This Reserve Rights RSR Price Prediction analysis covers the RSR token’s associated tokenomics, price history, and predicted growth as well as provides a detailed self-forecast of RSR tokens for the years 2025-2030.

The exploration of the factors that influence RSR value goes as far as the expansion of DeFi and the use of Reserve stablecoins (RSV). RSR price predictions for 2030 range from $0.012 to $0.15, meaning things are looking bright for RSR.

This article also covers the challenges on the investment side of RSR compared to other stablecoins, investment strategies in an RSR token, and other risks associated with RSR. The final notes discuss RSR expected value and significance alongside evolving DeFi opportunities.

What is Reserve Rights (RSR)?

Reserve Rights (RSR) is an ERC-20 token used in the Reserve protocol for two main purposes: staking to overcollateralize Reserve stablecoins (RTokens) and participating in governance by proposing and voting on changes to their setup. RSR was launched in May 2019 through an initial exchange offering (IEO) on the Huobi Prime platform.

RSR Price History: Key Price Movements (2023-2025)

RSR has experienced significant volatility in recent years. Initially gaining attention in the DeFi space, RSR has seen fluctuations due to market conditions.

Key Price Movements (2023-2025)

| Year | RSR Price Range | Key Market Events |

|---|---|---|

| 2023 | $0.002833 – $0.00324 | Start price and end price of the year. |

| 2024 | $- 0.003248- $0.01319 | Start price and end price of the year. |

| 2025 | $0.01319 to Continuing | The start price is $0.01319 at the start of the year. |

All-Time High (ATH): $0.1189 (Apr 16, 2021)

All-Time Low (ATL): $0.001247 (Mar 16, 2020 )

Source

Current Market Situation & Price (2025)

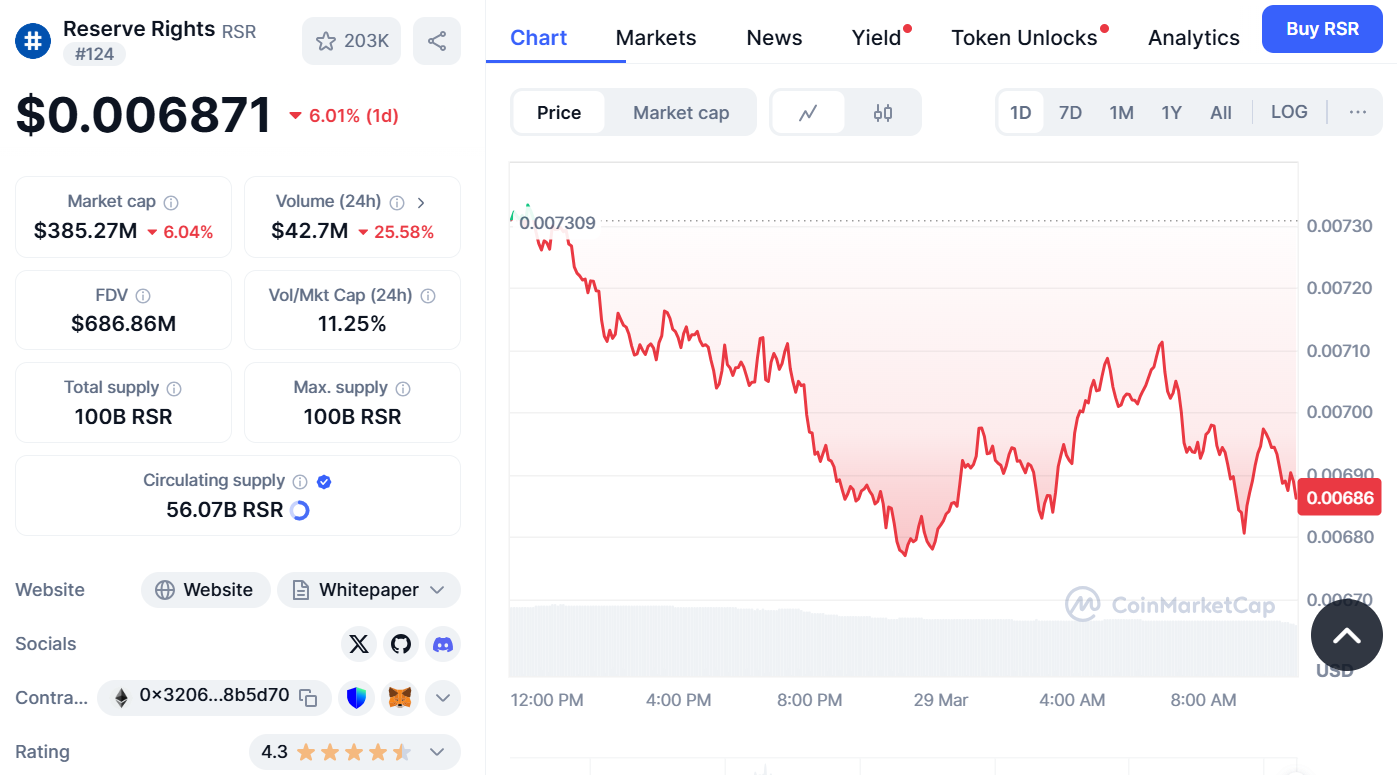

On March 18, 2025 RSR token was trading with a price of $0.006871 which is 6.01% lower compared to the previous day’s close.

