors as a whole come into contact with the level of value attached to PYTH.

- Technological Advancements: Integration of cross-chains along network upgrades enhances the demand and utility queues the need.

- Competition with Other Oracles: Competing forces such as Chainlink to Pyth Network will have an effect on the price and market share value of PYTH.

Pyth Network (PYTH) Price Prediction (2025-2030)

Just like forecasting any other cryptocurrency, we need to take everything into account for Pyth Network (PYTH) such as adoption, market shifts, and ecosystem trends for its future pricing. However, below is a definitive price range relative to now:

| Year | PYTH Price Prediction Range (USD) | PYTH Price Prediction Market Outlook |

|---|---|---|

| 2025 | $1.50 – $3.50 | Increased adoption in DeFi and TradFi. |

| 2026 | $2.80 – $5.00 | Stronger integrations and network expansion. |

| 2027 | $4.00 – $7.50 | Potential mainstream adoption of on-chain data. |

| 2028 | $6.00 – $10.00 | Institutional adoption accelerates growth. |

| 2029 | $8.50 – $15.00 | DeFi and Oracle market dominance solidifies. |

| 2030 | $12.00 – $18.00 | Widespread use of blockchain oracles. |

Pyth Network (PYTH) Ecosystem and Partnerships

- Decentralized Oracle Network – Powers DeFi apps with live, precise financial data.

- Cross-Chain Integration – Enables interoperability to many blockchains.

- Major Partnerships – Works together with leading DeFi, exchange, and institutional data companies.

- Institutional Data Providers – From prominent financial corporations who provide price feeds as accurate market data.

- DeFi & TradFi Adoption – Accepted in decentralized trading, lending, and derivatives.

- Expanding Developer Community – Builder-friendly open-source ecosystem inviting more projects.

- Continuous upgrades – Improvements in security, scalability, and data accuracy.

Risks and Challenges of Investing in Pyth Network (PYTH)

- Market Issues: Pyth’s prices can change with trends in the cryptocurrency market.

- Demand Uncertainty: Possible rules on decentralized oracles could limit their acceptance.

- Market Competition: Competitors such as Chainlink and Band Protocol may restrict full adoption of PYTH.

- Price Movements: Reduced trading activity may lead to increased price volatility.

- Attack Vectors: Weaknesses in smart contracts or external breaches of the network could be threats.

- Token releases are likely to impact prices: Future releases of blockchain tokens are likely to alter market valuations.

The mentioned considerations need to be made when concerning investments in PYTH. It is one of the many emerging ventures in the Oracle sphere and will carry both risk and promise.

Regulatory Landscape and PYTH’s Future

It is still forming within the DeFi ecosystem. Data compliance and security regulation is bound to influence the adoption of PYTH in both DeFi and TradFi. Adopting them will greatly assist growth and the long-term sustainability of PYTH within the DeFi ecosystem.

PYTH vs. Chainlink and Other Oracle Networks

| Feature | Pyth Network (PYTH) | Chainlink (LINK) | Other Oracle Networks |

|---|---|---|---|

| Data Source | Institutional financial data providers | Wide range of data sources (DeFi, TradFi) | Varies by the network ( Band Protocol) |

| Use Case | Focused on real-time financial data for DeFi | General-purpose oracle for DeFi, smart contracts | Varies, generally for decentralized apps |

| Network Type | Decentralized oracle network | Decentralized oracle network | Typically decentralized or hybrid networks |

| Main Advantage | High-fidelity data from financial institutions | Extensive network and data variety | Focus on specific sectors (e.g., data oracles, price feeds) |

| Adoption | Growing in DeFi and TradFi | Widely adopted across DeFi platforms | Limited compared to Chainlink and Pyth |

| Market Position | Emerging but with strong potential | Market leader in decentralized oracles | Niche players with smaller market share |

This comparison highlights the unique positioning of Pyth Network (PYTH), emphasizing its strength in financial data, compared to broader-use oracles like Chainlink (LINK).

Is Pyth Network (PYTH) a Good Investment?

Considering its scope of expansion, Pyth Network (PYTH) is well poised to capture market share owing to its focus on top-tier financial data for both DeFi and TradFi. It is likely to flourish with further adoption and partnerships in the growing decentralized finance ecosystem. Still, volatility and regulatory measures are also factors that need addressing while investment is concerned.

Where to Buy and Store Pyth Network (PYTH)

You can trade PYTH tokens on centralized crypto exchanges. The most popular platform to buy and trade Pyth Network is Toobit, where the PYTH/USDT pair reached a 24-hour trading volume of $4,522,440. Other most active platforms include Binance and MEXC.

Conclusion

Focusing on high-quality financial data feeds makes Pyth Network (PYTH) a very fundamentally bullish asset, especially when considering its growth potential. PYTH Price Prediction forecasts depict a favorable outlook on the prospective value of the PYTH, but the degree of market volatility and regulatory risk ought to be considered.

[…] JASMY targets data ownership and IoT integration which sets it apart in the blockchain industry, enabling its differentiation. Furthermore, it has use cases and partnerships that increase its long-term potential while its growing ecosystem adds more value.Jasmy’s value is fluctuating with the market and the regulatory landscape while still needing scrutiny. Despite these challenges, crypto enthusiasts and investors looking for long-term bets may find Jasmy attractive.Read More: PYTH Price Prediction: Is It the Future of Decentralized Data? […]