RSR Tokenomics Explained

Understanding RSR tokenomics is very important as it helps assess RSR value. Serving as the token for Reserve Protocol, RSR is fundamental in ensuring the Reserve Stablecoin (RSV) maintains its peg and encourages participation in the ecosystem.

Tokenomics features a deflationary strategy that eliminates a certain number of tokens over time. This decreases supply while increasing demand which results in a rise in the token’s market value.

Tokenomics Breakdown

| Attribute | Details |

|---|---|

| Total Supply | 100 Billion RSR Tokens |

| Circulating Supply | 15-20% in circulation (subject to ongoing token burns and staking activities) |

| Utility | Staking, Governance, Collateral for RSV |

| Main Use Cases | 1. Stabilizing RSV2. Governance3. Token Burn |

| Staking Rewards | Earn rewards by staking RSR, helping secure the network. |

| Token Burn Mechanism | Regular token burns to reduce supply and potentially increase value. |

| Governance | RSR holders vote on protocol upgrades and key decisions. |

Through the features of deflationary mechanics, staking rewards, and governance within the Reserve Protocol, RSR ensures long-term value for its holders.

RSR Price Prediction (2025-2030)

The future price of RSR is likely to rise continuously alongside the decentralized finance ecosystem and the increased usage of RSV. Here’s a breakdown of RSR’s price forecast for the next several years:

| Year | RSR Price Prediction Range | Key Drivers |

|---|---|---|

| 2025 | $0.012 – $0.020 | Increased DeFi adoption, RSV usage |

| 2026 | $0.03 – $0.05 | RSV’s role in decentralized financial systems |

| 2027 | $0.05 – $0.07 | Continued DeFi growth, improved scalability |

| 2028 | $0.07 – $0.10 | Global expansion, mainstream adoption |

| 2029 | $0.08 – $0.12 | Institutional interest in RSV and DeFi |

| 2030 | $0.10 – $0.15 | RSV is a global decentralized stablecoin |

- Enhanced Adoption of RSV: Increases in RSV will correlate directly with greater demand for RSR.

- Governance and Staking: Staking and long-term holding will increase demand due to rewards.

- Global Economic Movement: RSR will benefit as the demand for decentralized financial mechanisms increases.

Ecosystem and Strong Projects

The Reserve Protocol – DeFi ecosystem is expanding, with a focus on stable assets. This includes:

RSV Stablecoin: An asset-backed stablecoin with the purpose of serving as a medium of exchange.

Integration into DeFi: RSR facilitates liquidity pools, a decentralized exchange, and a lending platform.

Adoption Growth: Increased adoption of RSV in developing economies add value to RSR in the long run.

Staking & Governance: RSR holders vote on governance and provide security for the network.

RSR vs. Other Stablecoins

Unlike stablecoins such as USDC, DAI, and Tether Tether (USDT), RSR is unique. Its decentralized structure makes it more robust and less dependent on central authorities.

| Feature | RSR | USDC | DAI | Tether (USDT) |

|---|---|---|---|---|

| Stability | Tied to decentralized stablecoin RSV | Pegged to USD | Pegged to USD | Pegged to USD |

| Decentralization | Fully decentralized (via Reserve Protocol) | Partially centralized | Fully decentralized | Centralized |

| Governance | Community-driven governance via RSR staking | Centralized governance | Community-driven governance | Centralized |

Risks of Investing in RSR

As with any other investment, RSR has its risks which include, but are not limited to the following:

- Market Volatility: Unlike stocks, crypto markets change very quickly. RSR might have great increases or decreases in value.

- Regulatory Risk: RSR might not gain adoption and value due to governmental policies.

- Adoption Risks: The overall success of RSR heavily relies on RSV usage. Low demand would hurt RSR.

- Competition: RSR could lose its place in the market due to many other decentralized stablecoins.

Investment Strategies for RSR

Here are a few methods that would help get the best out of your RSR investment:

- Staying Inactive: Passive holder of RSR to get more value as time passes and RSV becomes more commonly used.

- Staking: You can earn passive rewards while also helping increase the security of the network.

- Diversification: Provides a safer way to invest in other cryptos that have RSR in its backing.

Is RSR a Good Investment?

RSR possesses substantial potential, especially with the upsurge of DeFi and decentralized stablecoins. Although the project’s future seems optimistic, investors need to analyze the volatility of the market and the inherent risks posed by regulations.

Where to Buy RSR?

RSR tokens are available on centralized crypto exchanges. The super active platform is Binance, where the RSR/USDT pair recorded a 24-hour trading volume of $4,292,522. Other exchanges include Toobit and LBank.

Conclusion: RSR’s Future Outlook

According to RSR Price Prediction, it will reach $0.15 by 2030 which demonstrates significant growth potential. As RSR facilitates the growth of decentralized finance alongside the adoption of stablecoins, RSR’s future appears to be promising. That said, prospective investors must keep in mind risks like market volatility and regulatory risks. For those willing to face these hurdles and contribute to the changing DeFi landscape, RSR provides great opportunities.

RSR FAQ

1. What is RSR?

RSR is the native token of the Reserve Protocol which aims to provide stability to the value of RSV while allowing users to partake in decentralized governance.

2. What drives the value of RSR?

The value of RSR is driven by the adoption of RSV, staking rewards, and growth within the DeFi ecosystem.

3. Is RSR a good long-term investment?

RSR can be an excellent investment in the long run, which comes with a great deal of market volatility and regulatory-related risks.